Overview

The article outlines essential steps and resources for checking property liens, emphasizing the critical importance of understanding various types of claims—mortgage, tax, and judgment—and their potential implications on real estate ownership.

A comprehensive guide is provided, detailing necessary tools, a step-by-step search process, and troubleshooting for common issues.

This underscores the vital nature of due diligence in real estate transactions, which is essential to avoid legal complications and ensure informed decision-making.

Introduction

Navigating the complex world of property liens is essential for current homeowners and prospective buyers alike. These legal claims, often arising from unpaid debts such as mortgages or taxes, can significantly impact property ownership and transactions.

With various types of liens—mortgage, tax, and judgment—each carrying unique implications, understanding their nuances is crucial for making informed decisions.

Furthermore, as the housing market remains resilient, the risks associated with liens continue to evolve, highlighting the importance of thorough checks and proactive measures.

This article delves into the intricacies of property liens, equipping readers with the knowledge needed to safeguard their investments and navigate the real estate landscape confidently.

Understand Property Liens and Their Implications

A real estate claim signifies a legal right against an asset, typically arising from overdue obligations such as mortgages, levies, or contractor charges. Understanding the various categories of claims—mortgage claims, tax claims, and judgment claims—is essential for landowners and potential purchasers, as each category has unique consequences:

- Mortgage Claims: These voluntary claims are established by lenders when financing real estate. Failure to settle the mortgage can lead to foreclosure, necessitating a check for property liens, which significantly impacts ownership rights.

- Tax Claims: Enforced by government entities for unpaid real estate taxes, these claims can result in the asset being sold at a tax claim auction if the debt remains unresolved. Therefore, it is crucial to check for property liens. In 2025, approximately 3.5% of assets in the U.S. are projected to have tax claims, underscoring the importance of promptly addressing tax responsibilities.

- Judgment Claims: These arise from court rulings against the asset owner, allowing creditors to assert claims against the asset to satisfy debts. Such claims can complicate real estate transactions and affect the owner's ability to sell or refinance, necessitating a check for property liens.

It is vital to check for property liens when considering the implications of these claims. For instance, in the first quarter of 2023, there were 58,120 home retention actions, indicating a growing concern over ownership stability. Additionally, in February 2024, Florence, SC reported that one in every 1,809 homes faced foreclosure, making it imperative to check for property liens related to mortgage obligations. This situation contrasts with the stability observed in the housing market, which remains resilient compared to the volatility experienced during the Great Recession.

Furthermore, REsimpli highlights that elevated home equity levels are currently preventing a massive foreclosure crisis, offering a more optimistic perspective on the market's health.

Case studies further illustrate these impacts. For instance, mechanic's claims in Oregon protect construction professionals by ensuring they can demand compensation for their services, thereby influencing the overall real estate value and transaction process. Likewise, investing in tax certificate options can be complex, but institutional investors associated with the National Tax Certificate Association (NTCA) provide valuable resources and networking opportunities, easing the burden of due diligence for prospective investors. These case studies emphasize the importance of understanding different claims and their effects on ownership and transactions, highlighting the necessity of checking for property liens.

Grasping these claims and their implications is crucial for making informed decisions in real estate dealings, which includes the imperative to check for property liens to avert potential legal issues.

