Introduction

Title insurance serves as a vital protection in real estate transactions, safeguarding against title defects and potential financial losses. However, it's important to understand that title insurance has exceptions and exclusions that may limit coverage. These exceptions can vary and may not cover specific risks or conditions.

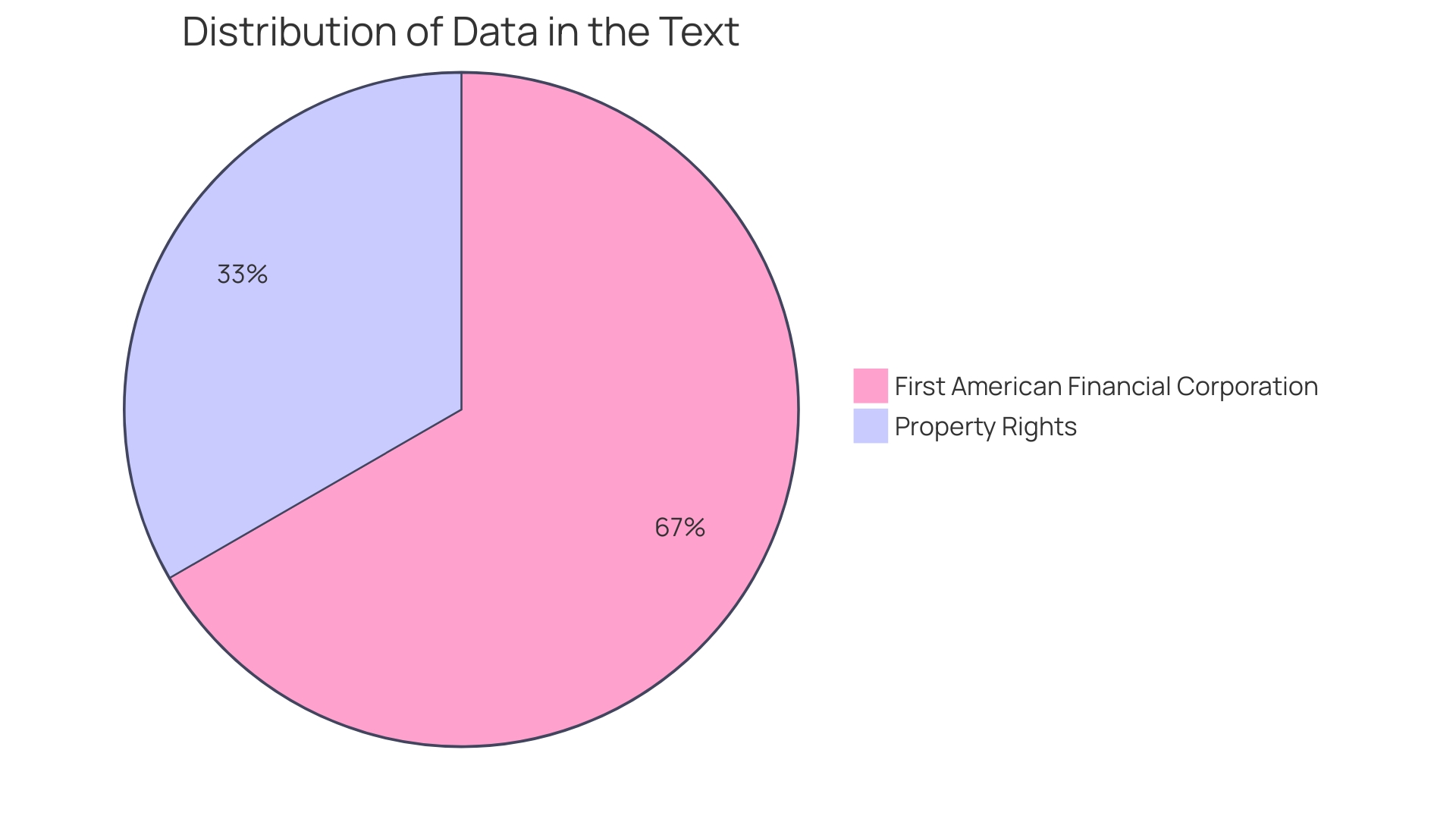

By comprehensively reviewing these exceptions, stakeholders can ensure they are fully informed of the protections and boundaries of their policy. This article explores the types of exceptions in title insurance, the impact of exceptions on coverage, and key considerations for understanding and managing exceptions. With the help of organizations like First American Financial Corporation, which has a long-standing history and expertise in the industry, stakeholders can navigate the complexities of title insurance and make informed decisions to protect their property rights.

