Overview

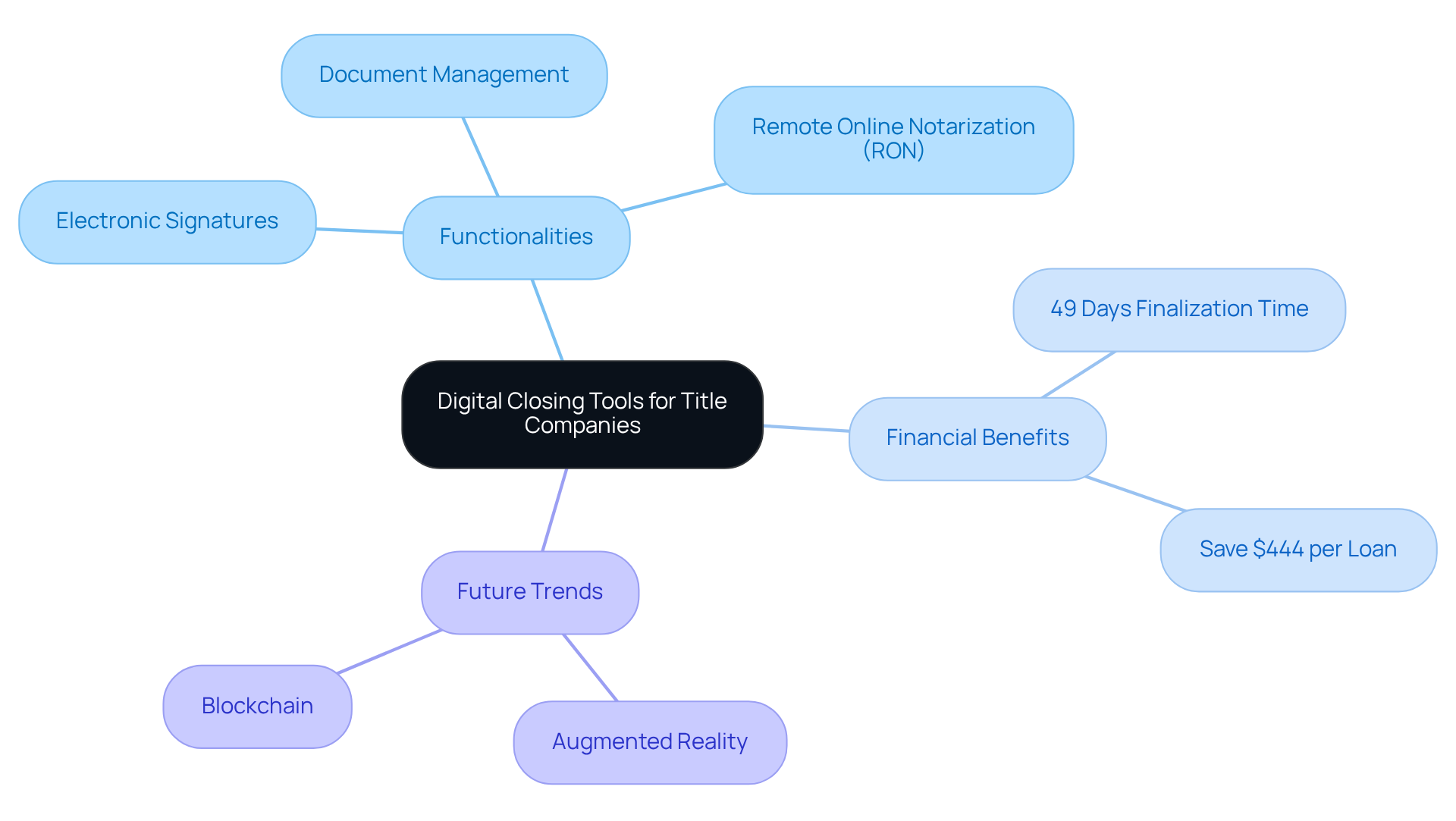

Digital closing tools for title companies are indispensable for automating and streamlining the closing process. They offer critical features such as:

- Electronic signatures

- Document management

- Remote online notarization (RON)

These features collectively enhance efficiency and client satisfaction. Furthermore, these tools not only reduce closing times and costs but also prepare firms for future technological advancements and regulatory changes. Consequently, they position title companies to thrive in a competitive market.

