Overview

This article examines the contrasting methodologies of AI and human appraisal in real estate, underscoring their respective strengths and weaknesses. It posits that, while AI offers remarkable speed and efficiency, human appraisers deliver essential qualitative insights and a nuanced understanding of local markets. Consequently, there is a discernible trend toward a hybrid model that integrates both approaches, resulting in more accurate valuations. This synthesis not only enhances the reliability of appraisals but also addresses the complexities inherent in real estate valuation.

Introduction

The landscape of real estate valuation is undergoing a seismic shift as artificial intelligence (AI) increasingly enters the fray, challenging traditional human appraisal methods. Notably,

- 37% of real estate firms are already utilizing AI for asset evaluations,

- 60% are investing in AI technologies.

This indicates that the industry is at a crossroads where speed and efficiency meet nuanced human insight. However, as reliance on automated systems grows, questions arise about the accuracy and depth of AI assessments compared to seasoned human evaluators. How can real estate professionals navigate this evolving terrain to strike the right balance between technological advancements and the irreplaceable value of human expertise?

Defining AI and Human Appraisal Methods in Real Estate

AI evaluation techniques leverage algorithms and machine learning to analyze extensive datasets, delivering asset valuations informed by historical data, market trends, and predictive analytics. These methodologies often employ Automated Valuation Models (AVMs), which can swiftly generate estimates without the need for physical inspections. Conversely, human assessment techniques depend on certified experts who evaluate assets through site visits, personal judgment, and a profound understanding of local market conditions.

Human assessors take into account qualitative factors such as the condition of real estate, neighborhood dynamics, and distinctive features that data-driven models might overlook. Notably, a significant 37% of real estate companies currently implement AI for asset valuations, highlighting a growing trend toward integrating technology into traditional evaluation practices. Furthermore, 60% of real estate firms are investing in AI technologies to enhance their operations, signaling a broader transformation within the industry.

However, challenges such as data accuracy and market unpredictability remain critical considerations in the adoption of AI in commercial real estate. This evolution emphasizes the changing landscape of real estate valuation, where the debate of AI vs human appraisal in real estate is essential for delivering precise evaluations.

