Overview

The article centers on the critical comparison of predictive analytics tools aimed at enhancing efficiency within the real estate sector. It underscores the significance of utilizing historical data alongside advanced algorithms to refine decision-making processes, boost operational efficiency, and mitigate risks. Notably, leading platforms exemplify substantial benefits, including increased rental income and enriched market insights, which serve to illustrate the compelling advantages of these tools.

Introduction

In the competitive landscape of real estate, the ability to predict market trends and buyer behavior can mean the difference between success and stagnation. Predictive analytics tools harness historical data and advanced algorithms to provide invaluable insights, empowering professionals to make informed decisions that enhance efficiency and profitability.

However, as these technologies evolve, questions arise:

- How can one navigate the myriad of available tools?

- What should be considered when choosing the right solution for specific real estate applications?

This article delves into the key features, benefits, and challenges of predictive analytics tools, offering a comprehensive comparison to help property experts stay ahead in a rapidly changing market.

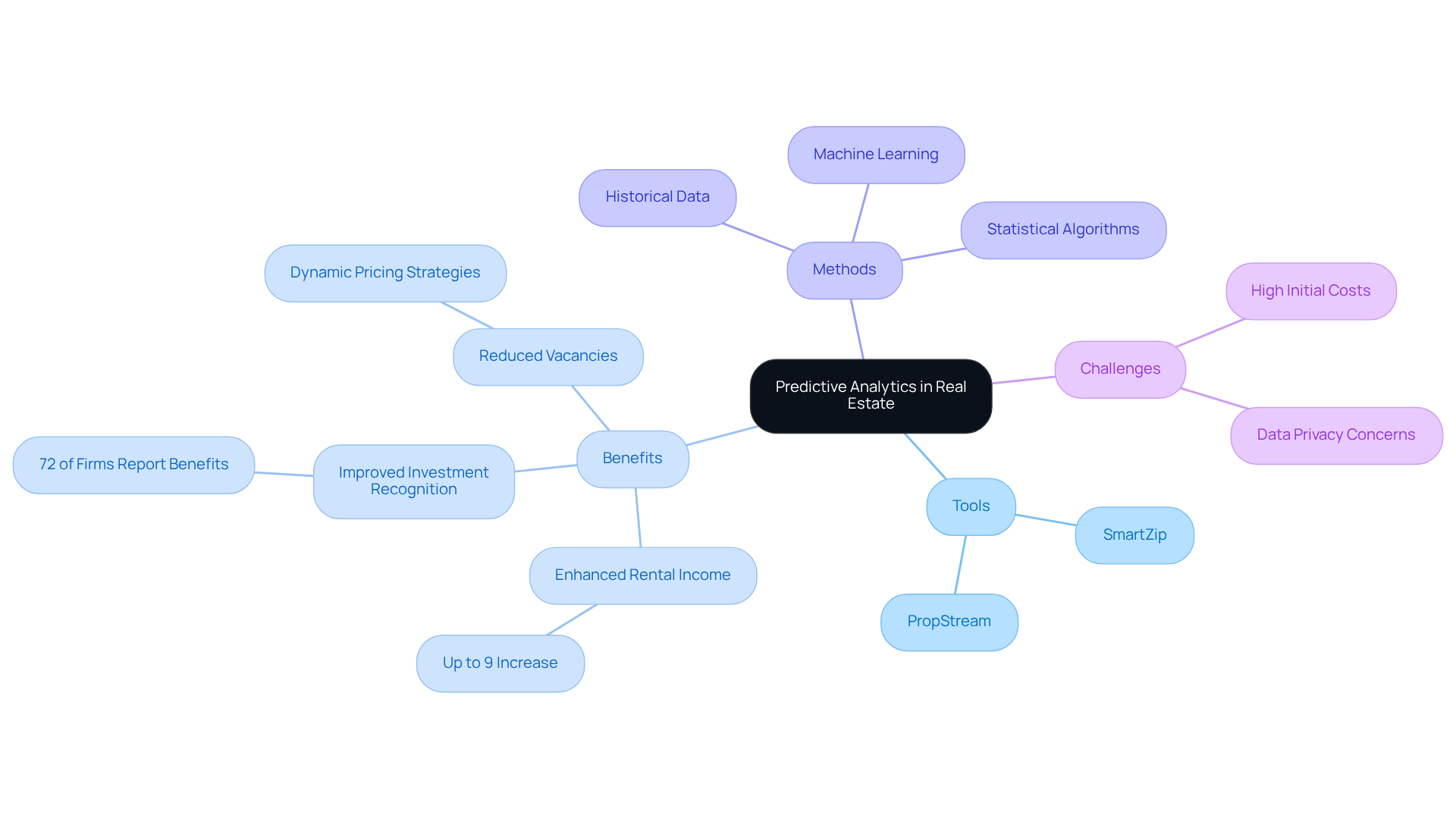

Understanding Predictive Analytics in Real Estate

In real estate, predictive analytics tools for real estate utilize historical data, statistical algorithms, and machine learning methods to forecast future results based on previous trends. This methodology empowers property professionals to use predictive analytics tools for real estate to anticipate property values, assess market demand, and analyze buyer behavior. By utilizing extensive datasets, predictive analytics tools for real estate deliver insights that support data-informed decision-making, ultimately enhancing operational efficiency and profitability within the real estate sector.

For instance, platforms such as SmartZip and PropStream harness forecasting data to identify potential buyers and sellers, enabling agents to refine their marketing strategies effectively. Predictive models evaluate factors like past property performance and local economic conditions to rank investment opportunities, thereby enriching the decision-making process. The impact of predictive analytics tools for real estate is substantial; research indicates that these tools can enhance rental income by as much as 7% and reduce vacancies through dynamic pricing strategies.