Gather Necessary Tools and Resources for Lien Checks

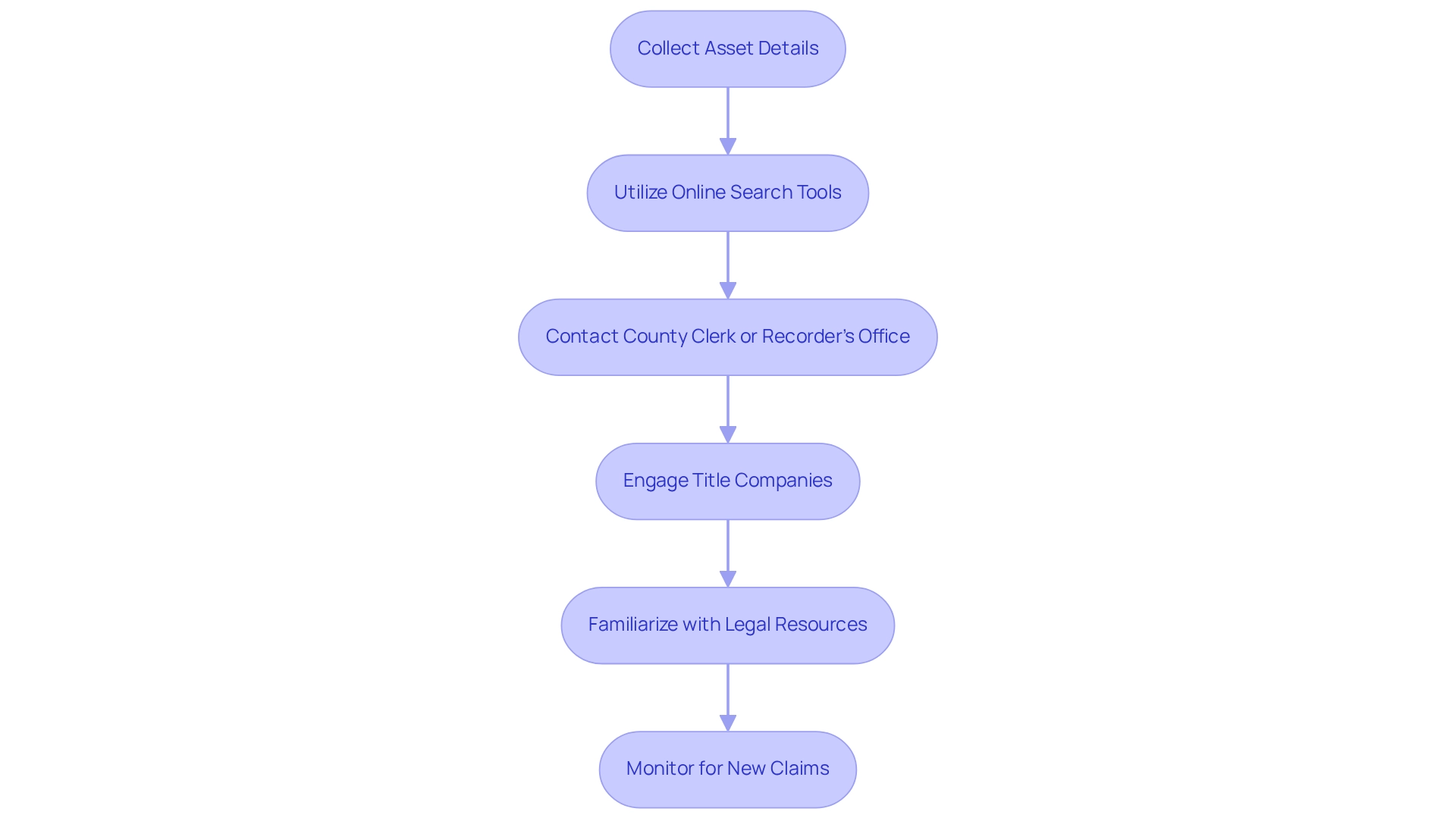

To conduct a thorough inquiry, it is essential to gather the following tools and resources:

- Asset Details: Start by collecting the asset's legal description, which includes the address, parcel number, and any prior ownership information. This foundational data is critical for accurate searches.

- Online Search Tools: Utilize online platforms such as PropertyChecker.com and local county recorder's office websites to efficiently access public records. These tools are increasingly favored by title companies, with usage statistics showing a significant rise in their adoption in 2025. Additionally, automated external inquiry services are recommended for conducting tax or UCC claims investigations at scale, thereby enhancing efficiency in the process.

- County Clerk or Recorder's Office: Directly visit or contact the local office where the asset is located to request encumbrance information. This step ensures that you obtain the most current and accurate data available.

- Title Companies: Engaging a title company can provide a comprehensive investigation, as they possess extensive databases and specialized expertise in identifying encumbrances. Their services are particularly valuable for complex properties or transactions.

- Legal Resources: Familiarize yourself with state-specific property claims laws and regulations, which are often accessible on government websites or through legal aid resources. Understanding these regulations is crucial for ensuring compliance and protecting investments. Furthermore, employing advanced machine learning tools from Parse AI, such as the example manager, can expedite document processing and enhance title research automation, allowing users to check for property liens more effectively during the inquiry process. Parse AI's platform facilitates rapid labeling and extraction of essential data from unstructured documents, greatly simplifying the task of locating claims.

Continuous monitoring is essential after completing a claim investigation to check for property liens. Assets can accumulate new claims over time, making regular assessments and follow-up inquiries vital for maintaining security in real estate investments. As one industry specialist noted, investing in comprehensive claims checks is an investment in certainty and safety that significantly outweighs the potential costs of oversight. Additionally, ensure that you record the transaction ID provided at the time of payment for future reference, as this detail is important in the process.

Conduct a Comprehensive Lien Search: Step-by-Step Process

To conduct a comprehensive lien search, follow these essential steps:

- Identify the Property: Collect all relevant details, including the legal description and current owner information, to ensure accuracy in your inquiry.

- Access Public Records: Visit the local county recorder's office or their website to search for recorded claims. Utilize the location address or parcel number for efficient searching.

- Check Online Databases: Utilize online resources like PropertyShark or local government records to discover any claims linked to the asset.

- Review Tax Records: Examine unpaid real estate taxes that may have resulted in a tax claim, usually obtainable via the county tax assessor's office.

- Consult with a Title Company: If difficulties emerge or a more comprehensive investigation is required, consider involving a title company for expert help in performing a detailed examination.

- Document Findings: Keep detailed records of all inquiries, including dates, sources, and any claims identified, to create an extensive overview of the asset's claim status.

The integrity of property transactions depends on comprehensive claims investigations. These steps to check for property liens are essential for real estate professionals. As an industry expert noted, "It's an investment in certainty and security that far outweighs the potential costs of neglect." By employing advanced tools and methods, such as those offered by Parse AI, title researchers can enhance their efficiency and accuracy in each of these steps, ultimately leading to significant cost savings in the title research process.