What is Title Insurance Coverage?

The acts as an essential protection in transactions related to real estate, guaranteeing the lawful transfer of assets and safeguarding against monetary damages arising from defects in ownership. This coverage protects against various concerns, such as , undisclosed claims, and errors in public records, which are important considering that a deed, as opposed to a property document, signifies legal ownership and is not simply a physical record. The importance of is underscored by the fact that First American Financial Corporation, a leading entity in title and settlement services, emphasizes how this specific form of coverage is a regulated product that provides protection for property rights and resolves potential issues before they escalate into claims.

However, it is crucial for stakeholders in to recognize that insurance does not cover all eventualities. Certain exceptions and exclusions may apply, which can range from pre-existing violations of zoning laws to claims that arise due to specific stipulations not covered by the policy. Considering this, First American Financial Corporation, with its vast expertise and a revenue of $7.6 billion in 2022, continues to innovate in offering comprehensive services and risk solutions. This commitment to excellence and innovation is evident as the company was named one of the 100 Best Companies to Work For by Great Place to Work® and Fortune Magazine for the eighth consecutive year in 2023.

Understanding Exceptions in Title Insurance

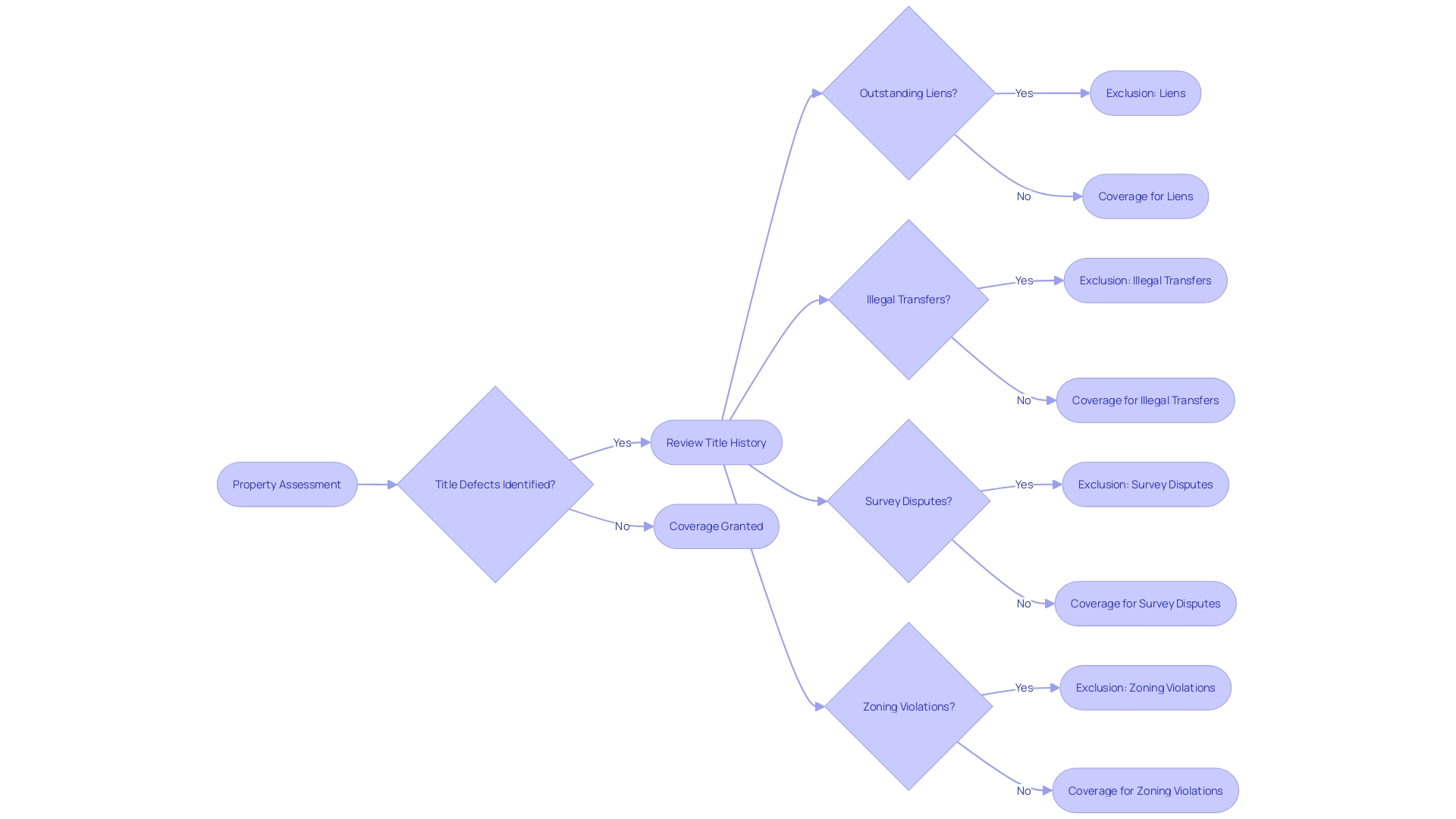

Policies for protecting property rights have a crucial function in ensuring comprehensive coverage against defects in ownership, which may involve problems like outstanding debts or unauthorized property transfers that could lead to monetary damage. A unique characteristic of , distinguishing it from other types of insurance, is that it is a one-time purchase made at closing. It not only offers protection if problems arise but also . This proactive approach by professionals in the field significantly . However, it is essential for policyholders to be aware that insurance does include certain exclusions. 'Referred to as 'exceptions,' these are clearly listed in the commitment or policy.'. Exceptions can vary by asset, location, and insurer, and may not cover specific risks or conditions. For example, approximately one-third of all coverage claims arise from matters not documented in public records. is crucial for landowners and lenders to grasp the scope of their coverage and the constraints that may impact their rights over assets. Considering this, it is the responsibility of stakeholders to carefully examine the exclusions of their policy to guarantee they have complete knowledge of the safeguards and the limitations of their coverage.