Moreover, AI can accurately forecast property value trends with 95% precision, and 72% of property firms using predictive analytics tools for real estate report improved recognition of investment opportunities and risk management. Success stories are plentiful, with firms utilizing predictive analytics tools for real estate achieving quicker due diligence and more agile portfolio management. Furthermore, forecasting analysis aids property managers in proactively initiating lease renewals and offering targeted retention incentives.

As the sector evolves, the use of predictive analytics tools for real estate is becoming essential for maintaining a competitive edge, particularly as the AI property market is projected to reach USD 41.5 billion by 2033. However, challenges such as high initial costs and data privacy concerns must also be addressed. As the landscape shifts, adopting foresight analysis will be crucial for property experts aiming to stay ahead.

Key Features of Leading Predictive Analytics Tools

Prominent predictive analytics tools for real estate, including Rentana, Catalyze AI, and Top Producer, offer a range of functions designed to enhance user experience and facilitate informed decision-making. Key features include:

- Data Integration: The capability to aggregate data from diverse sources, yielding a comprehensive view of market conditions.

- Forecasting Models: Sophisticated algorithms that use predictive analytics tools for real estate to predict future trends in property values and rental prices.

- Lead Scoring: Tools that prioritize leads based on their likelihood to convert, thereby optimizing marketing efforts.

- User-Friendly Dashboards: Intuitive interfaces that enable users to visualize data and insights with ease.

- Custom Reporting: Options for generating tailored reports that address specific business needs.

Collectively, these features empower property professionals to make strategic decisions that align with evolving market dynamics using predictive analytics tools for real estate.