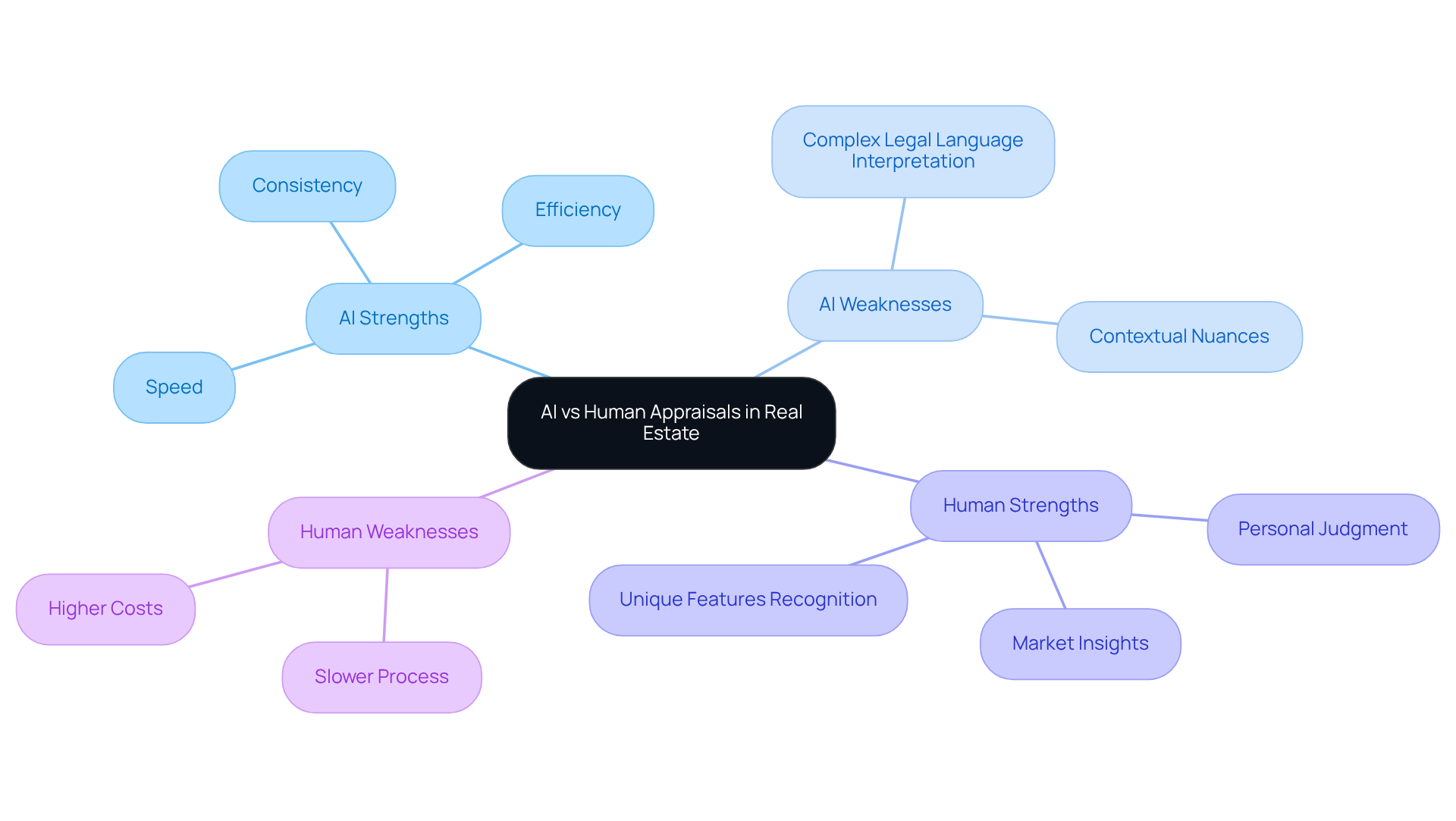

Evaluating Strengths and Weaknesses of AI and Human Appraisals

AI assessments demonstrate remarkable speed and efficiency, which is a key factor in the discussion of AI vs human appraisal in real estate, as they can process extensive datasets in mere minutes, significantly reducing the time required for valuations. This swift analysis minimizes errors and guarantees consistent valuations across multiple properties. For instance, Freddie Mac's automated collateral assessment system has successfully cut evaluation times from weeks to mere minutes, all while maintaining precision comparable to that of human evaluators. However, the discussion of AI vs human appraisal in real estate reveals the challenges AI systems face in interpreting complex legal language and contextual nuances, which are essential in real estate transactions.

Conversely, individual evaluations offer invaluable insights and personal judgment that demonstrate the advantages of AI vs human appraisal in real estate, which AI cannot replicate. Experienced evaluators can discern unique real estate features and regional market trends that significantly influence value, including community dynamics and forthcoming development initiatives. A study by the Appraisal Institute highlighted the discrepancies in AI vs human appraisal in real estate, showing that individual evaluators maintain a margin of error of 5-7% for standard properties, while AI models may exhibit a 15-20% margin of error, particularly for highly customized luxury homes. Despite their depth of insight, evaluations conducted by individuals tend to be slower and more costly due to the labor-intensive nature of the work. Thus, it is crucial for real estate professionals to carefully consider the advantages of speed in relation to AI vs human appraisal in real estate, against the nuanced understanding that skilled evaluators provide.

