Introduction

In the fast-paced realm of real estate, the efficiency of title research can significantly influence the outcome of a transaction. Professionals are increasingly focused on streamlining workflows and enhancing accuracy, making the emergence of advanced mortgage search engines critical. This article delves into seven essential tools that not only simplify title research but also empower users with real-time data and automation capabilities. How can these innovative platforms revolutionize the way real estate professionals navigate the complexities of mortgage processes and compliance challenges?

Furthermore, accurate title research is paramount in mitigating risks and ensuring smooth transactions. However, professionals often face challenges such as time constraints and the overwhelming volume of data. Consequently, the right tools can transform these challenges into opportunities for efficiency and precision.

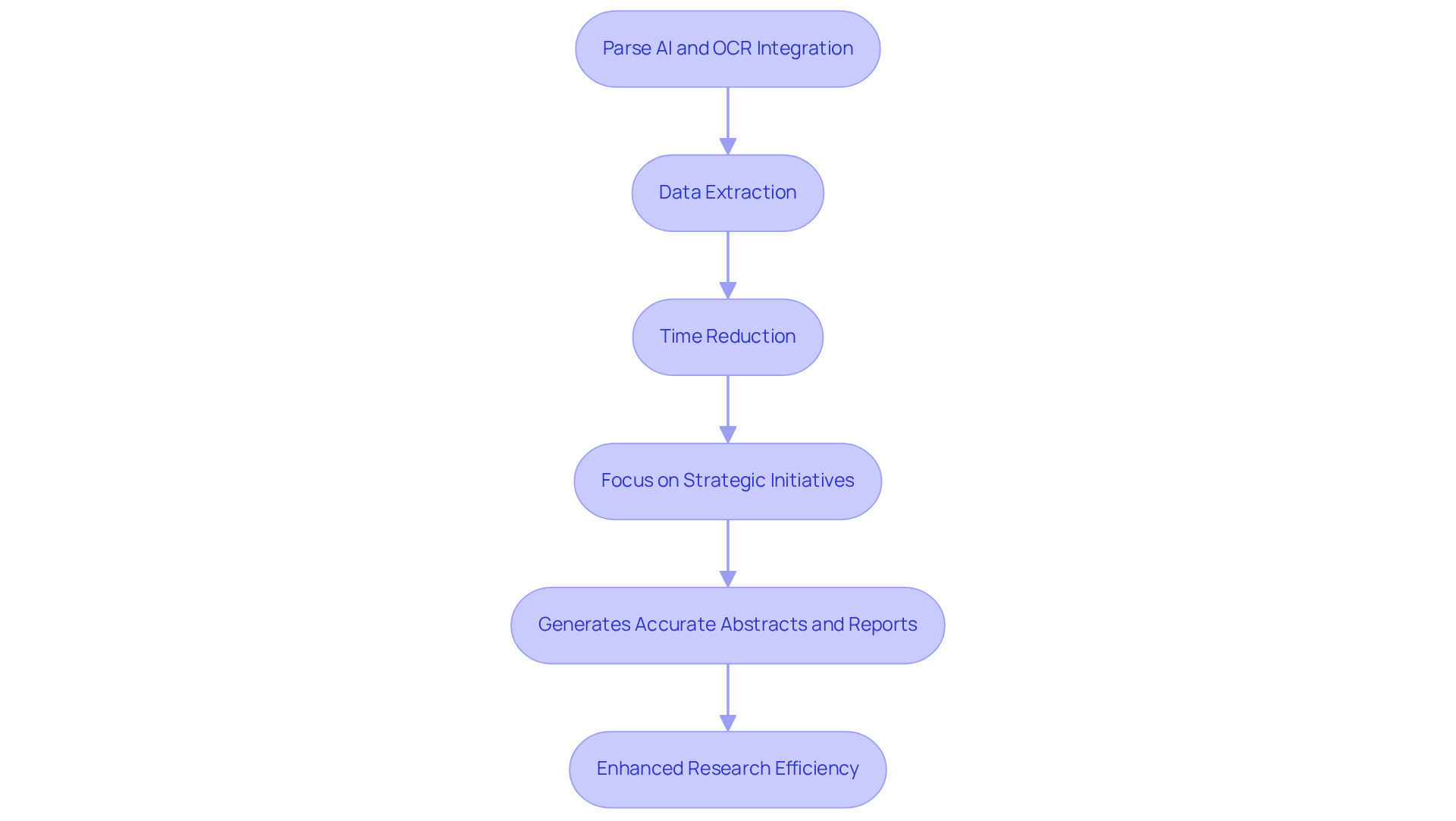

Parse AI: Advanced Machine Learning for Title Research Automation

Parse AI harnesses advanced machine learning algorithms and optical character recognition (OCR) to revolutionize the extraction of essential data from extensive document collections. This cutting-edge technology drastically reduces the time needed for ownership research, empowering professionals to concentrate on strategic initiatives. By swiftly processing and analyzing vast volumes of documents, Parse AI enables researchers to generate accurate abstracts and reports with remarkable efficiency.

The integration of OCR not only enhances productivity but also significantly mitigates the risk of human error, making it an invaluable asset for real estate professionals seeking to optimize their workflows. As one industry expert noted, "The speed and precision offered by OCR technology have transformed our approach to title research, allowing us to serve our clients more effectively and promptly." This perspective underscores the increasing acknowledgment among real estate firms of OCR's pivotal role in streamlining title document processing and boosting overall research efficiency.

Furthermore, with the machine learning market anticipated to reach $90.97 billion by 2025, adopting OCR technology is becoming essential for companies aiming to maintain a competitive edge. However, challenges such as data complexity and the demand for skilled talent persist as obstacles to widespread implementation. This reality highlights the necessity of strategic planning when integrating these advanced technologies.

