Overview

The article underscores the critical compliance tracking systems essential for title companies, highlighting their pivotal role in enhancing operational efficiency, mitigating risks, and ensuring regulatory adherence. It articulates how advanced technologies—such as automation and AI—streamline compliance processes, significantly reducing errors and costs. Furthermore, these innovations foster stronger relationships with clients and stakeholders, thereby emphasizing the indispensable role these systems play within the industry.

Introduction

Navigating the complex landscape of regulatory compliance presents a formidable challenge for title companies, particularly as the stakes continue to escalate. With an ever-growing demand for accuracy and efficiency, organizations are actively pursuing innovative solutions to streamline their compliance processes. This article delves into nine essential compliance tracking systems tailored specifically for title companies, illustrating how these tools can markedly enhance operational efficiency, mitigate legal risks, and cultivate stronger client relationships. As firms confront the shifting landscape of regulations, the pressing question arises: which compliance tracking systems will most effectively bolster their growth and protect their interests in an increasingly dynamic environment?

Parse AI: Advanced Document Processing for Compliance Tracking

Parse AI is at the forefront of revolutionizing tracking regulations for property firms through its advanced document processing technologies. By harnessing machine learning and optical character recognition, Parse AI proficiently extracts critical information from extensive document collections, guaranteeing that regulatory requirements are met with precision. This innovative approach not only accelerates the compliance process but also significantly —an essential factor in an industry where accuracy is paramount.

Businesses that have adopted document automation report a remarkable 50% reduction in document processing time. Furthermore, AI-driven document processing achieves data extraction accuracy rates of up to 99% for structured documents. As the demand for seamless compliance tracking systems for title companies rises, organizations that employ document automation can reduce regulation-related errors by as much as 85%.

Consequently, Parse AI emerges as an indispensable tool for firms seeking compliance tracking systems for title companies to enhance their monitoring systems and uphold regulatory standards.

![]()