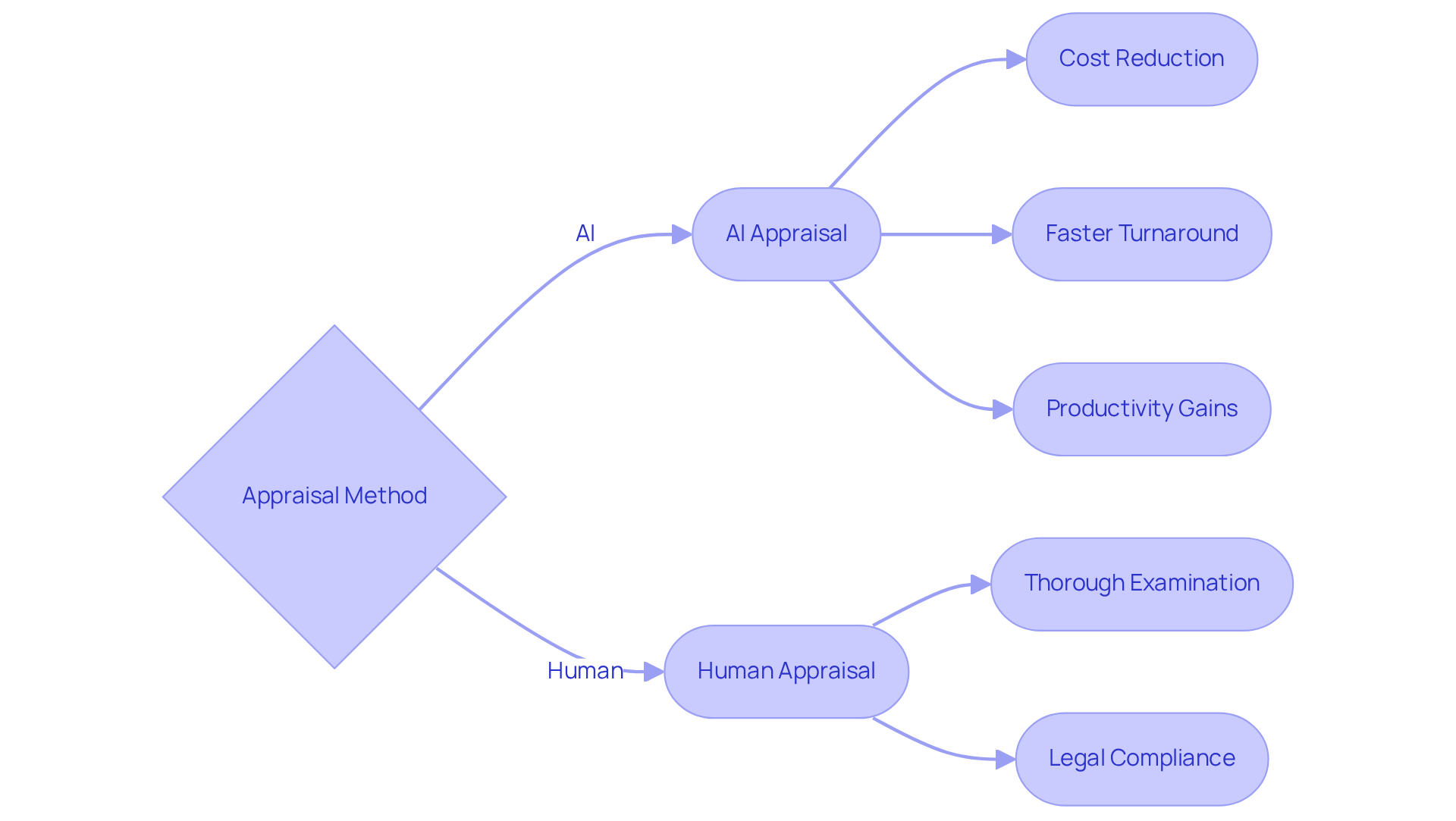

Practical Implications: Cost, Efficiency, and Workflow Impact

In the context of AI vs human appraisal in real estate, AI evaluations significantly reduce expenses via automation, facilitating faster turnaround times and decreasing reliance on personnel. This efficiency results in lower fees for clients and accelerated transaction processing. For instance, AI can cut evaluation times from one month to just a few days, representing an 80% reduction in duration.

Conversely, evaluations conducted by individuals, while generally more expensive, remain crucial for complex assets or situations that demand thorough examination and personal engagement, highlighting the importance of AI vs human appraisal in real estate. The impact on workflow is substantial; AI streamlines processes, boosting productivity by up to 81% as firms utilize AI tools for data aggregation and initial analysis.