Evaluating Pros and Cons of Predictive Analytics Solutions

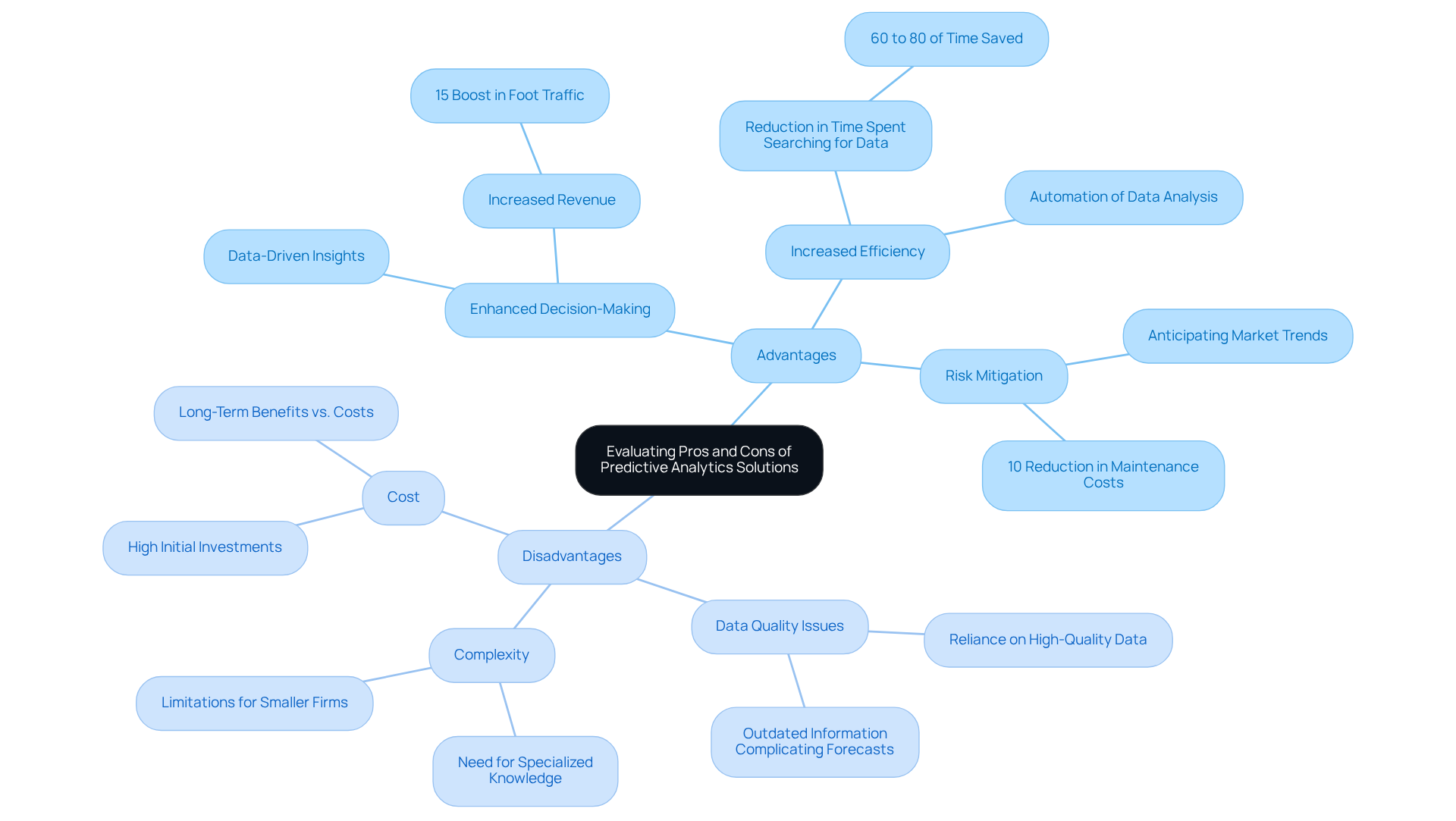

When evaluating predictive analytics solutions, it is essential to consider both their advantages and disadvantages:

-

Enhanced Decision-Making: Predictive analytics equips real estate professionals with data-driven insights, significantly improving the accuracy of forecasts and strategic planning. For instance, a retail chain that employed analytical forecasting for store location selection experienced a 15% increase in foot traffic and revenue, showcasing the potential for informed decision-making.

-

Increased efficiency is possible with predictive analytics tools for real estate, as automation of data analysis not only saves time but also alleviates the workload for real estate professionals. Numerous agents indicate that they dedicate 60% to 80% of their time looking for data, which analytical tools can assist in reducing by simplifying access to vital information.

-

Risk Mitigation: By using predictive analytics tools for real estate to anticipate market trends, forecasting techniques allow professionals to make informed decisions that reduce financial risks. For example, a property management company that utilized forecasting models to anticipate maintenance requirements successfully lowered expenses by 10%.

-

Data Quality Issues: The effectiveness of forecasting analysis is heavily reliant on the quality of the data utilized. Outdated information from different data sources can lead to flawed forecasts and misguided decisions, underscoring the importance of investing in data cleansing and normalization processes.

-

Complexity: Some forecasting tools may require specialized knowledge to operate effectively, posing a barrier for smaller firms that may lack the necessary expertise. Smaller organizations often face limitations in computing power, connectivity, or secure data storage, which can complicate the implementation of these tools.