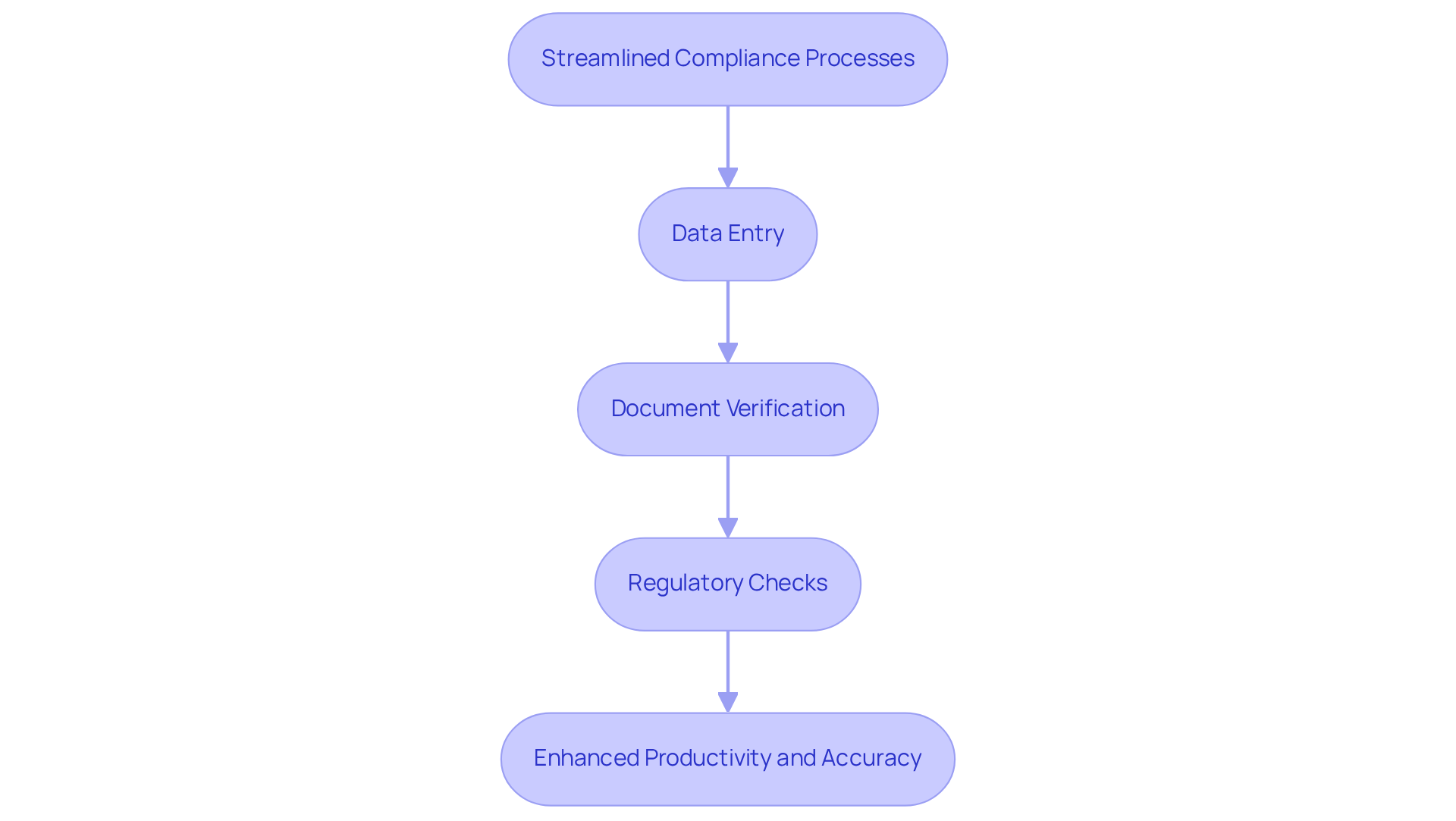

Streamlined Compliance Processes: Eliminate Manual Tasks

By automating regulatory procedures with Parse AI's advanced machine learning tools, firms managing property documents can eliminate tedious manual tasks that often lead to errors and delays. Our platform's robust research automation and document processing features effectively handle:

- Data entry

- Document verification

- Regulatory checks

Consequently, this allows staff to concentrate on more strategic activities. With capabilities such as and machine learning extraction, regulatory management seamlessly integrates into the workflow, significantly enhancing accuracy and overall productivity.

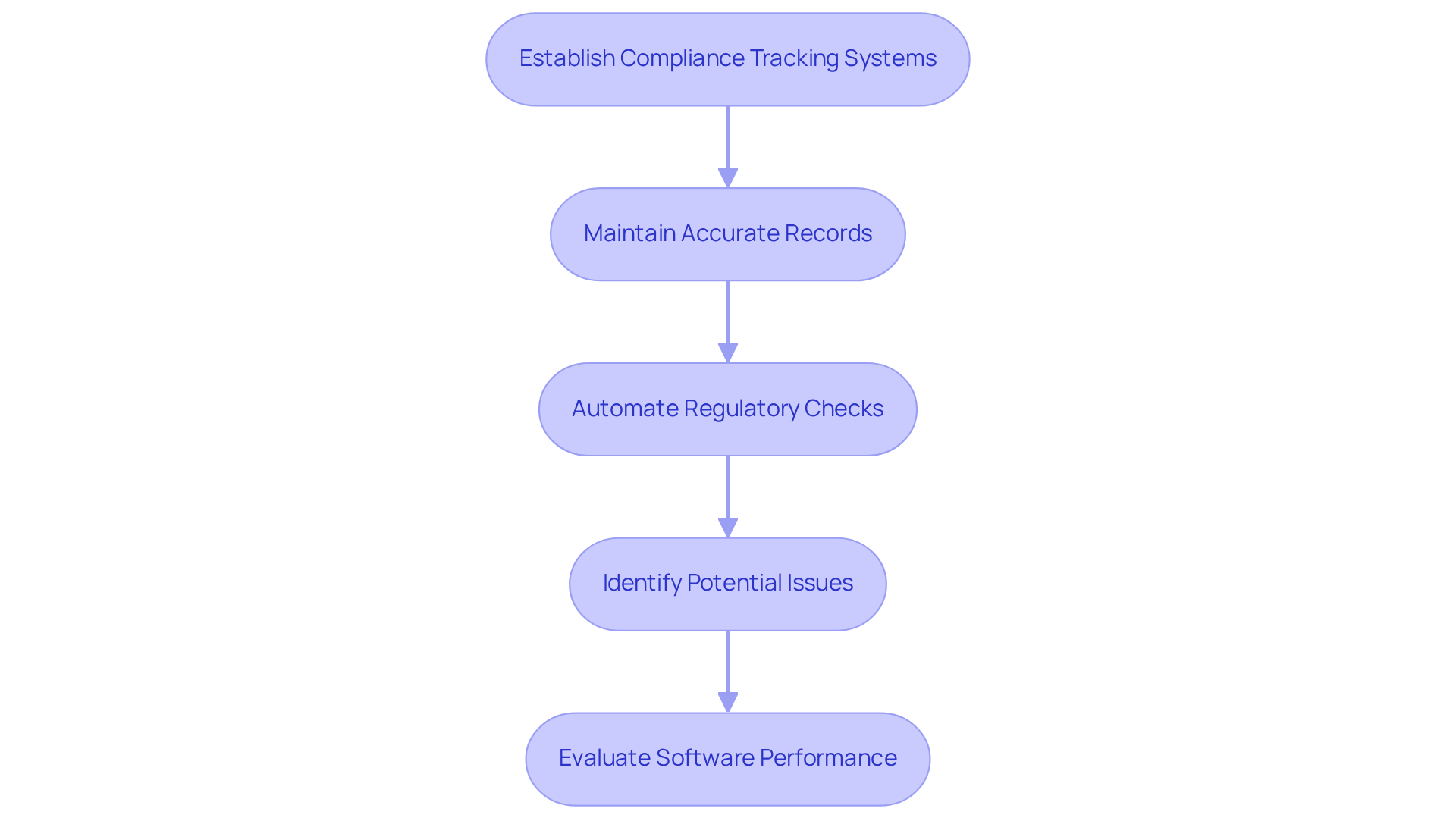

Regulatory Compliance Assurance: Reduce Fines and Legal Risks

Establishing robust compliance tracking systems for title companies is essential for firms aiming to meet regulatory obligations and mitigate legal risks. These compliance tracking systems for title companies facilitate the maintenance of accurate records and automate regulatory checks, enabling businesses to proactively identify and address potential issues before they escalate.

