Overview

Conducting a title search for a home is a critical process that requires a meticulous review of public records, an examination of the chain of ownership, and the identification of any liens or encumbrances that could impact the property. This article presents a step-by-step guide that underscores the importance of thorough documentation. Furthermore, it highlights the integration of technology to enhance the efficiency and accuracy of the title search, thereby safeguarding the buyer's investment in real estate.

Introduction

In the intricate world of real estate transactions, the title search process serves as a pivotal safeguard for both buyers and sellers. This meticulous examination of public records not only confirms legal ownership but also uncovers any claims, liens, or encumbrances that could jeopardize a property deal. As the landscape of real estate evolves, particularly in 2025, the importance of a thorough title search has never been more pronounced.

Furthermore, with advancements in technology, such as AI-driven tools, the efficiency and accuracy of title searches are being transformed, allowing for faster and more reliable transactions. This article delves into the essential components of the title search process, provides a step-by-step guide to conducting one, and highlights the critical role of title insurance in protecting investments. Consequently, every stakeholder can navigate the complexities of property ownership with confidence.

Understanding the Title Search Process

A document review constitutes a thorough analysis of public records aimed at determining the legal ownership of real estate while uncovering any claims, liens, or encumbrances that may affect it. This procedure is essential for verifying that the seller possesses the authority to sell the asset and that the buyer will obtain a clear deed upon acquisition. Typically, a title search home involves a review of various documents, including deeds, tax records, and legal filings pertinent to the asset.

Mastering this process is crucial for safeguarding your investment in real estate.

Key Components of a Title Search

- Public Records: These documents, filed with government entities, provide critical information regarding asset control and any claims against it. In 2025, the dependence on public records remains crucial, as they serve as the foundation for verifying possession and ensuring transparency in transactions.

- Chain of Title: This component outlines the history of possession of the asset. A clear and unbroken chain of ownership is essential for a successful transaction; any gaps can lead to disputes or challenges in ownership.

- Liens and Encumbrances: Identifying outstanding debts or claims against the property is vital. These encumbrances can significantly influence ownership rights and must be meticulously examined during the inquiry.

In 2025, approximately 62% of companies handling property claims are outsourcing tax research, including liens and exemptions, highlighting a growing trend towards efficiency and specialization in the ownership verification process. The combination of automation and AI technologies, such as those provided by Parse AI, is increasingly recognized as essential for enhancing data quality, ensuring accuracy, and improving efficiency in document reviews and examinations. Parse AI offers advanced machine learning tools that accelerate document processing and interpretation, enabling streamlined runsheet creation and precise extraction of essential information from ownership documents.

Significantly, features like the example manager allow users to swiftly annotate documents, while the interactive labeling functionality facilitates customized data extraction, enhancing the overall efficiency of the document retrieval process. Furthermore, preserving data integrity is paramount; high-profile mistakes, such as overlooked defects or data breaches, can result in considerable reputational harm and loss of clients, as demonstrated by the case study on reputation management in property insurance. The reputation of a property insurance firm stands as a crucial intangible asset, and any compromise in data quality can lead to extensive negative publicity.

Successful property investigations not only safeguard investments but also enhance the overall well-being of the real estate market. Real estate experts stress that a thorough title search home is essential to any transaction, ensuring that buyers can proceed with assurance. As the landscape of title research continues to modernize, embracing innovative solutions like Parse AI will be key to navigating the complexities of ownership verification.

Step-by-Step Guide to Conducting a Title Search

-

Gather Asset Information: Begin by compiling comprehensive details about the asset. Vital information includes the address, the current owner's name, and any previous owners. This foundational step is crucial for a successful title search.

-

Identify the County: Pinpoint the county where the asset is situated. This is vital as it determines the specific jurisdiction for accessing land records, which can vary significantly from one county to another.

Access Public Records: Navigate to the county clerk's office or their official website to access public records. Essential documents to pursue include land deeds, tax records, and any other pertinent paperwork. Utilizing online resources can expedite this process, especially in 2025, where many counties have digitized their records. Furthermore, consider using resources such as the Property Tax Search and Geographic Information System (GIS) for aerial views and parcel information to enhance your search.