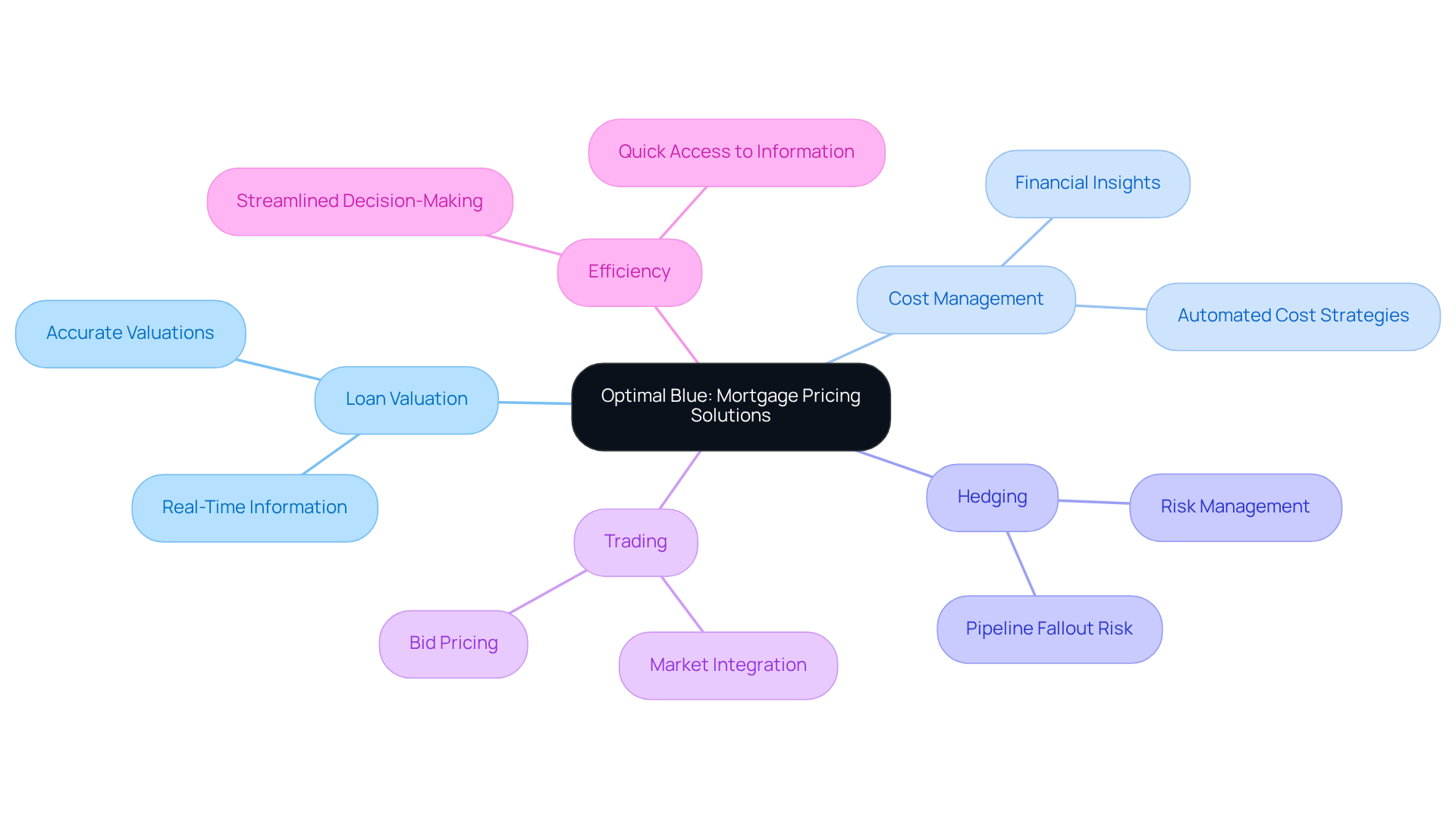

Optimal Blue: Comprehensive Mortgage Pricing Solutions

Optimal Blue stands out as a robust platform for loan valuation, empowering lenders with real-time information and analytics. Its comprehensive solutions include cost management, hedging, and trading capabilities—essential tools for loan brokers and lenders alike. By delivering practical insights and automated cost strategies, Optimal Blue streamlines the decision-making process. This ensures that document analysts can quickly access vital financial information, facilitating their transactions efficiently.

In a fast-paced real estate market, where timely decisions can significantly influence outcomes, this efficiency is crucial. Furthermore, Optimal Blue's platform not only enhances operational effectiveness but also positions lenders to make informed choices that drive success. With its authoritative approach and commitment to simplifying complex processes, Optimal Blue is an indispensable ally in navigating the intricacies of loan valuation.

Mortech: Robust Mortgage Pricing and Product Eligibility Tools

Mortech offers a comprehensive suite of tools that function as a mortgage search engine, enhancing the efficiency of mortgage lenders through improved mortgage cost and product eligibility assessments. By enabling users to swiftly assess product eligibility based on various criteria, Mortech ensures that ownership investigators have immediate access to the most pertinent information necessary for confirming property ownership using a mortgage search engine. Furthermore, the platform's advanced analytics capabilities, along with the mortgage search engine, empower lenders to make quick, informed decisions, which is essential for maintaining a competitive edge in the ever-evolving real estate market.

Significantly, Mortech's integration with Calyx Point allows users to compare loan cost scenarios from over 400 supported investor rate sheets, further streamlining the process. According to Doug Foral, General Manager of Mortech, "In today’s competitive marketplace, using a mortgage search engine to close loan transactions quickly and efficiently is critical, and lenders are increasingly looking for technology solutions to help streamline the loan process."

By incorporating Mortech's tools into their workflows, title researchers can drastically reduce the time spent on cost evaluation and eligibility assessments with a mortgage search engine. The mortgage search engine can reduce loan quote generation times from eight days to just hours, thereby enhancing overall productivity.