Organizations utilizing regulatory tracking software have reported significant reductions in fines, with many achieving cost savings through streamlined processes. Tax document mismanagement can lead to audits and substantial penalties, highlighting the financial risks of non-compliance. This proactive approach not only but also enhances the organization's reputation within the industry.

Legal experts emphasize that effective adherence tracking can lead to a considerable decrease in non-adherence penalties, with one specialist stating, "Effective records management is the key to legal and regulatory adherence." As regulatory landscapes evolve, title firms must remain vigilant regarding current adherence requirements to ensure compliance tracking systems for title companies and mitigate risks associated with legal repercussions.

Routine evaluations and performance assessments are critical to ascertain whether the software meets regulatory objectives, and educating staff on policy requirements is crucial for successful implementation. Furthermore, adherence tracking software is available in various pricing structures, providing options that can accommodate diverse financial needs.

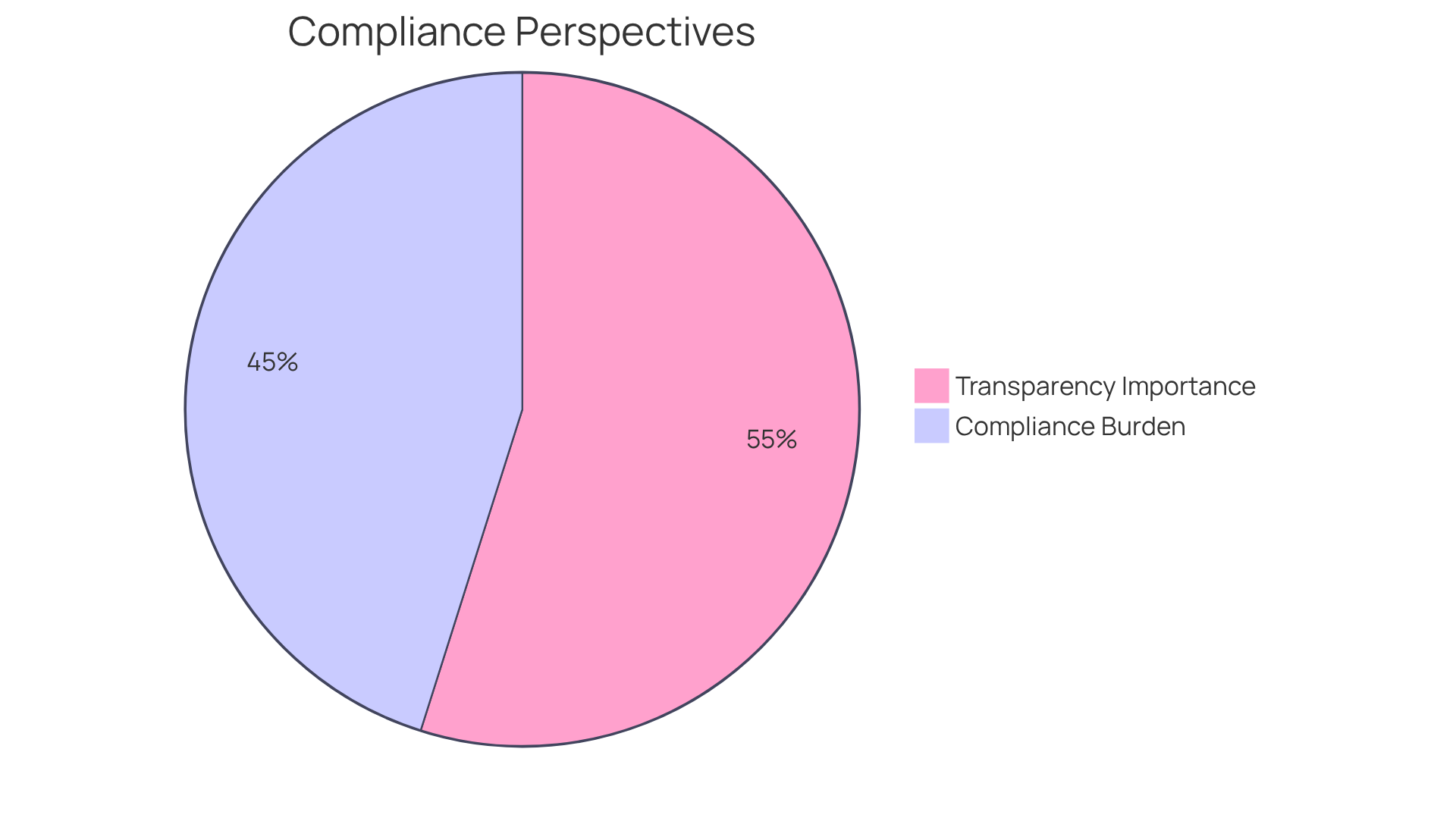

Enhanced Reporting Efficiency: Improve Transparency in Compliance

Contemporary compliance tracking systems for title companies significantly enhance reporting efficiency, empowering firms to generate detailed reports that offer clear insights into their regulatory status. This capability is paramount for maintaining , fostering trust and accountability. Automated report generation guarantees that companies access up-to-date information, essential for audits and regulatory reviews.