Introduction

The landscape of title companies is rapidly evolving, driven by the necessity for efficiency and innovation in the closing process. Digital closing tools have emerged as essential assets, offering features such as electronic signatures and remote online notarization that not only streamline operations but also enhance client satisfaction. However, with a multitude of options available, how can firms discern which tools best align with their needs and objectives? This article delves into the key features, advantages, and drawbacks of leading digital closing solutions, equipping title companies with the insights required to navigate this transformative landscape effectively.

Overview of Digital Closing Tools for Title Companies

The industry has been fundamentally transformed by digital closing tools for title companies, which automate and simplify the closing process. These tools provide a range of functionalities, including:

- Electronic signatures

- Document management

- Remote online notarization (RON)

All designed to facilitate faster transactions, minimize paperwork, and enhance security. As title companies face increasing pressure to improve efficiency and reduce costs, digital closing tools for title companies have become indispensable. Currently, the typical finalization time is 49 days, and lenders utilizing eClosing can save up to $444 per loan, underscoring the financial benefits of adopting these technologies.

The rise in remote closings, particularly accelerated by the COVID-19 pandemic, has highlighted the critical role of these innovations. By 2025, the integration of augmented reality (AR) and blockchain is anticipated to further enhance property evaluations and transaction security, with AR offering detailed visualizations and blockchain providing secure, immutable records.

Furthermore, real estate firms must prepare for potential regulatory changes expected in 2025, which could impact their operations. Embracing these innovations not only boosts operational efficiency but also positions firms to meet the evolving demands of a tech-savvy clientele.

Key Features of Leading Digital Closing Solutions

Digital closing tools for title companies are meticulously crafted to meet the specific needs of title companies, thereby enhancing both operational efficiency and client satisfaction. These solutions encompass several key functionalities:

- Electronic Signatures: Empowering parties to sign documents remotely, this feature significantly diminishes the necessity for in-person meetings. Notably, 81% of borrowers prefer electronic signatures, which not only accelerates the signing process but also elevates customer satisfaction scores by 127%. Moreover, the implementation of electronic signatures can amplify the turnaround time on signed documents by a remarkable 25 times.

- Document Management: The centralized storage and organization of final documents facilitate streamlined retrieval and sharing, effectively minimizing delays and boosting workflow efficiency.

- Remote Online Notarization (RON): With RON, notarization of documents occurs without the need for physical presence, offering both convenience and security. Surveys reveal that 52% of respondents experienced reduced completion times when utilizing RON, while 43% reported cost savings. The average investment required to stands just under $30,000 per office, underscoring the financial commitment associated with this advancement.

- Integration Capabilities: Ensuring compatibility with existing software and systems is vital for streamlining workflows, allowing organizations to maximize their current technology investments effectively.

- Compliance Tracking: Tools designed to ensure adherence to legal and regulatory requirements play a crucial role in minimizing risks linked to non-compliance, which is increasingly pertinent in a rapidly evolving digital landscape.

- Client Portals: These platforms provide clients with access to their documents and transaction status, thereby enhancing transparency and communication throughout the finalization process.

Collectively, these attributes not only bolster the effectiveness of the finalization process but also empower firms to deliver exceptional service to their clients, strategically positioning them for success in a competitive market. Significantly, 64% of surveyed professionals in the field indicated that their organizations actively encourage the use of digital closing tools for title companies to attract and retain clients, thereby highlighting the critical role of digital solutions in the contemporary environment.