Types of Exceptions in Title Insurance

policies are crafted to protect property owners and lenders from potential due to defects in the title. Nevertheless, they also incorporate particular exclusions that restrict the extent of coverage. For example, survey exclusions are quite common, excluding any boundary disputes or encroachments that would have been evident from an accurate land survey. Zoning exclusions are another common removal, eliminating coverage for issues arising from violations of zoning regulations. Additionally, title insurance may not cover certain liens such as those related to environmental or construction (mechanic's) issues, as well as pre-existing easements. These exclusions are crucial to the policy framework, outlining the insurer's responsibility and specifying the hazards that the policyholder is safeguarded from.

Understanding these exceptions is crucial, particularly in light of an ownership landscape that is becoming increasingly complex. According to First American Financial Corporation, a leader in settlement solutions for real estate, the industry is evolving with technological advancements and digital transformation. In such a dynamic environment, the certainty offered by ensuring rights and ownership can be invaluable. The significance of safeguarding against potential concerns in real estate transactions is underscored by the complex nature of these transactions, which can include conflicts related to marital ownership that may affect the sequence of ownership and lead to financial damages. By mitigating such risks, protection against legal issues remains an essential component of secure real estate transactions, ensuring that ownership rights are clear and protected.

Impact of Exceptions on Title Insurance Coverage

Title protection serves as a safeguard against potential ownership defects that could challenge the rights and financial well-being of land possessors and lenders. It's essential to understand that the may contain exclusions which, if triggered by a claim, could lead to the insurer denying coverage for that particular matter. Such exclusions could leave the owner or lender to address and rectify the issue at their own expense, potentially leading to significant financial loss. This underscores the importance of meticulously reviewing the policy's listed exceptions and evaluating the associated risks in alignment with the property's history and the current real estate climate.