For instance, organizations that embrace automated regulatory reporting frequently experience a marked improvement in their ability to meet legal obligations, with 90% of regulatory professionals asserting that transparency in reporting is vital for cultivating stakeholder trust. Furthermore, 74% of organizations acknowledge that compliance is a burden, highlighting the necessity for automated solutions to alleviate this challenge.

Compliance tracking systems for title companies automate the reporting process, reducing the time spent on manual data collection and allowing teams to focus on strategic initiatives. In fact, organizations investing in regulatory automation report substantial cost savings and expedited decision-making. By leveraging these technologies, firms can not only enhance their compliance posture but also demonstrate their commitment to transparency and accountability in their operations.

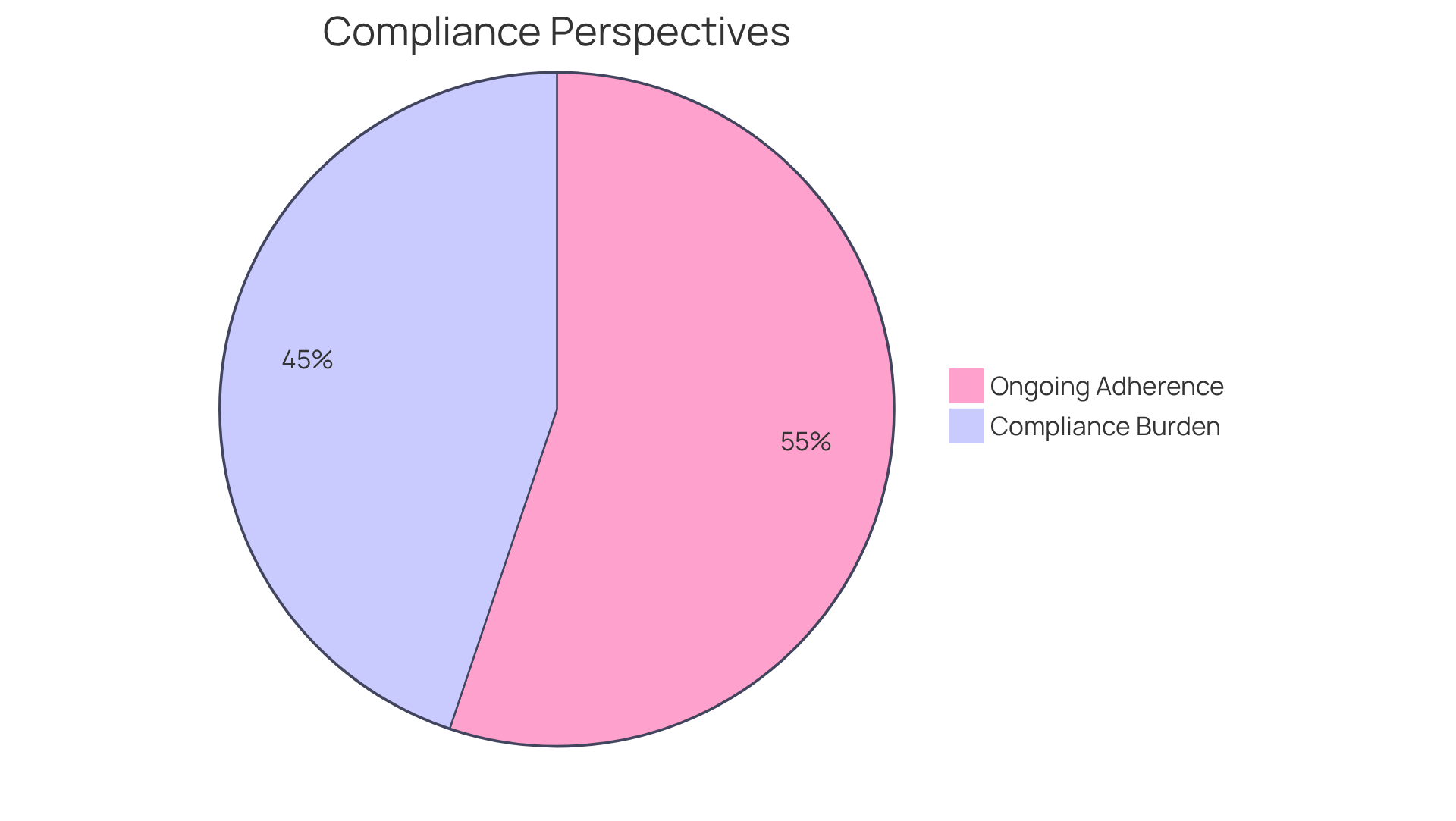

Risk Management: Mitigate Compliance-Related Risks

Compliance monitoring tools are essential for effective risk management, particularly in the real estate sector, where they play a crucial role in identifying and mitigating compliance-related risks. By continuously monitoring adherence activities and pinpointing potential issues, these systems empower title firms to implement corrective actions before problems escalate. This proactive strategy not only safeguards the company's interests but also enhances its flexibility in adapting to regulatory changes.