Pros and Cons of Each Digital Closing Tool

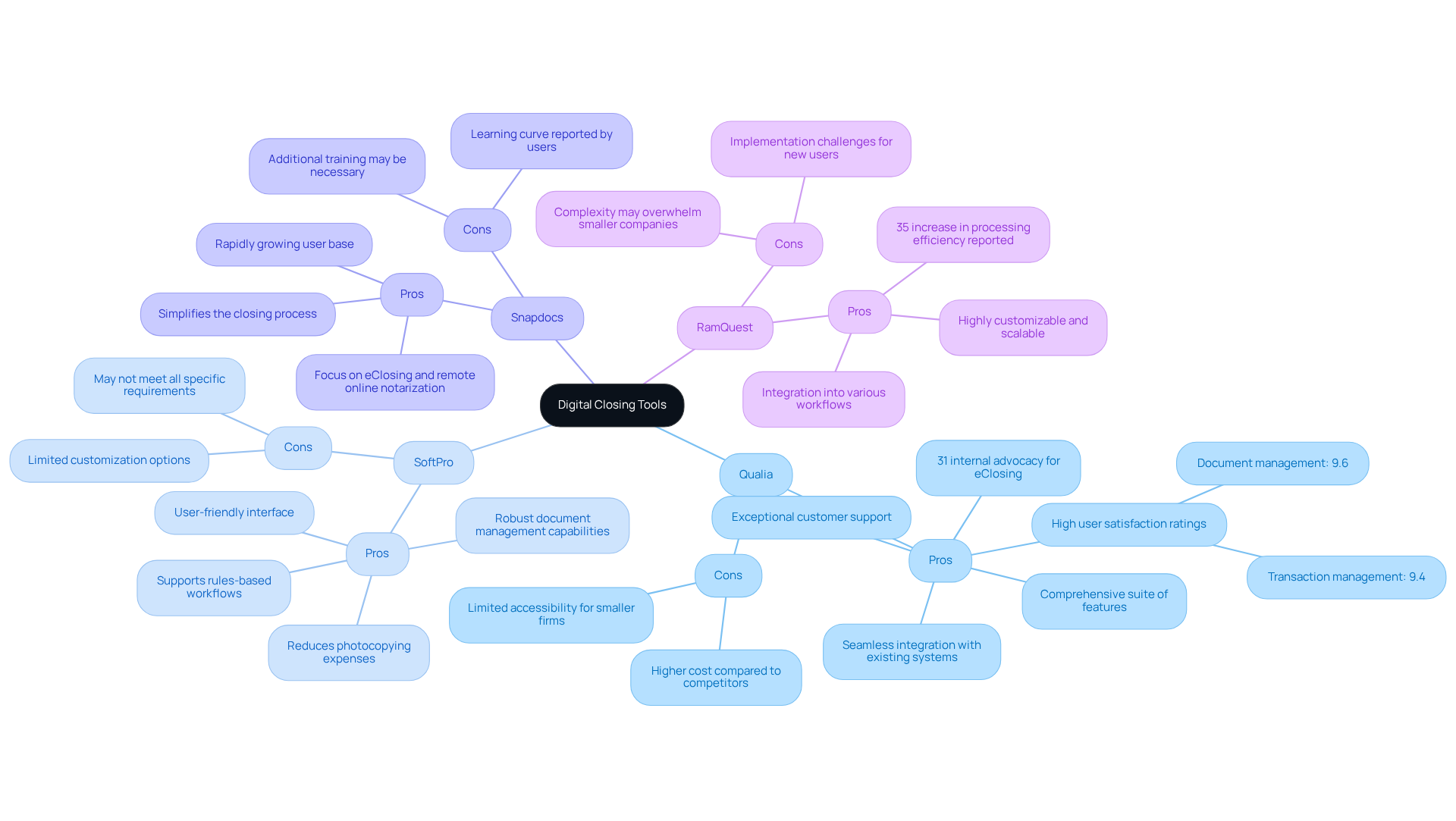

When evaluating for title companies, it is crucial to understand their strengths and weaknesses to enhance efficiency and client satisfaction.

-

Qualia:

- Pros: Qualia offers a comprehensive suite of features, seamless integration with existing systems, and exceptional customer support. This makes it a preferred choice for many in the industry. User satisfaction ratings underscore its ease of use, with a score of 9.4 for transaction management and 9.6 for document management. Furthermore, 31% of survey respondents indicated internal advocacy as a reason for moving toward eClosing, reflecting its growing acceptance.

- Cons: However, the higher cost compared to some competitors can be a barrier for smaller firms, potentially limiting accessibility for those with tighter budgets.

-

SoftPro:

- Pros: SoftPro is known for its user-friendly interface and robust document management capabilities, effectively streamlining workflows. It supports rules-based workflows and text editing, enhancing operational efficiency. Additionally, digital transactions utilizing SoftPro can reduce photocopying expenses, making it an economical option.

- Cons: On the downside, limited customization options may not address all specific requirements of title firms, which could hinder some businesses from fully optimizing their processes.

-

Snapdocs:

- Pros: Snapdocs focuses heavily on eClosing and remote online notarization (RON), boasting a rapidly growing user base. Its features are designed to simplify the closing process, making it appealing for firms looking to modernize.

- Cons: Nonetheless, some users have reported a learning curve associated with the platform, which may necessitate additional training and adjustment time for staff.

-

RamQuest:

- Pros: RamQuest is highly customizable and scalable, making it suitable for larger operations that require tailored solutions. Its flexibility allows for integration into various workflows, enhancing overall productivity. Notably, title firms that invested in automation technologies in 2023 reported a 35% increase in processing efficiency, highlighting the operational advantages of utilizing such technologies.