The digital transformation of the industry that deals with protecting , led by companies such as First American Financial Corporation, with a long-standing track record of financial resilience and innovation spanning over 130 years, highlights the evolving nature of safeguarding property ownership and the importance of staying informed about the latest developments. Given First American's substantial annual revenue of $7.6 billion in 2022 and recognition as one of the 100 Best Companies to Work For by Great Place to Work® and Fortune Magazine, there's an evident commitment to excellence within the industry that benefits clients through reliable and sophisticated services.

As the real estate market anticipates a surge in home purchases and refinancing, the importance of protecting property rights becomes even more crucial. Potential purchasers and existing property owners must understand the idea of safeguard coverage, which varies from other coverage products because of its preventative nature and single payment at the conclusion. Significantly, the coverage for property titles prioritizes resolving potential ownership issues before they escalate into claims, thereby upholding lower claim rates compared to other forms of insurance. The most common sources of include unresolved mortgages, judgments, liens, and mechanic's liens.

With the First American Economics team providing insights into the landscape of , albeit with a disclaimer regarding the accuracy and currentness of information, stakeholders in real estate transactions can make more informed decisions. This professional guidance, coupled with the comprehensive regulation of real estate title coverage, ensures that ownership rights are thoroughly protected for over a century, making it a trusted solution in the real estate sector.