Notably, 91% of organizations plan to establish ongoing adherence within the next five years, recognizing its benefits in maintaining robust regulatory frameworks. Furthermore, 74% of organizations perceive adherence as a burden, underscoring the need for efficient frameworks that streamline compliance processes. Title companies that embrace these systems can significantly bolster their , ensuring compliance while minimizing potential liabilities.

As Paul Koziarz highlights, without adherence, organizations may lack critical security measures, leading to inconsistent standards and increased vulnerability to risks. Additionally, with the global average cost of a data breach reaching $4.88 million in 2024, prioritizing adherence monitoring is not merely a regulatory obligation but a financial imperative. By focusing on regulatory monitoring, firms can protect their operations and enhance their overall business performance.

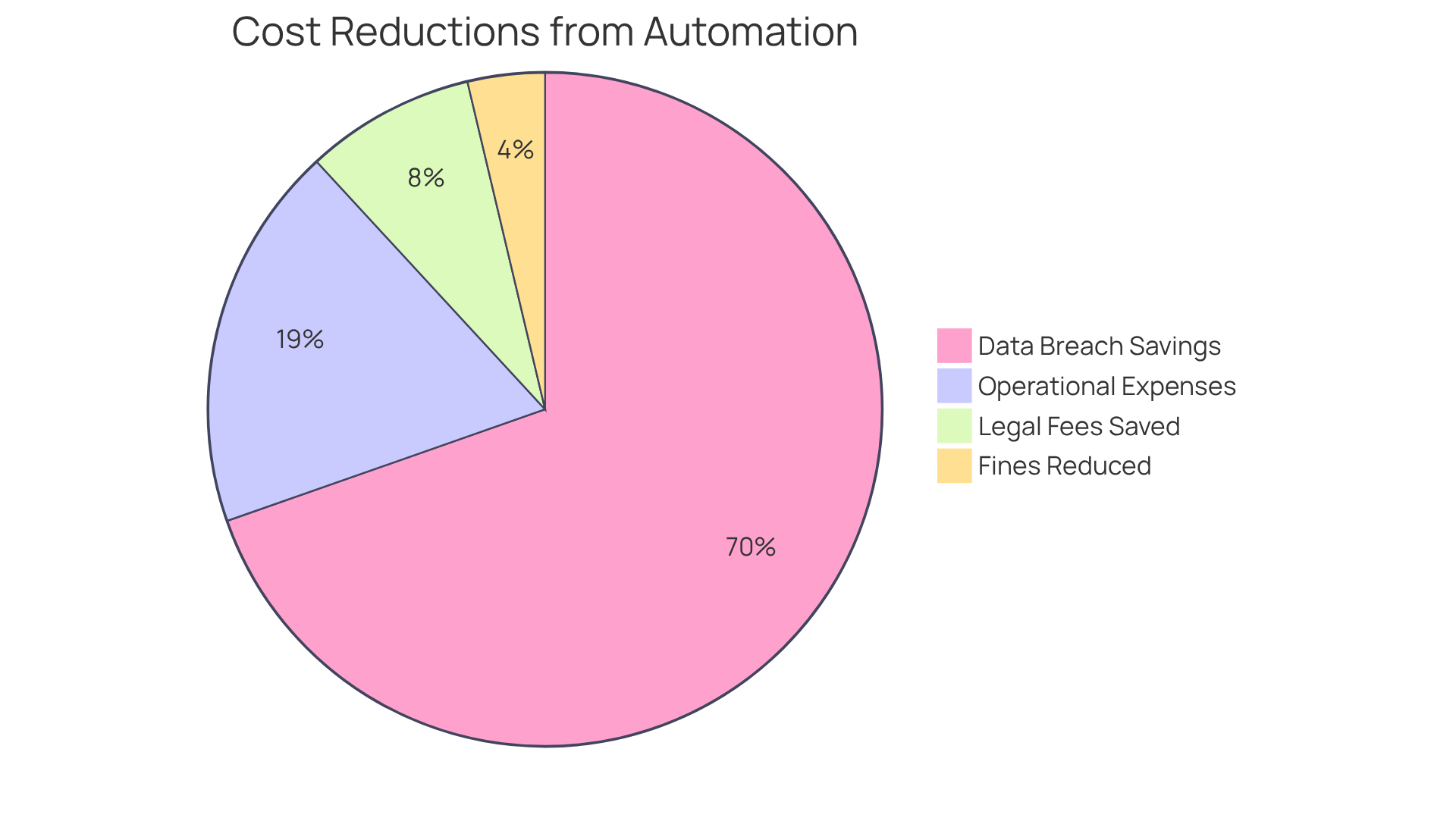

Cost Savings: Optimize Operational Expenses with Compliance Software

Investing in compliance tracking systems for title companies offers substantial cost reductions by automating regulatory procedures and diminishing the necessity for manual oversight. This transition not only lowers operational expenses but also significantly curtails associated with compliance tracking systems for title companies.