- Cons: Conversely, the complexity of the platform may overwhelm smaller companies or those new to digital resources, potentially leading to implementation challenges.

By thoughtfully considering these advantages and disadvantages, firms can align their selection of digital solutions with their operational objectives and client expectations, ensuring a smoother transition to digital procedures.

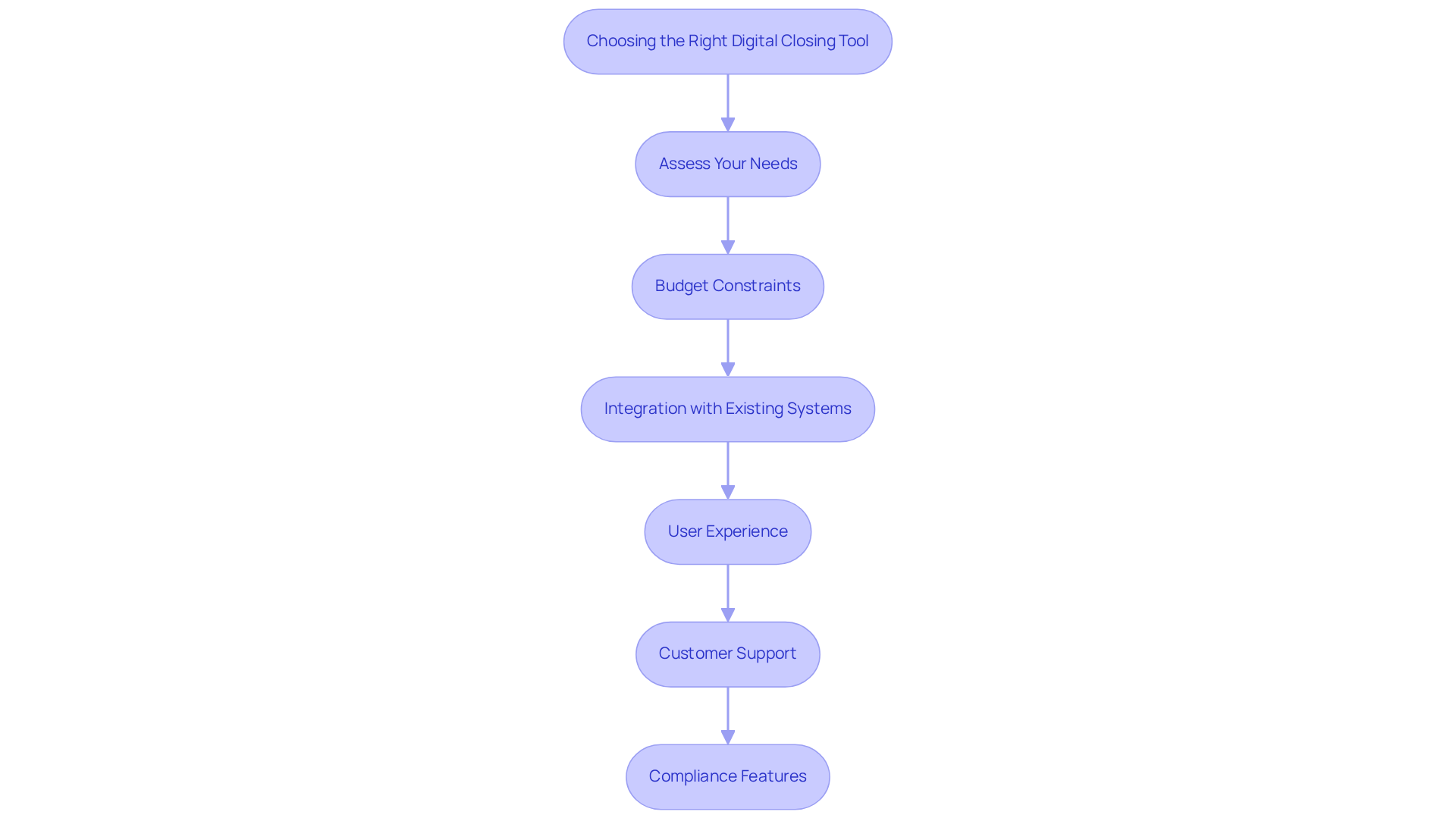

Choosing the Right Digital Closing Tool for Your Title Company

Choosing the right digital closing tool for your title company necessitates a strategic approach, focusing on several essential considerations:

- Assess Your Needs: Begin by identifying the specific challenges your title establishment encounters. Understanding these pain points will help determine which features are crucial for effective resolution. For instance, organizations that have successfully adopted digital closing tools for title companies frequently report enhanced processing efficiency and reduced operational expenses.