According to a RE/MAX report, 81% of firms identify productivity gains as their primary AI ROI metric. Nevertheless, individuals assessing properties play a crucial role in the AI vs human appraisal in real estate, ensuring compliance with legal standards, as numerous regulatory frameworks require personal judgment in the process, addressing unique property issues that necessitate expert evaluation.

As the industry progresses, the integration of AI with existing systems is anticipated to enhance the evaluators' roles, enabling them to concentrate on investigative tasks rather than routine data entry.

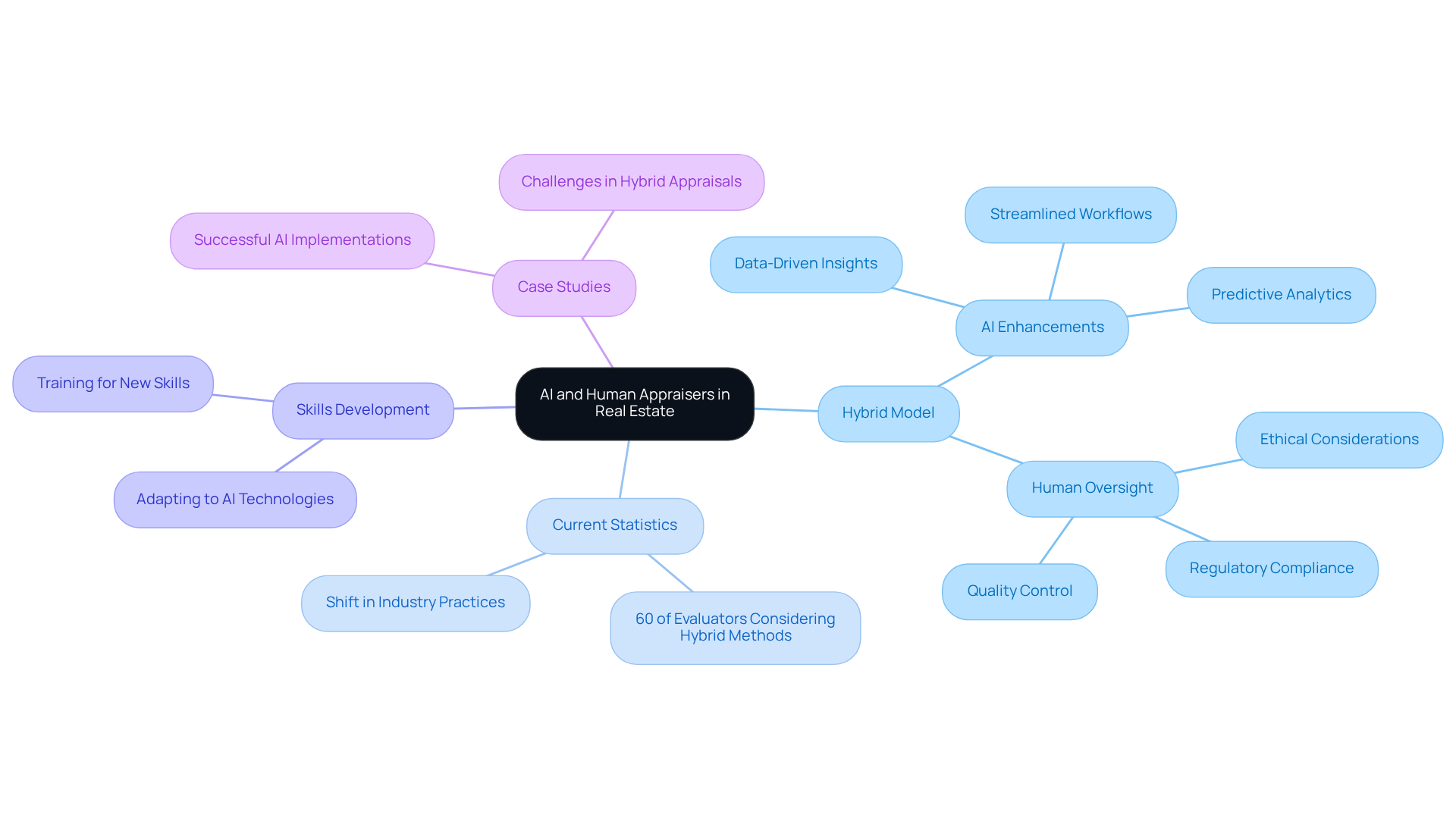

Future Trends: The Evolving Role of AI and Human Appraisers

The future of real estate evaluation is poised for a hybrid model, focusing on AI vs human appraisal in real estate, where AI tools enhance the capabilities of human evaluators rather than replace them. As AI technology advances, it will contribute to the discussion on AI vs human appraisal in real estate by providing evaluators with data-driven insights and predictive analytics, leading to more accurate valuations and improved efficiency.

Current statistics reveal that 60% of evaluators are contemplating hybrid methods, indicating a notable shift within the industry. Nevertheless, individual oversight remains crucial, particularly for addressing ethical considerations and ensuring adherence to regulatory standards.

The integration of AI into the appraisal process highlights the ongoing debate of AI vs human appraisal in real estate, requiring appraisers to adapt and develop new skills to effectively utilize these technologies. Furthermore, case studies underscore the successful implementation of AI tools, illustrating their potential to streamline workflows and enhance quality control while preserving the essential human elements of property valuation.

Conclusion

The discussion surrounding AI versus human appraisal in real estate signifies a transformative shift in property valuation practices. AI technologies provide remarkable speed and efficiency, enabling rapid data processing and consistent valuations. However, human appraisers contribute invaluable insights and nuanced understanding that technology alone cannot replicate. As the industry evolves, the integration of these two methodologies offers a compelling opportunity to enhance both accuracy and efficiency in real estate evaluations.