Troubleshoot Common Issues in Lien Searches

When conducting a lien search, several common issues may arise that can complicate the process:

- Incomplete Records: A significant challenge in property searches is the prevalence of incomplete public records. While specific statistics on incomplete records were not provided, it is essential to consult multiple sources or directly contact the county office for clarification to ensure comprehensive information.

- Mistakes in Public Records: Public records may contain inaccuracies, such as misspellings or incorrect property descriptions, which can lead to disregarded claims. Always cross-verify information against various records to minimize the risk of missing critical details.

- Concealed Claims: Some claims may not be officially documented or can be difficult to reveal. Engaging with a title company can provide a more comprehensive investigation, ensuring that all potential liens are identified. As Kim Armstrong, Vice President of Title Automation Services, notes, "Title professionals working with home buyers and investors on the purchase of a distressed property should make sure to help their clients uncover all hidden risk prior to purchase."

- Access Issues: Difficulties in accessing online databases or public records can hinder your search. If you encounter such issues, reach out to the relevant office for assistance or explore alternative methods to obtain the necessary information.

- Legal Complications: Upon discovering a claim, it is crucial to consult with a legal professional to fully understand the implications and determine the best course of action for resolution. Proactive financial planning can assist property owners in meeting tax obligations and circumventing risks linked to claims. This step is essential to reduce any possible risks related to the claim.

By proactively addressing these common issues, title professionals can enhance their efficiency and accuracy, enabling them to check for property liens more effectively. This ultimately benefits their clients and their own operations. Additionally, integrating AI into title businesses can enhance various aspects of operations, from routine task automation to customer service improvements, leading to increased efficiency and accuracy.

Conclusion

Understanding property liens is essential for homeowners and prospective buyers to safeguard their investments and navigate real estate transactions with confidence. This article underscores the importance of recognizing the various types of liens—mortgage, tax, and judgment—and their distinct implications. Each type of lien can significantly influence property ownership and market dynamics, highlighting the necessity for thorough research and proactive measures.

Gathering the appropriate tools and resources is critical for conducting comprehensive lien searches. Utilizing online databases, local county offices, and title companies can significantly enhance the accuracy and efficiency of these searches. Furthermore, maintaining vigilance post-search is imperative, as new liens can surface that may affect property value and ownership rights.

The step-by-step process outlined for conducting a lien search serves as a practical guide for real estate professionals and buyers alike. By adhering to these steps and addressing common issues that may arise—such as incomplete records or hidden liens—individuals can facilitate a smoother transaction process and protect their investments.

In conclusion, navigating the complexities of property liens demands diligence, knowledge, and the right resources. By comprehending the implications of different liens and implementing effective search strategies, property owners and buyers can mitigate risks and make informed decisions in the ever-evolving real estate landscape. Prioritizing lien checks is not merely a precaution; it is a strategic investment in security and peace of mind.

Frequently Asked Questions

What is a real estate claim?

A real estate claim signifies a legal right against an asset, typically arising from overdue obligations such as mortgages, levies, or contractor charges.

What are the main categories of real estate claims?

The main categories of real estate claims are mortgage claims, tax claims, and judgment claims, each with unique consequences for landowners and potential purchasers.

What are mortgage claims?

Mortgage claims are voluntary claims established by lenders when financing real estate. Failure to settle the mortgage can lead to foreclosure and necessitates checking for property liens, which significantly impacts ownership rights.

What are tax claims?

Tax claims are enforced by government entities for unpaid real estate taxes. If the debt remains unresolved, the asset can be sold at a tax claim auction. It is crucial to check for property liens, as approximately 3.5% of assets in the U.S. are projected to have tax claims by 2025.

What are judgment claims?

Judgment claims arise from court rulings against the asset owner, allowing creditors to assert claims against the asset to satisfy debts. These claims can complicate real estate transactions and affect the owner's ability to sell or refinance, making it necessary to check for property liens.

Why is it important to check for property liens?

Checking for property liens is vital as it helps avoid potential legal issues related to mortgage, tax, or judgment claims that could impact ownership stability and real estate transactions.

What recent statistics highlight the importance of checking for property liens?

In the first quarter of 2023, there were 58,120 home retention actions, indicating growing concern over ownership stability. Additionally, in February 2024, one in every 1,809 homes in Florence, SC faced foreclosure, underscoring the need to check for property liens related to mortgage obligations.

How do elevated home equity levels influence the foreclosure crisis?

Elevated home equity levels are currently preventing a massive foreclosure crisis, providing a more optimistic perspective on the health of the housing market compared to the volatility experienced during the Great Recession.

What role do case studies play in understanding real estate claims?

Case studies illustrate the impacts of different claims, such as mechanic's claims in Oregon, which protect construction professionals and influence real estate value and transactions. They also highlight the complexity of investing in tax certificate options and the resources provided by institutional investors.

What is the overall importance of understanding different real estate claims?

Grasping the various claims and their implications is crucial for making informed decisions in real estate dealings, including the imperative to check for property liens to avert potential legal issues.