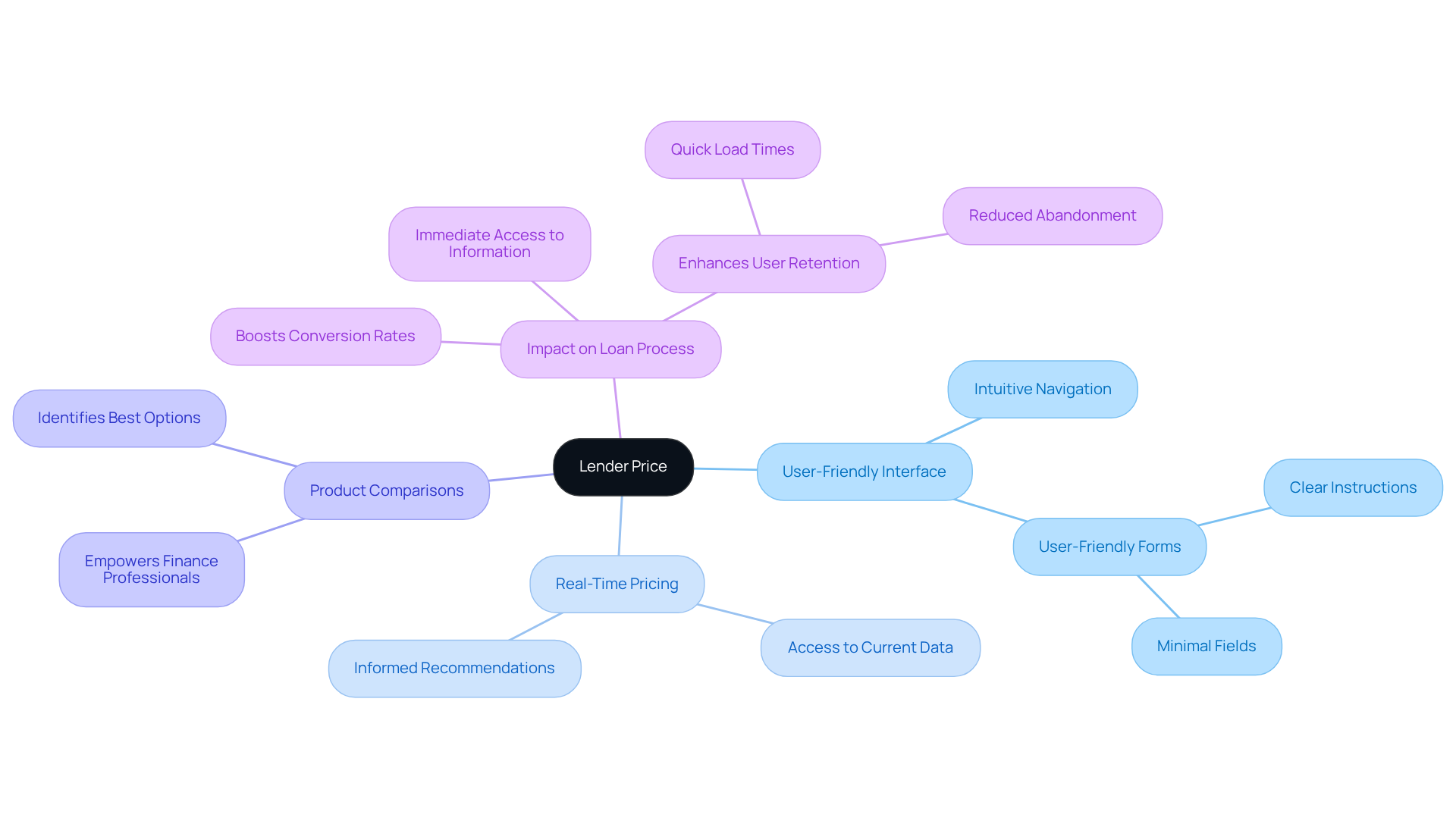

Lender Price: User-Friendly Real-Time Pricing and Product Comparisons

Lender Price stands out with its user-friendly interface, which significantly streamlines the loan cost process for users. By providing real-time pricing and product comparisons, it empowers finance professionals to swiftly identify the best options for their clients. This efficiency is particularly beneficial for document investigators who must deliver precise and timely information regarding property financing. Notably, 38% of loan customers initiate collaboration with a lender at the outset of their home-buying journey, underscoring the critical need for immediate access to relevant information.

The ability to access current pricing data enables title researchers to offer informed recommendations, ultimately enhancing the overall effectiveness of the loan process. Furthermore, user-friendly design elements on loan platforms can dramatically boost conversion rates by motivating visitors to take actions such as submitting contact information or starting applications. Quick load times are essential for user retention; slow-loading websites can frustrate users and lead to abandonment.

As Bruce Gehrke from JD Power highlights, the housing finance market is evolving towards providing valuable guidance and innovative solutions, making these attributes essential for success. Consequently, embracing these advancements not only meets the demands of today's market but also positions lenders to thrive in a competitive landscape.