- Budget Constraints: Evaluate the cost of the tool in relation to your budget and potential return on investment. A well-planned financial strategy can ensure that the investment aligns with your company's growth objectives. Keep in mind that it costs five times more to acquire a new client than to retain an existing one, making the right choice essential for client retention.

- Integration with Existing Systems: It is vital to ensure that the chosen solution can seamlessly integrate with your current software. This integration minimizes workflow disruptions and enhances overall efficiency. Title organizations that invested in automation resources during 2023 reported a 35% increase in processing efficiency, showcasing the tangible advantages of embracing the appropriate technological solutions.

- User Experience: A is crucial. Complicated systems can hinder productivity, so prioritize resources that provide intuitive navigation and ease of use. As noted by industry specialists, the most successful firms are ruthlessly efficient in their core processes, which includes selecting user-friendly resources.

- Customer Support: Opt for providers that deliver robust customer support. Reliable assistance is essential for resolving any issues that may arise during implementation or daily operations. Companies that outsource certain time-intensive tasks to qualified title support services can free up valuable resources for growth initiatives.

- Compliance Features: Ensure that the system includes features designed to maintain adherence to legal and regulatory standards. This is critical for safeguarding your operations and protecting your clients. Title firms with established risk management protocols encounter 40% fewer claims than those lacking such measures, highlighting the significance of compliance in equipment selection.

By thoughtfully considering these factors, title companies can make informed decisions that significantly enhance operational efficiency and improve client satisfaction with the help of digital closing tools for title companies. Incorporating these insights and statistics not only strengthens the argument for specific features in digital closing tools but also provides a more authoritative perspective.

Conclusion

The evolution of digital closing tools for title companies represents a pivotal transformation in transaction processes, significantly streamlining operations and enhancing efficiency. By adopting these technologies, title companies can reduce closing times and elevate customer satisfaction through features like electronic signatures, document management, and remote online notarization. As the industry anticipates future advancements—such as augmented reality and blockchain—the significance of these tools is poised to increase further.

Throughout this article, critical insights have been provided regarding the functionality and advantages of leading digital closing solutions. An analysis of tools like Qualia, SoftPro, Snapdocs, and RamQuest has illuminated their respective strengths and weaknesses, empowering title companies to make informed decisions tailored to their unique needs and budgetary constraints. Furthermore, the focus on user experience, integration capabilities, and compliance tracking underscores the necessity of selecting tools that enhance operational efficiency while aligning with the evolving demands of clients.

In a rapidly changing real estate landscape, the adoption of digital closing tools is not merely an option; it stands as a strategic imperative. Title companies that invest in these technologies will position themselves to thrive in a competitive market, ensuring they meet client expectations and adapt to forthcoming regulatory changes. By prioritizing the right features and solutions, firms can unlock substantial operational advantages and pave the way for a more efficient and client-centered closing process.

Frequently Asked Questions

What are digital closing tools for title companies?

Digital closing tools for title companies are technologies that automate and simplify the closing process, including functionalities such as electronic signatures, document management, and remote online notarization (RON).

How do digital closing tools benefit title companies?

These tools facilitate faster transactions, minimize paperwork, enhance security, improve efficiency, and reduce costs, making them indispensable for title companies.

What is the typical finalization time for closings without digital tools?

The typical finalization time for closings is currently 49 days.

How much can lenders save per loan by using eClosing?

Lenders utilizing eClosing can save up to $444 per loan.

What impact did the COVID-19 pandemic have on remote closings?

The COVID-19 pandemic accelerated the rise in remote closings, highlighting the importance of digital closing tools.

What future technologies are expected to enhance digital closing tools by 2025?

By 2025, the integration of augmented reality (AR) and blockchain is anticipated to enhance property evaluations and transaction security.

How will augmented reality (AR) and blockchain benefit the closing process?

AR will offer detailed visualizations, while blockchain will provide secure, immutable records, improving transaction security and property evaluations.

What should real estate firms prepare for in 2025?

Real estate firms should prepare for potential regulatory changes expected in 2025 that could impact their operations.

Why is it important for firms to embrace digital closing innovations?

Embracing these innovations boosts operational efficiency and positions firms to meet the evolving demands of a tech-savvy clientele.