-

Review the Chain of Ownership: Conduct a thorough examination of the chain of ownership. This involves a title search to trace the title history and identify any breaks or discrepancies that could impact the asset's title. Typically, this requires reviewing documents that span several decades, ensuring a clear and uninterrupted ownership lineage.

-

Check for Liens and Encumbrances: Investigate any existing liens or encumbrances on the asset. This includes mortgages, unpaid taxes, or legal claims that could impact the transaction. Understanding these factors is essential for evaluating the marketability and potential risks of the asset during a title search.

Document Findings: Maintain meticulous records of your discoveries throughout the investigation process. Document any issues that arise, as these may need to be resolved before proceeding with the purchase. This step is essential for ensuring clarity and comprehensiveness in the property examination process.

In 2025, the average property review involves examining approximately 50 to 100 documents, depending on the property's history and complexity. Subscription services like Laredo, which offer access to comprehensive real estate records for a monthly charge of $800, can greatly improve efficiency for professionals performing multiple inquiries. By utilizing these resources, researchers can optimize their workflows and ensure thorough coverage of all essential documentation, ultimately aiding their examination process.

The Importance of Historical Data in Title Searches

Historical information plays a crucial role in title search home investigations, providing a comprehensive view of a property's lineage. This encompasses several critical aspects.

- Previous Owners: Understanding the identities and circumstances of prior owners is essential for uncovering potential claims or disputes. Research indicates that approximately 30% of ownership disputes arise from historical ownership data, highlighting the necessity of thorough investigation. Employing an expert for a title search home not only provides peace of mind but also ensures a clear report for closing, which is essential for reducing risks associated with prior ownership.

- Legal Issues: Historical legal complications, such as foreclosures or boundary disputes, can significantly impact current ownership. A comprehensive title search home of past legal matters can prevent future liabilities and ensure a smoother transaction process.

- Easements and Restrictions: Historical documentation often uncovers easements or restrictions that may limit property usage. These findings are crucial for buyers to understand their rights and obligations regarding the title search home. By meticulously analyzing historical data related to the title search home, buyers can make well-informed decisions, thereby mitigating risks and avoiding potential pitfalls in their real estate transactions.

The integration of advanced technologies, such as those employed by Parse AI, enhances the efficiency and accuracy of this process. Parse AI's Document Processing exemplifies how machine learning and optical character recognition can streamline the extraction of essential historical data, ensuring that researchers can deliver comprehensive reports swiftly and reliably. Furthermore, when choosing a provider for property services, it is crucial to evaluate their experience, reputation, and the technology they utilize, as these elements greatly affect the quality of the ownership investigation process.

Identifying Potential Issues in Title Searches

During an ownership investigation, several potential concerns may arise that can significantly impact real estate possession and transaction procedures. Understanding these challenges is essential for ensuring a seamless transaction:

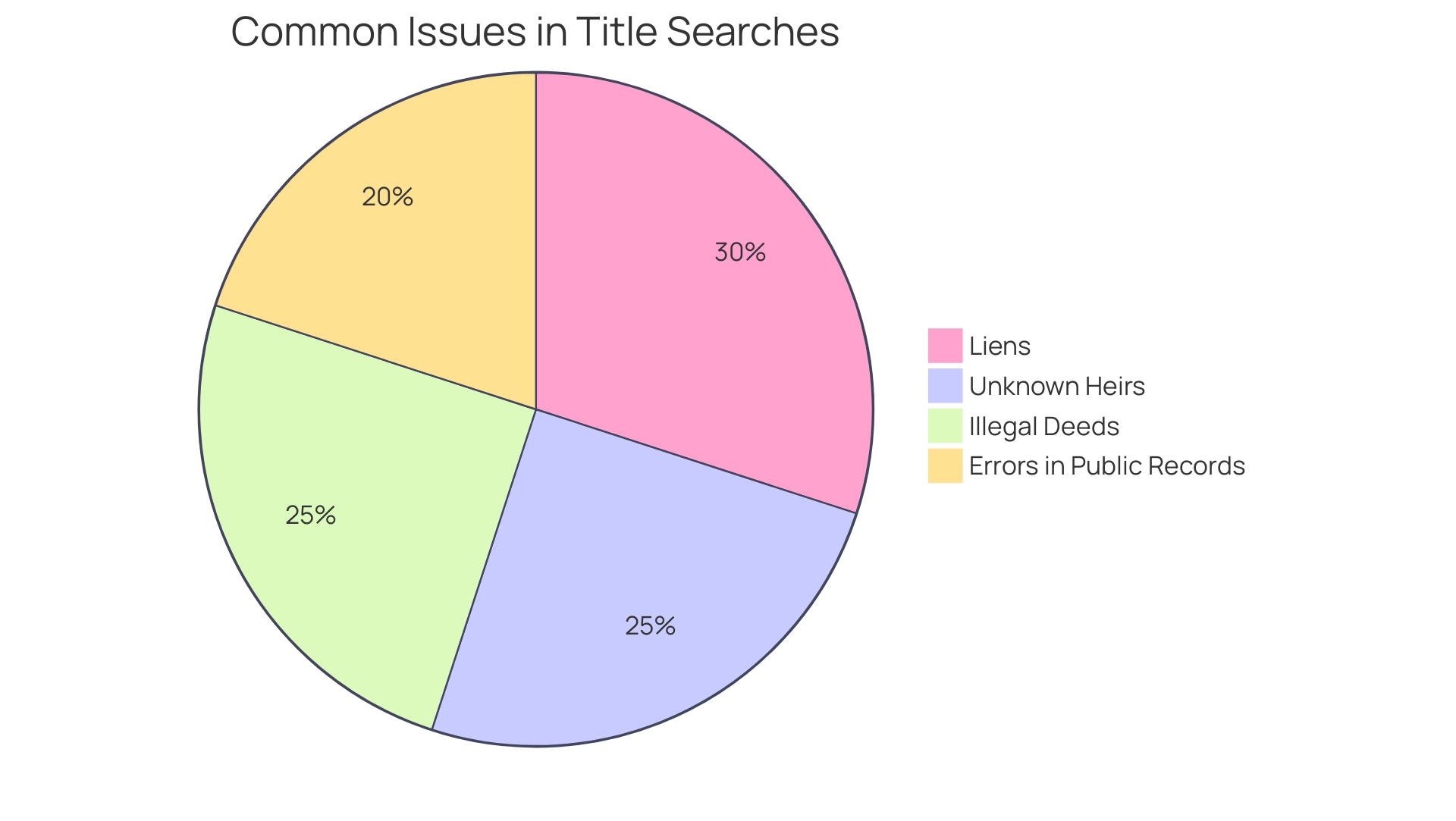

- Liens: Unpaid debts associated with the property can lead to claims against the title. In 2025, statistics indicate that approximately 30% of title search home document searches reveal existing liens, underscoring the necessity of thorough investigation.

- Errors in Public Records: Mistakes in documentation can create confusion regarding possession. Such errors may stem from clerical mistakes or outdated information, complicating the verification process.

- Unknown Heirs: If a previous owner passed away without a clear will, unknown heirs may emerge, complicating ownership. Recent insights suggest that around 25% of property searches uncover unknown heirs, which can delay transactions and necessitate additional legal scrutiny.

- Illegal Deeds: Any deeds that were not executed properly can nullify ownership. This issue has gained relevance as the industry shifts towards digital solutions, where the risk of improper execution may increase without adequate training and oversight.

Identifying these issues early in the title search home process allows purchasers and researchers to address them proactively. For instance, a case study on identifying issues in ownership searches in 2025 highlighted how a company successfully navigated a complex situation involving unknown heirs by implementing advanced AI tools, ultimately streamlining the resolution process. This aligns with the trend of digital closings becoming essential, as clients increasingly expect the ability to complete real estate transactions online.

By leveraging technology, such as Remote Online Notarization (RON), companies can enhance client convenience while effectively addressing these challenges.

Furthermore, as noted by the American Land Title Association (ALTA), there exists a 'false promise of savings' associated with neglecting these issues, emphasizing the need for thorough ownership research. By staying informed about these common challenges and leveraging technology, professionals can enhance their efficiency and maintain competitiveness in the evolving real estate landscape.