For instance, organizations that extensively utilize AI and automation reported an average reduction of $1.88 million in data breach costs, underscoring the financial impact of streamlined processes. Moreover, 82% of businesses plan to invest more in automation for regulatory management, reflecting a growing awareness of its financial advantages and the connection between increased investment and operational cost reductions.

As Haresh Sippy aptly stated, "Automation is cost cutting by tightening the corners and not cutting them." Furthermore, breaches incur nearly $220,000 extra on average when failure to comply with regulations is involved, further illustrating the financial implications of compliance tracking systems for title companies in ensuring adherence.

By implementing sophisticated regulatory monitoring tools, firms can streamline their operational costs and enhance their profitability.

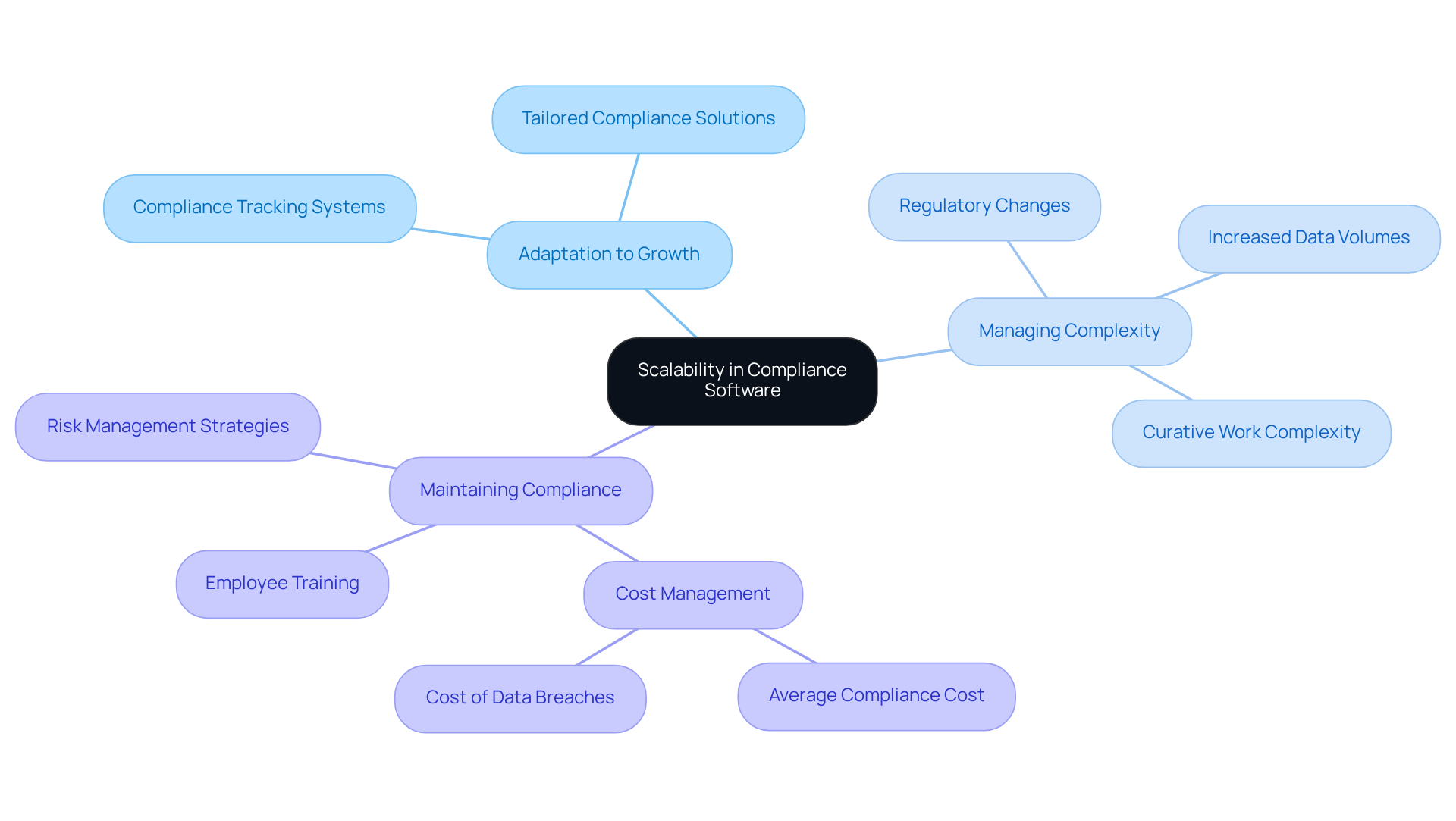

Scalability: Compliance Software that Grows with Your Business

Scalability stands as a pivotal element of regulatory software, empowering title firms to adapt their frameworks in tandem with their growth. As business activities expand, regulatory requirements often become more complex. A scalable adherence solution, such as compliance tracking systems for title companies, is adept at managing increased data volumes and additional regulatory demands, all without necessitating a complete system overhaul. This capability ensures that organizations as they evolve, reinforcing the reliability of their operational frameworks.