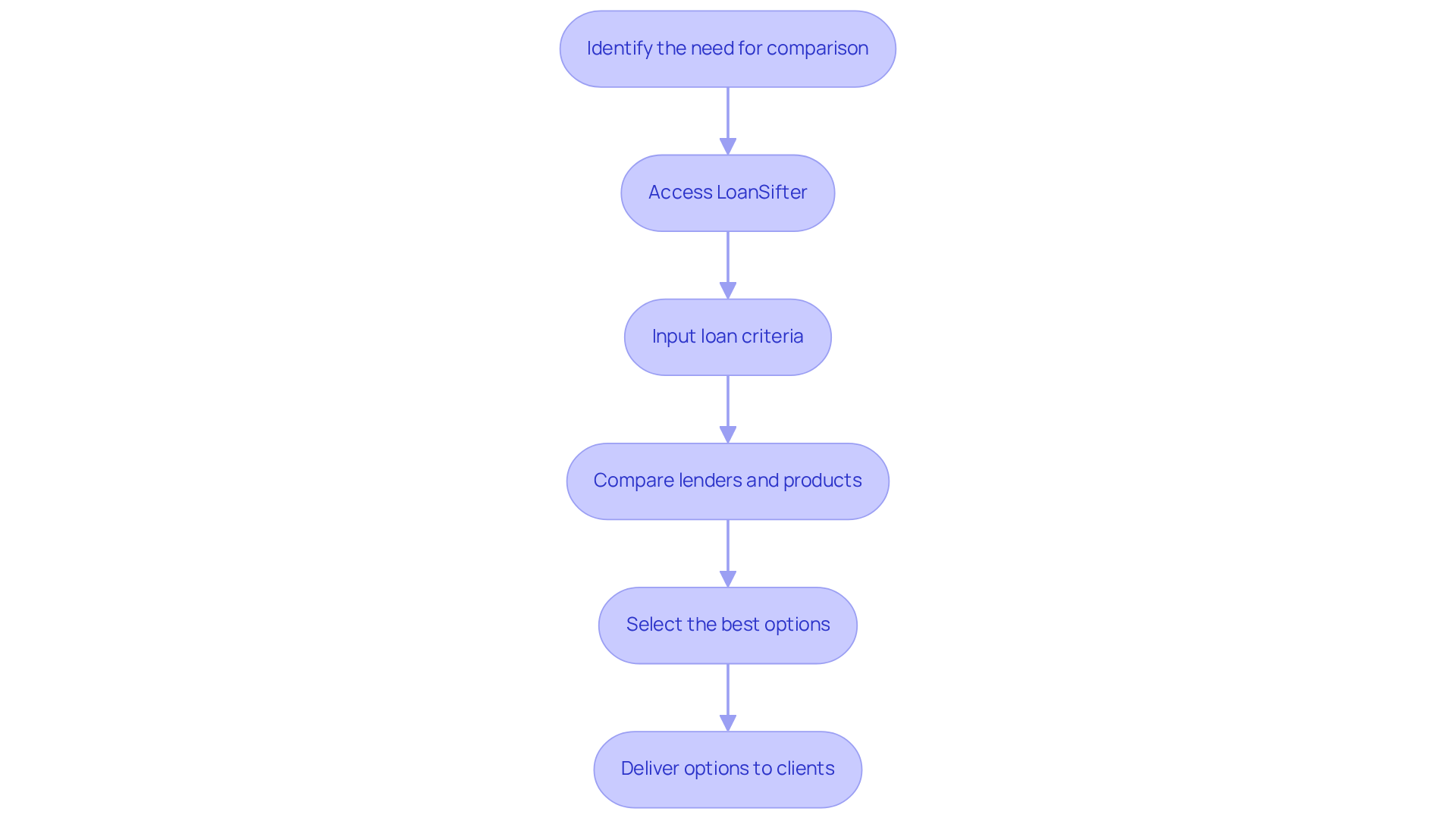

LoanSifter: Innovative Pricing Engine for Streamlined Mortgage Processes

LoanSifter stands out as an essential tool that streamlines the loan process by providing comprehensive product and cost details. This platform empowers finance professionals to swiftly compare various lenders and products, ensuring that property examiners have access to the most competitive options available. By integrating LoanSifter into their workflows, professionals can significantly enhance their efficiency, minimize the time spent on pricing comparisons, and ultimately deliver superior service to their clients. In a market where speed and accuracy are crucial, this tool proves invaluable.