Protecting Your Investment: The Role of Title Insurance

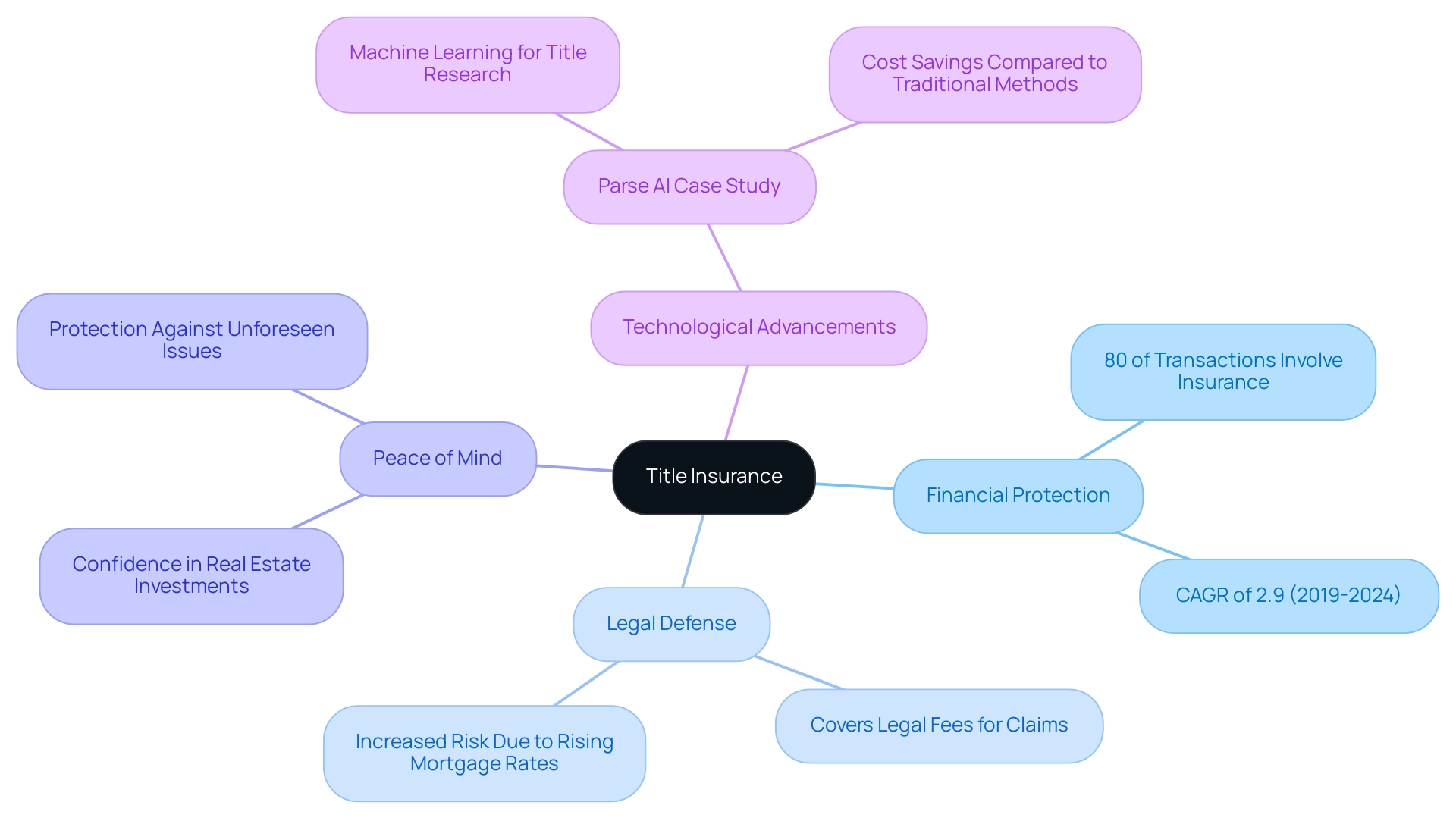

Ownership insurance plays a crucial role in the real estate transaction process, protecting buyers against potential defects that may not be uncovered during a search. The key benefits of title insurance include:

- Financial Protection: Title insurance provides a safety net against financial loss stemming from claims against the title, such as liens or ownership disputes. Approximately 80% of real estate transactions involve insurance for ownership, underscoring its significance in protecting buyers' investments. The insurance sector's growth rate of 2.9% from 2019 to 2024 further highlights its importance in the market context of 2025.