-

Cost: Implementing advanced forecasting solutions can be costly, especially for smaller property businesses. While initial investments may be high, the long-term benefits often outweigh these costs, especially when starting with pilot projects to demonstrate value.

Grasping these elements is essential for property experts seeking to successfully implement predictive analytics tools for real estate.

Determining Suitability for Various Real Estate Applications

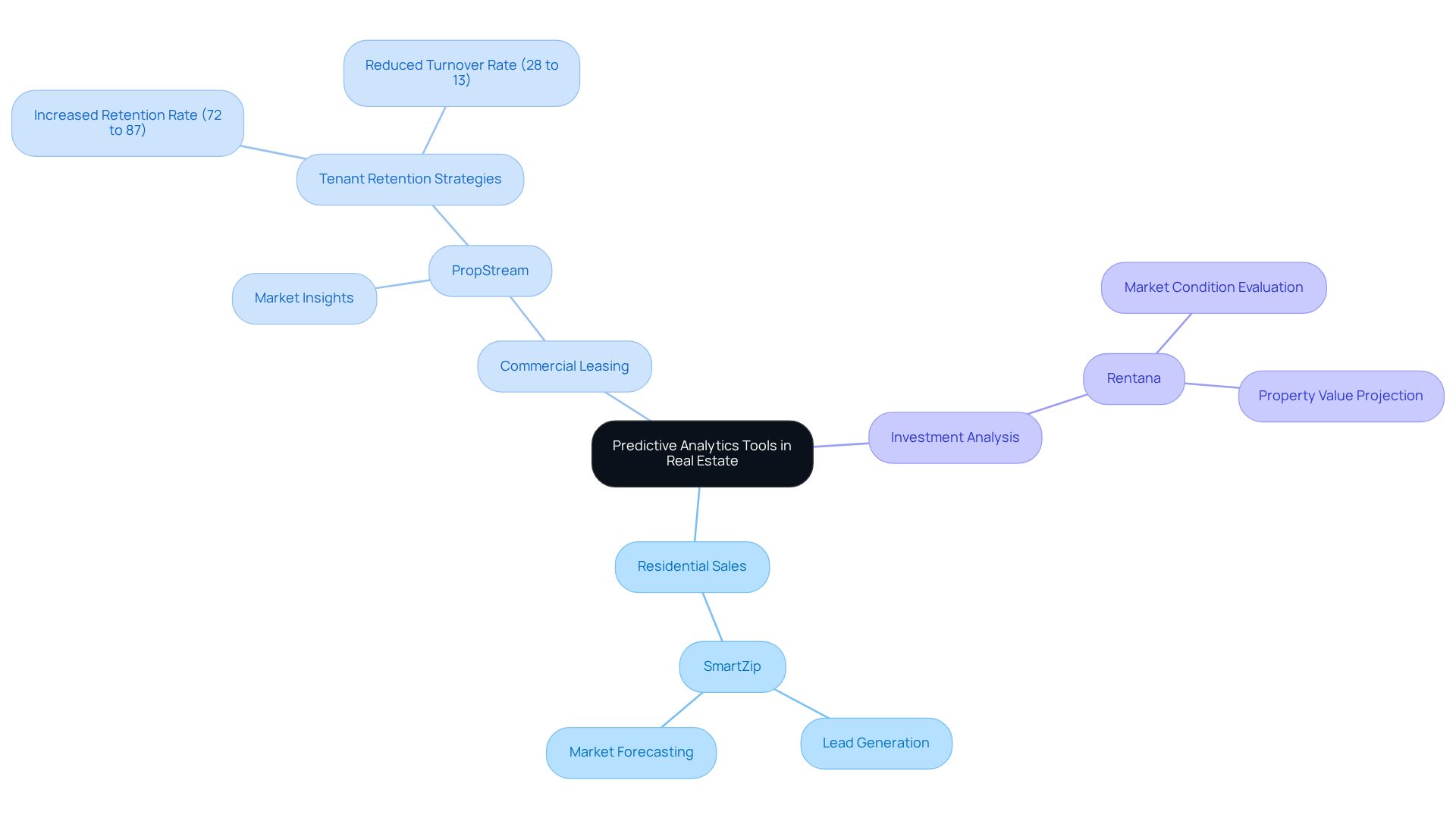

Predictive analytics tools for real estate play a pivotal role in the sector, tailored to address distinct user needs. For instance:

-

Residential Sales: Tools like SmartZip excel in lead generation, empowering agents to pinpoint potential sellers within targeted neighborhoods. This method has proven effective, with forecasting data aiding agents in anticipating market fluctuations and understanding consumer behaviors, ultimately enhancing sales efficiency.