Current trends reveal an increasing dependence on loan product comparison tools, highlighting the necessity for real estate professionals to harness these innovations for a competitive edge. As the landscape evolves, leveraging such tools not only meets the demands of the market but also positions professionals at the forefront of their field.

Polly: Integration Capabilities and Real-Time Data for Enhanced Search Experience

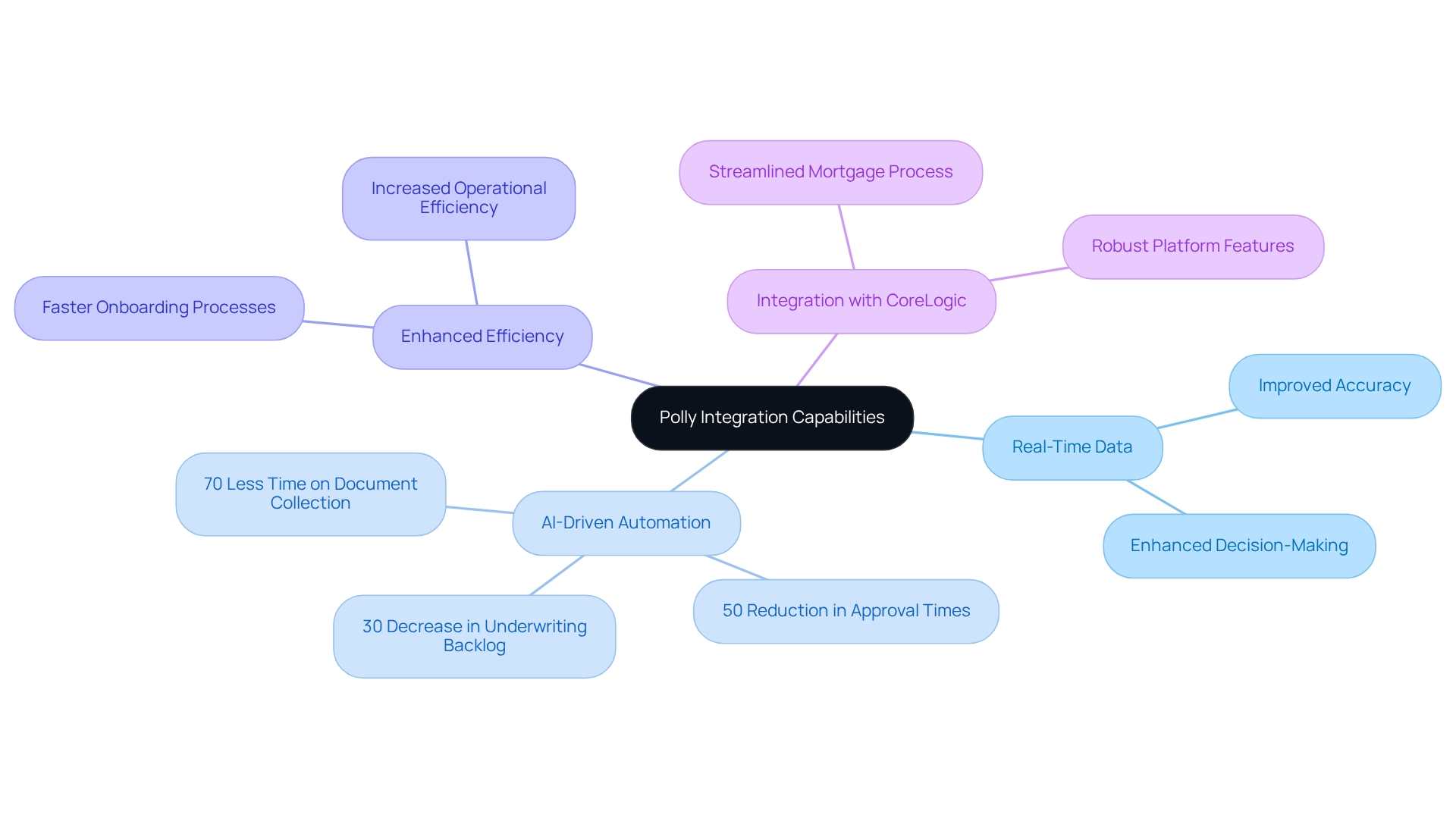

Polly offers advanced integration features that significantly enhance the home loan search experience for both loan officers and document examiners. By delivering real-time data and insights, Polly empowers users to make informed decisions swiftly. Its AI-driven automation capabilities streamline workflows, allowing researchers to focus on critical tasks rather than tedious manual data entry. This integration not only boosts efficiency but also improves the accuracy of processed information, establishing Polly as an indispensable tool for professionals in the real estate sector.

Furthermore, the implementation of AI across the industry has resulted in a reported 30% decrease in underwriting backlog and a remarkable 50% reduction in mortgage approval times. As Derrick Barker, CEO of Nectar, noted, "Brokers using these systems report spending 70% less time on document collection," underscoring the transformative impact of real-time data on research workflows. In addition, Polly's integration with CoreLogic enhances its features, providing users with a more robust platform tailored to their research needs.

Encompass Product and Pricing Service: Comprehensive Tools for Pricing and Compliance