Common Exceptions in Title Insurance Policies

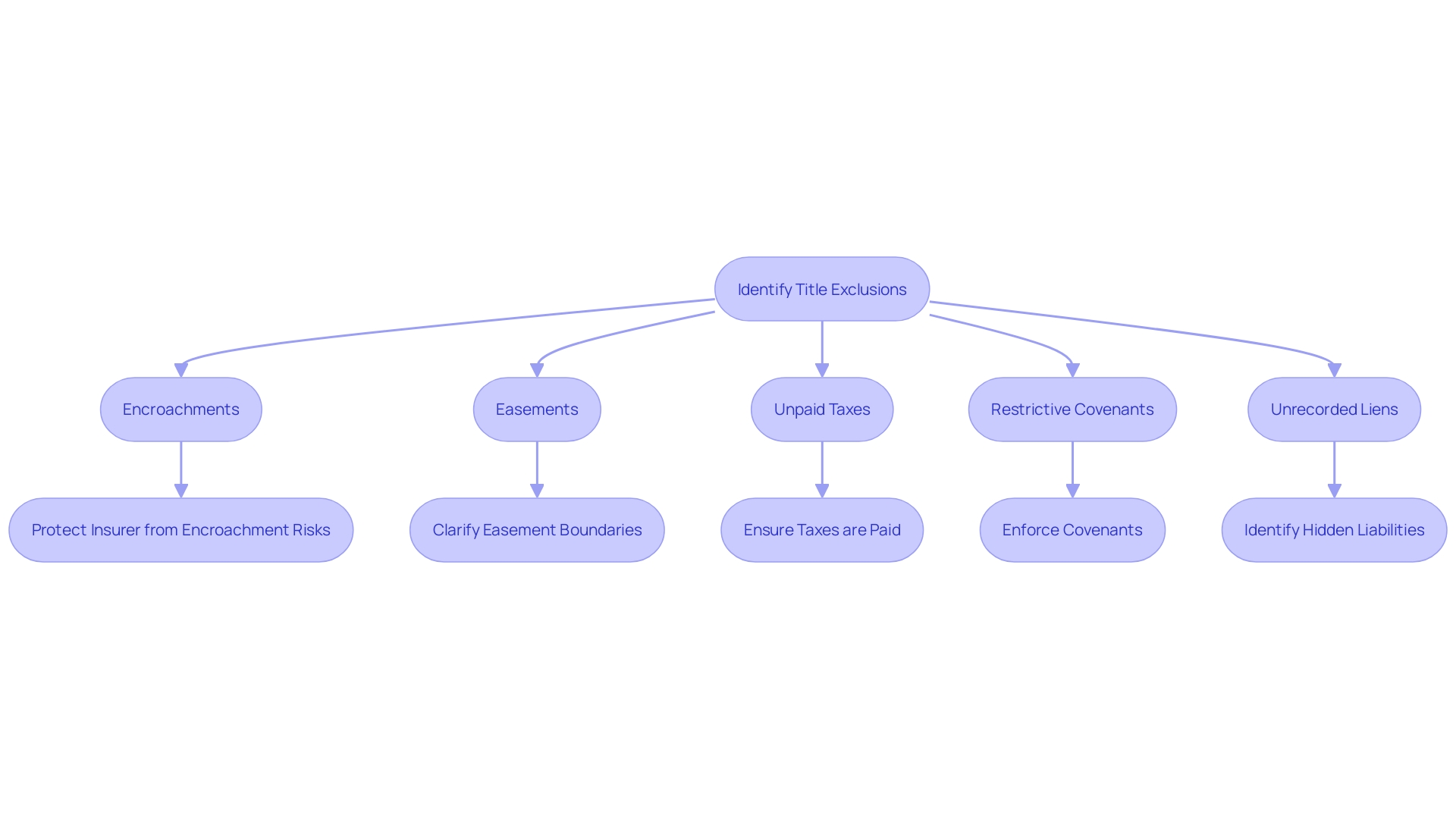

Title insurance policies are designed to protect real estate owners and lenders from potential title issues. However, these policies typically include certain exclusions, which are critical for stakeholders to recognize. Among the most prevalent exceptions, you'll find issues such as encroachments, which involve a neighbor's structures infringing upon the insured premises. Easements are another frequent exception, acknowledging the legal rights of others to utilize portions of the land for specific purposes, such as utility maintenance or right of way. , particularly those that could result in a lien, are also typically excluded from coverage.

Moreover, restrictive covenants, which may impose conditions on the use of the property in accordance with local zoning or homeowners association regulations, are often not covered by the insurance that guarantees the ownership rights of the property. Moreover, unrecorded liens, which may include those arising from construction work or court judgments that have not been properly documented in public records, are standard exclusions. These exclusions are in place to protect the insurer from unforeseen risks and to clarify the scope of protection offered by the policy.

The real estate industry, which includes the protection of property rights, is undergoing a digital transformation, as demonstrated by organizations like First American Financial Corporation, which reported a total revenue of $7.6 billion in 2022. This company, among others, is pioneering the integration of innovative technologies and comprehensive data assets to streamline document and settlement processes. As industry practices change, comprehending the intricacies of coverage for property ownership, including typical exclusions, continues to be a fundamental aspect of safe real estate transactions.

Extended Title Insurance Coverage: An Overview

When purchasing real estate, securing title coverage is essential to safeguard against possible title defects. protects the policyholder from financial loss caused by problems like unsatisfied liens or unlawful transfers. While a standard policy offers substantial protection, it's important to consider that safeguard against additional risks. These can include mechanic's liens, which may arise post-closure, or zoning violations that could impact land utilization. Considering the intricacy and diversity of the issues related to property ownership, owners and lenders must assess their specific risk factors and decide if extended coverage is advisable.

Expanded coverage for property ownership becomes more important as it addresses issues not always apparent in public records. As per First American Financial Corporation, a prominent player in the field of title and settlement, approximately one-third of all claims related to stem from issues beyond the scope of public documentation. As the real estate industry changes, and with First American's reported revenue of $7.6 billion in 2022, the significance of is emphasized for both residential and commercial transactions. With groundbreaking technologies and a thorough approach to risk management, extended coverage for property rights stands as a vital tool for ensuring peace of mind in real estate transactions.

Key Considerations for Title Insurance Exceptions

Mastering the complexities of is vital for safeguarding . These exclusions, described in the insurance policy, outline the limitations of the coverage. It's essential to thoroughly understand the specific risks that are not covered under your policy. For instance, suppose a property has a history of ownership disputes such as the case where two properties were argued over whether they should be considered matrimonial property. The legal and financial complexities in such scenarios emphasize the significance of carefully assessing the potential impact of the variations on your asset.

Exploring further the range of exclusions, you must ascertain if extra protection is justified for specific risks that lie beyond the regular policy. Companies like First American Financial Corporation, which has a longstanding history and a strong financial foundation, emphasize the importance of having a robust risk solution in place. They highlight the and the availability of innovative technologies that can assist in managing these risks.

In cases where the exclusions raise concerns or prompt questions, it is advisable to seek professional advice. Engaging with a or an expert in can provide clarity and insights. This guidance guarantees that you are well-informed about the ramifications of the , which is crucial for making wise real estate and loan-related decisions.