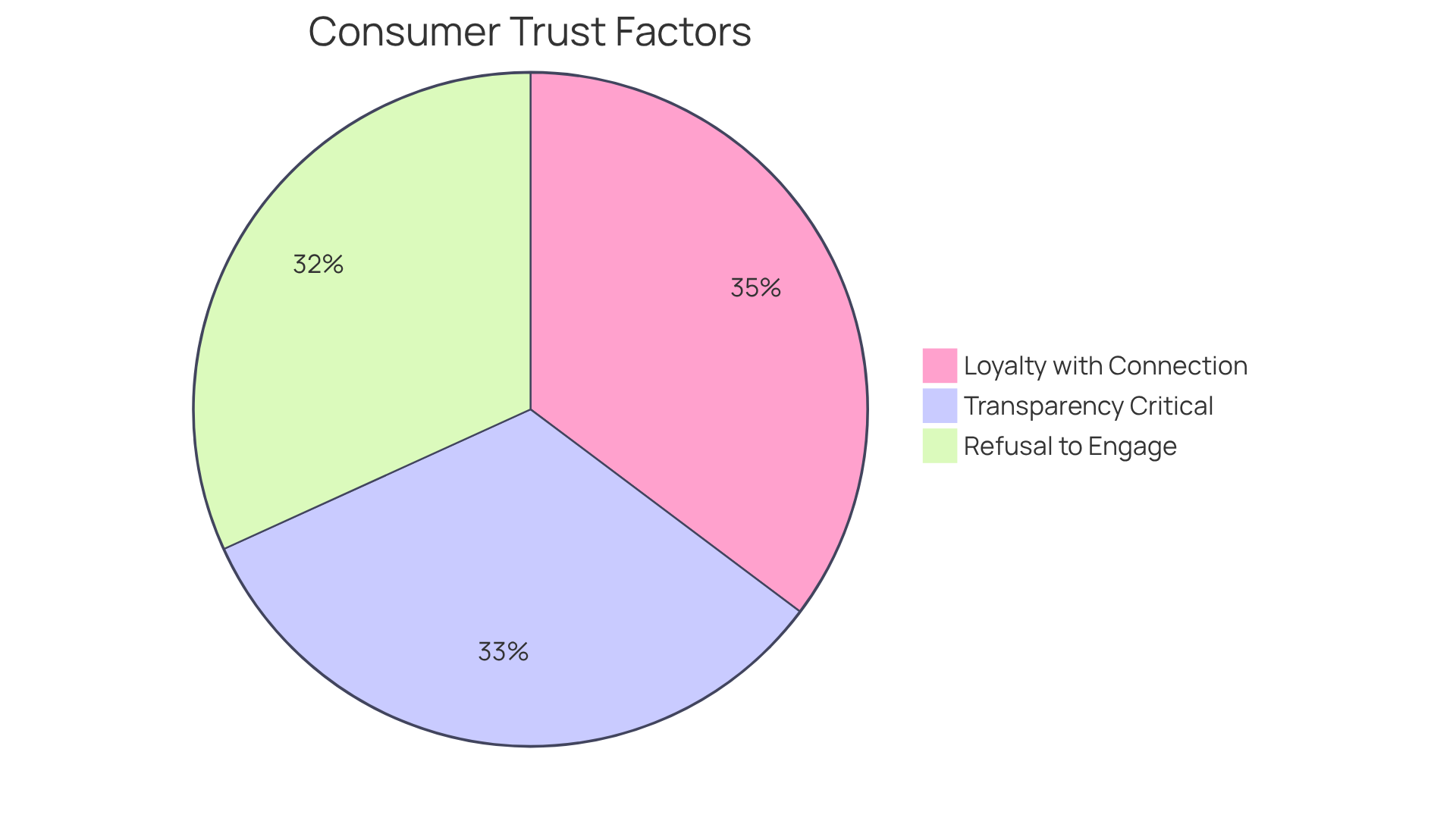

Increased Transparency: Build Trust with Clients and Stakeholders

Increased openness in regulatory procedures is essential for cultivating trust between title firms and their clients. By transparently sharing compliance practices and results, organizations can demonstrate their commitment to ethical standards and regulatory adherence. This approach not only fortifies client relationships but also elevates the organization's reputation in the marketplace.

Research indicates that:

- 86% of American customers believe transparency from businesses is more critical than ever.

- 83% of consumers refuse to engage with brands they do not trust.