Key insights from the article underscore the strengths and weaknesses of both approaches. AI excels in processing large datasets swiftly and reducing operational costs, making it an appealing option for many firms. Nevertheless, the human element remains critical, especially in complex transactions where personal judgment and local market knowledge are indispensable. The future is poised to embrace a hybrid model, merging the advantages of AI with the expertise of human evaluators to tackle the unique challenges of the real estate market.

Ultimately, the incorporation of AI into appraisal practices marks a significant evolution within the industry. Real estate professionals must adapt to these changes, leveraging technology to enhance their capabilities while preserving the essential human touch in property evaluations. Embracing this hybrid approach will not only improve the accuracy of valuations but also ensure compliance with regulatory standards and ethical considerations, paving the way for a more efficient and effective real estate appraisal landscape.

Frequently Asked Questions

What are AI evaluation techniques in real estate?

AI evaluation techniques use algorithms and machine learning to analyze large datasets, providing asset valuations based on historical data, market trends, and predictive analytics.

What are Automated Valuation Models (AVMs)?

Automated Valuation Models (AVMs) are tools that quickly generate property estimates without requiring physical inspections, leveraging AI methodologies.

How do human appraisal methods differ from AI methods in real estate?

Human appraisal methods rely on certified experts who evaluate properties through site visits, personal judgment, and a deep understanding of local market conditions, considering qualitative factors that AI models may overlook.

What qualitative factors do human assessors consider?

Human assessors take into account factors such as the condition of the property, neighborhood dynamics, and unique features that may not be captured by data-driven models.

What percentage of real estate companies currently use AI for asset valuations?

Approximately 37% of real estate companies are currently implementing AI for asset valuations.

How are real estate firms investing in AI technologies?

Around 60% of real estate firms are investing in AI technologies to enhance their operations, indicating a shift towards integrating technology into traditional evaluation practices.

What challenges does AI face in commercial real estate?

Key challenges for AI in commercial real estate include data accuracy and market unpredictability, which are critical considerations for its adoption.

Why is the debate between AI and human appraisal important?

The debate between AI and human appraisal is essential for ensuring precise evaluations in the evolving landscape of real estate valuation.