Comprehending the exceptions to your is not just about identifying what's excluded; it's about actively managing potential vulnerabilities and guaranteeing that your rights are adequately protected. Whether it's a dispute over property ownership or other legal entanglements, being proactive and informed can significantly mitigate risks associated with real estate transactions.

Conclusion

In conclusion, title insurance is essential for protecting property rights and mitigating financial risks in real estate transactions. However, it's important to be aware of the exceptions and exclusions that can limit coverage. Understanding these exceptions is crucial for stakeholders to fully comprehend the extent of their policy's protections and limitations.

By reviewing the exceptions in their title insurance policy, property owners and lenders can navigate the complexities of coverage. Common exceptions include boundary disputes, zoning violations, and certain types of liens. Meticulously evaluating these exceptions helps stakeholders make informed decisions and protect their property rights.

The impact of exceptions on title insurance coverage is significant. It's vital to carefully review the listed exceptions and assess associated risks to avoid potential financial losses. Encroachments, easements, unpaid taxes, restrictive covenants, and unrecorded liens are among the common exceptions that clarify the insurer's liability and the policyholder's protected risks.

Considering extended title insurance coverage can provide additional protection against risks not evident in public records. Mechanic's liens and zoning violations are examples of risks that extended coverage can address. Property owners and lenders should evaluate their specific risk factors to determine if extended coverage is necessary.

Seeking professional counsel from real estate attorneys or title insurance experts can provide valuable insights when navigating title insurance exceptions. Being proactive and well-informed about these exceptions helps stakeholders manage potential vulnerabilities and safeguard their property rights.

In conclusion, stakeholders in real estate transactions must thoroughly review their title insurance exceptions to understand the protections and limitations of their policy. By understanding and managing these exceptions, property owners and lenders can make informed decisions and protect their property rights effectively.

Frequently Asked Questions

What is title insurance?

Title insurance protects property owners and lenders from financial losses due to defects in the title, such as outstanding debts or unauthorized transfers of property ownership.

Why is title insurance important in real estate transactions?

It guarantees the lawful transfer of assets and safeguards against monetary damages arising from ownership defects, ensuring that ownership rights are clear and protected.

What types of issues does title insurance cover?

Title insurance covers various concerns, including ownership conflicts, undisclosed claims, and errors in public records. It aims to resolve potential ownership issues before they escalate into claims.

Are there exclusions in title insurance policies?

Yes, title insurance policies include specific exclusions, which are clearly listed. These exclusions can limit coverage for certain risks, such as zoning violations or boundary disputes.

What are common exclusions found in title insurance policies?

Common exclusions include: Survey exclusions (boundary disputes), Zoning exclusions (violations of zoning laws), Unpaid taxes (leading to liens), Restrictive covenants (conditions on property use), Unrecorded liens (construction or court judgments).

How do exclusions impact property owners and lenders?

If an exclusion is triggered by a claim, the insurer may deny coverage for that matter, leaving the property owner or lender to address the issue at their own expense. This can lead to significant financial loss.

What steps should stakeholders take regarding exclusions?

Stakeholders should meticulously review the policy's listed exceptions and assess the associated risks based on the property's history and current real estate climate.

How does the digital transformation of the industry affect title insurance?

Companies like First American Financial Corporation are integrating innovative technologies to streamline processes in title insurance, ensuring more effective risk management and protection of ownership rights.

What should property owners consider regarding extended title coverage?

Extended coverage options can provide protection against additional risks not covered in standard policies, such as post-closing mechanic's liens or zoning violations. Owners should evaluate their specific risk factors to determine if extended coverage is advisable.

Why is it crucial to understand title insurance exclusions?

Understanding exclusions helps property owners actively manage potential vulnerabilities and ensure their rights are adequately protected, especially in complex ownership situations. Engaging with a real estate lawyer or property protection expert can provide further clarity.

How has First American Financial Corporation contributed to the title insurance industry?

With a revenue of $7.6 billion in 2022 and a focus on innovation, First American has established itself as a leader in title and settlement services, emphasizing the importance of strong protection for property rights in a changing real estate landscape.