-

Commercial Leasing: Platforms such as PropStream provide invaluable insights into commercial property trends, enabling landlords to refine their leasing strategies. By leveraging data-informed insights, landlords can set competitive rates and improve tenant retention. Notably, the implementation of forecasting retention strategies has increased average tenant retention rates from 72% to 87%, while the unexpected turnover rate has significantly decreased from 28% to just 13%, underscoring the efficacy of these strategies.

-

Investment Analysis: Solutions like Rentana cater to investors aiming to evaluate market conditions and project property values. These tools employ advanced algorithms to forecast future rental income, equipping investors to make informed decisions grounded in comprehensive market insights.

Selecting the right tool depends on the user's specific objectives, whether they focus on sales, leasing, or investment. By effectively utilizing forecast analysis, property professionals can enhance their operational efficiency and achieve superior business outcomes. As highlighted by industry experts, the integration of AI in predictive analytics tools for real estate is projected to generate $34 billion in efficiency gains by 2030, emphasizing the transformative potential of these predictive analytics tools for real estate within the landscape.

Conclusion

The integration of predictive analytics tools in the real estate sector is revolutionizing how property professionals operate. By leveraging historical data and advanced algorithms, these tools enable more informed decision-making. Not only do they enhance operational efficiency, but they also provide a competitive edge in a rapidly evolving market. As the industry continues to embrace data-driven strategies, the importance of adopting predictive analytics cannot be overstated.

Key arguments discussed in the article highlight the significant benefits of predictive analytics, such as:

- Improved decision-making

- Increased efficiency

- Effective risk mitigation

Tools like SmartZip, PropStream, and Rentana showcase how tailored solutions can address specific user needs, from residential sales to commercial leasing and investment analysis. However, challenges such as data quality, complexity, and costs must be navigated to fully harness the potential of these tools.

Ultimately, the future of real estate is intertwined with predictive analytics. Property professionals are encouraged to explore these innovative solutions. By embracing the transformative capabilities of predictive analytics, stakeholders can enhance their operational strategies and position themselves for long-term success in a data-centric industry. The journey towards improved efficiency and profitability begins with a commitment to leveraging these powerful tools.

Frequently Asked Questions

What is predictive analytics in real estate?

Predictive analytics in real estate involves using historical data, statistical algorithms, and machine learning methods to forecast future outcomes based on past trends. This helps property professionals anticipate property values, assess market demand, and analyze buyer behavior.

How do predictive analytics tools benefit real estate professionals?

Predictive analytics tools provide insights that support data-informed decision-making, enhance operational efficiency, and improve profitability within the real estate sector. They help identify potential buyers and sellers, refine marketing strategies, and evaluate investment opportunities.

What are some examples of predictive analytics platforms in real estate?

Examples of predictive analytics platforms include SmartZip and PropStream, which use forecasting data to help agents identify potential buyers and sellers.

How do predictive models evaluate investment opportunities?

Predictive models assess factors such as past property performance and local economic conditions to rank investment opportunities, enriching the decision-making process for property professionals.

What impact do predictive analytics tools have on rental income and vacancies?

Research indicates that predictive analytics tools can enhance rental income by up to 7% and reduce vacancies through dynamic pricing strategies.

How accurate are AI forecasts for property value trends?

AI can accurately forecast property value trends with 95% precision.

What percentage of property firms report improved recognition of investment opportunities using predictive analytics?

72% of property firms using predictive analytics tools report improved recognition of investment opportunities and risk management.

What are some success stories related to predictive analytics in real estate?

Firms using predictive analytics tools have achieved quicker due diligence and more agile portfolio management, as well as proactive lease renewals and targeted retention incentives.

Why is predictive analytics becoming essential in the real estate sector?

As the real estate sector evolves, predictive analytics tools are crucial for maintaining a competitive edge, especially with the AI property market projected to reach USD 41.5 billion by 2033.

What challenges do property experts face when adopting predictive analytics?

Challenges include high initial costs and data privacy concerns that must be addressed as the landscape shifts.