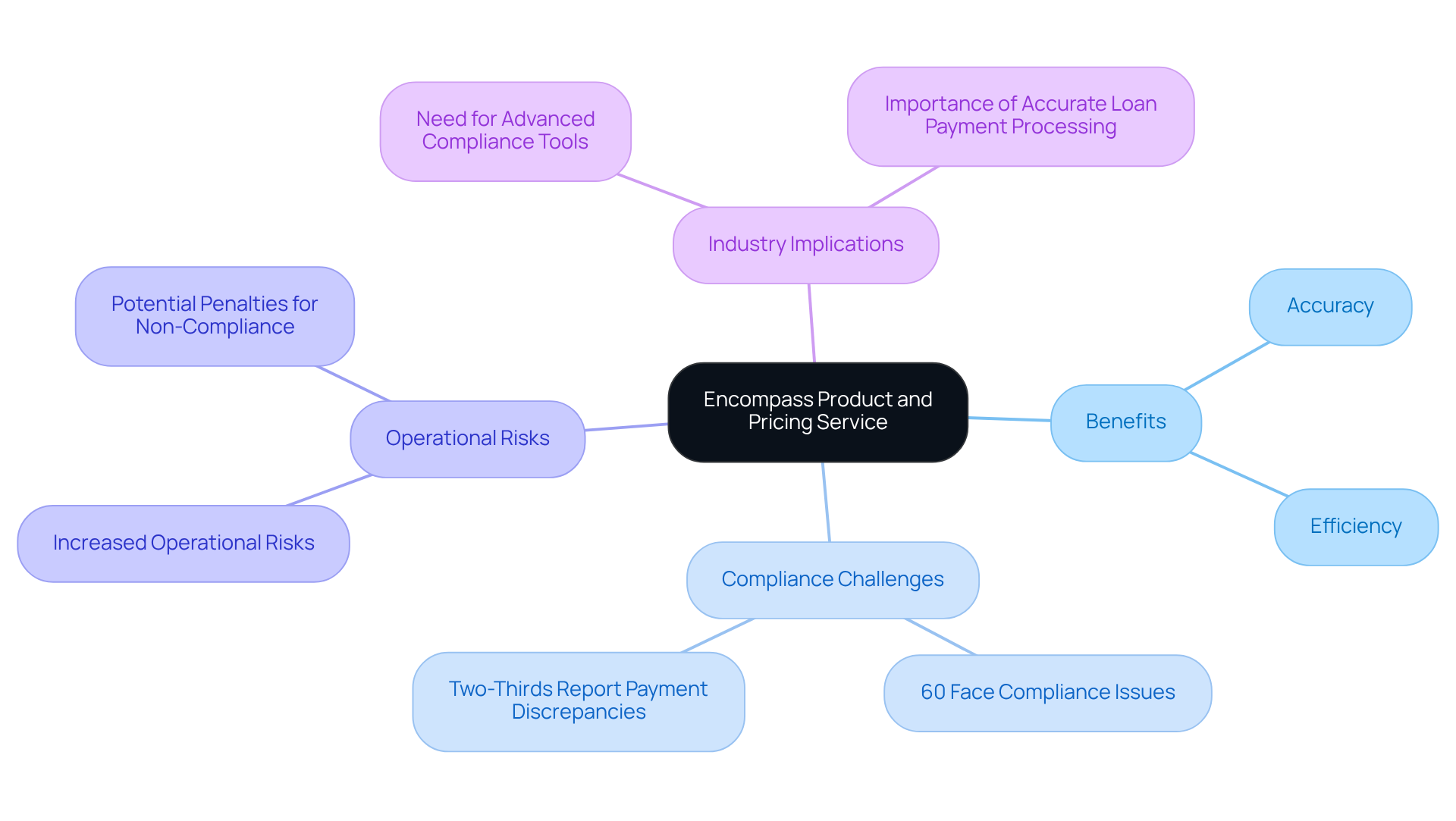

The Encompass Product and Pricing Service stands as an essential suite of tools tailored for lending professionals, emphasizing the critical need for pricing accuracy and compliance adherence. In an industry where precision is paramount, this platform equips document analysts with the ability to access accurate product information while deftly navigating complex regulatory landscapes.

Furthermore, by leveraging Encompass, title researchers can streamline their workflows, significantly mitigate compliance risks, and enhance the overall efficiency of the loan process. This capability is particularly vital in a climate characterized by heightened regulatory scrutiny, where maintaining compliance is not just important but essential for real estate professionals.

Significantly, 60% of organizations within the lending sector grapple with compliance challenges, highlighting the urgent need for advanced compliance tools. In addition, two-thirds of organizations report facing issues with monthly loan payment discrepancies, underscoring the operational risks tied to compliance failures.

As the industry continues to evolve, integrating these tools becomes indispensable for ensuring that pricing strategies align with regulatory requirements. This alignment not only fosters trust but also enhances reliability within the mortgage sector.

Conclusion

In the realm of title research, the integration of advanced technology is not merely beneficial; it is essential for enhancing efficiency and accuracy. This article highlights seven pivotal mortgage search engines that are transforming the landscape of title research, each offering unique features designed to streamline processes and empower professionals in the real estate sector.

Key insights from the discussion reveal the groundbreaking capabilities of Parse AI in automating data extraction, the comprehensive pricing solutions provided by Optimal Blue, and Mortech's robust tools for assessing mortgage cost and product eligibility. Furthermore, platforms like Lender Price and LoanSifter emphasize the importance of user-friendly interfaces and innovative pricing engines, while Polly and Encompass focus on integration and compliance—critical factors in today’s regulatory environment.