- Title firms that can expect enhanced client loyalty and advocacy, as 92% of consumers are more likely to remain loyal to a brand when a positive emotional connection is established.

Furthermore, proactive communication regarding regulatory initiatives and performance indicators keeps clients informed and engaged, reinforcing their trust in the organization. Building trust requires time; however, it can be swiftly eroded by poor decisions. As the sector evolves, maintaining a clear regulatory structure will be vital for fostering enduring connections and ensuring sustained success.

Key Features of Compliance Software: What Title Companies Need

When selecting for title companies, they must prioritize essential features that enhance operational efficiency and meet specific regulatory requirements. Key functionalities include:

- Automated document processing, which streamlines workflows and significantly reduces manual errors.

- Proactive management of regulatory obligations through real-time adherence monitoring.

- Adjustable reporting tools, which allow companies to tailor reports for specific regulatory inquiries, thereby promoting improved decision-making and transparency.

User satisfaction data indicates that organizations employing these features experience substantial advancements in regulatory management, with 93% of regulatory teams agreeing that AI and cloud software streamline adherence processes. This is especially relevant given that 40% of regulatory teams still rely on basic tools such as spreadsheets, underscoring the necessity for advanced regulatory solutions.

Additionally, an intuitive interface is essential, ensuring that staff can navigate the platform efficiently without extensive training. By focusing on these critical elements, organizations can enhance their compliance tracking systems for title companies and mitigate risks associated with regulatory challenges, particularly in a dynamic regulatory landscape that presents significant threats.

![]()

Overall Benefits of Compliance Tracking Systems for Title Companies

Compliance tracking systems for title companies are essential tools that provide significant advantages, including enhanced operational efficiency, reduced risks, and substantial cost savings. By implementing these frameworks, organizations can streamline regulatory processes, ensuring compliance with legal obligations while fostering stronger relationships with clients and stakeholders.

For instance, companies that invested in automation tools in 2023 experienced an impressive 35% increase in processing efficiency, illustrating the concrete benefits of these systems. Furthermore, adherence management software minimizes the likelihood of human errors, facilitating accurate and timely task execution, which is critical in a landscape where 62% of regulatory officers spend 1 to 7 hours weekly monitoring legal updates.

This proactive approach not only but also cultivates trust with stakeholders, ultimately contributing to the development of a more resilient business model in a competitive sector. As highlighted by industry experts, successful title companies are marked by their relentless efficiency in core processes, emphasizing the necessity of integrating compliance tracking systems for title companies into their operational framework.

![]()

Conclusion

Compliance tracking systems for title companies are essential for navigating the intricate regulatory landscape and ensuring operational efficiency. These systems not only streamline compliance processes but also significantly mitigate risks and costs associated with regulatory non-compliance. By leveraging advanced technologies such as AI and automation, title firms can enhance their monitoring capabilities, minimize human errors, and ultimately foster stronger relationships with clients and stakeholders.

Throughout the article, the key benefits of implementing robust compliance tracking systems have been highlighted, including:

- Improved reporting efficiency

- Proactive risk management

- Substantial cost savings

The significance of features such as automated document processing, real-time adherence monitoring, and scalable solutions is emphasized, showcasing how these elements contribute to a more resilient and transparent operational framework. Furthermore, the discussion underscores the necessity for title companies to prioritize compliance as a strategic imperative rather than merely a regulatory obligation.

In conclusion, the integration of compliance tracking systems transcends mere protection against regulatory penalties; it represents a strategic advantage that can propel title companies toward greater success. As the industry evolves, embracing these advanced solutions will be crucial for maintaining compliance, optimizing operational costs, and building trust with clients. Organizations are encouraged to invest in these technologies, ensuring they remain competitive and compliant in an ever-changing regulatory environment.

Frequently Asked Questions

What is Parse AI and how does it assist property firms?

Parse AI is an advanced document processing technology that helps property firms track regulations by using machine learning and optical character recognition to extract critical information from documents, ensuring compliance with regulatory requirements.

What are the benefits of using Parse AI for compliance tracking?

Businesses using Parse AI report a 50% reduction in document processing time and achieve data extraction accuracy rates of up to 99% for structured documents. It can also reduce regulation-related errors by as much as 85%.

How does Parse AI streamline compliance processes?

Parse AI automates regulatory procedures, eliminating manual tasks such as data entry, document verification, and regulatory checks, allowing staff to focus on more strategic activities and enhancing overall productivity.

What impact does effective compliance tracking have on legal risks and fines?

Robust compliance tracking systems help firms maintain accurate records and automate regulatory checks, leading to significant reductions in fines and legal risks. Organizations can proactively identify potential issues and mitigate financial penalties associated with non-compliance.

Why is routine evaluation important for compliance tracking software?

Routine evaluations and performance assessments are essential to ensure that the software meets regulatory objectives and to identify any necessary adjustments in adherence to evolving regulations.

What factors should firms consider when implementing compliance tracking systems?

Firms should educate staff on policy requirements, evaluate pricing structures of adherence tracking software, and ensure the software's capabilities align with their regulatory needs to facilitate successful implementation.