- Legal Defense: Should a claim arise against ownership, the insurance company assumes responsibility for covering legal fees to defend the owner's rights. This aspect is particularly crucial in 2025, as rising mortgage rates and tighter credit conditions may increase the likelihood of disputes, posing potential risks to financial performance.

- Peace of Mind: With ownership insurance, buyers can invest in real estate with confidence, knowing they are protected against unforeseen issues that could jeopardize their ownership. This assurance is invaluable, especially in a market where the insurance sector has experienced steady growth.

Furthermore, the case study of Parse AI demonstrates how advancements in technology can improve research efficiency and offer substantial cost savings, further highlighting the significance of insurance in safeguarding real estate investments.

As Ralph Villegas, Manager II - Life/A&H & Fraternal Financial Analysis, observes, 'Financial protection through ownership insurance is crucial for safeguarding investments in an evolving market.'

In essence, ownership insurance acts as a critical safeguard for property buyers, ensuring their investments remain secure even in the face of potential challenges. As the landscape of real estate transactions evolves, the importance of title insurance continues to be underscored by expert opinions and case studies demonstrating its effectiveness in protecting real estate investments.

Conclusion

The title search process is a crucial element of real estate transactions, offering vital protection for both buyers and sellers. By thoroughly examining public records, stakeholders can verify legal ownership and uncover any claims or encumbrances that may impact property dealings. In 2025, the significance of a comprehensive title search is heightened by technological advancements, including AI-driven tools that improve efficiency and accuracy, facilitating quicker and more dependable transactions.

Grasping the essential components of a title search—such as public records, chain of title, and the identification of liens and encumbrances—is imperative for protecting investments. The provided step-by-step guide delineates a clear pathway for conducting a title search, underscoring the necessity of meticulous documentation and historical data analysis. Recognizing potential issues—like liens, inaccuracies in public records, and unknown heirs—can significantly mitigate risks and ensure a more seamless transaction process.

Title insurance stands out as a critical safeguard in this context, offering financial protection and legal defense against unforeseen complications that may arise post-transaction. As the real estate market evolves, the integration of innovative technologies and practices will be instrumental in refining the title search process. Ultimately, a thorough understanding of title searches and the protective measures available, such as title insurance, empowers buyers and sellers to navigate the complexities of property ownership with confidence and security.

Frequently Asked Questions

What is a document review in the context of real estate?

A document review is a thorough analysis of public records aimed at determining the legal ownership of real estate and uncovering any claims, liens, or encumbrances that may affect it. This process verifies that the seller has the authority to sell the asset and that the buyer will obtain a clear deed upon acquisition.

What are the key components of a title search?

The key components of a title search include: Public Records, which are documents filed with government entities that provide critical information about asset control and claims against it; Chain of Title, which is the history of possession of the asset; and Liens and Encumbrances, which are outstanding debts or claims against the property that can influence ownership rights.

Why is a title search important for real estate transactions?

A title search is crucial for safeguarding investments in real estate by ensuring that buyers can proceed with assurance, confirming the seller's ownership, and identifying any potential legal issues related to the property.

How has the process of title research evolved in recent years?

In 2025, there is a growing trend of outsourcing tax research related to property claims, with approximately 62% of companies adopting this approach. Additionally, automation and AI technologies, such as those provided by Parse AI, are increasingly used to enhance data quality, accuracy, and efficiency in document reviews.

What tools and resources can assist in conducting a title search?

Essential tools include accessing public records through county clerk offices or websites, utilizing online resources for land deeds and tax records, and employing services like Property Tax Search and Geographic Information Systems (GIS) for enhanced data retrieval.

What steps should be taken to conduct a title search?

The steps to conduct a title search include: 1. Gather asset information, including the address and ownership history; 2. Identify the county where the asset is located to access relevant land records; 3. Review the chain of ownership for any discrepancies; 4. Check for existing liens and encumbrances on the asset; 5. Document findings meticulously throughout the process.

How many documents are typically reviewed during a property examination?

In 2025, the average property review involves examining approximately 50 to 100 documents, depending on the property's history and complexity.

What are the potential consequences of overlooking issues during a title search?

Overlooking defects or data breaches during a title search can result in significant reputational harm and loss of clients, emphasizing the importance of maintaining data integrity throughout the examination process.