As the mortgage industry continues to evolve, embracing these advanced search engines is vital for professionals seeking to remain competitive. By leveraging these tools, real estate experts can significantly reduce research time, minimize errors, and ultimately deliver superior service to their clients. The future of title research is bright, and those who adapt to these technological advancements will be well-positioned to thrive in a rapidly changing marketplace.

Frequently Asked Questions

What is Parse AI and how does it benefit title research?

Parse AI utilizes advanced machine learning algorithms and optical character recognition (OCR) to automate the extraction of essential data from large document collections, significantly reducing the time required for ownership research and allowing professionals to focus on strategic initiatives.

How does OCR enhance the efficiency of title research?

OCR improves productivity by swiftly processing and analyzing vast amounts of documents, reducing the risk of human error, and enabling researchers to generate accurate abstracts and reports efficiently.

What are the implications of adopting OCR technology in the real estate industry?

The adoption of OCR technology is crucial for real estate professionals to optimize workflows and improve client service. It is increasingly recognized for its role in streamlining title document processing and enhancing overall research efficiency.

What challenges does the machine learning market face in implementing OCR technology?

Challenges include data complexity and the demand for skilled talent, which can hinder the widespread implementation of OCR technology. Strategic planning is necessary to address these obstacles.

What is Optimal Blue and what solutions does it provide?

Optimal Blue is a comprehensive platform for loan valuation that offers real-time information and analytics, including cost management, hedging, and trading capabilities, essential for loan brokers and lenders.

How does Optimal Blue improve decision-making for lenders?

By providing practical insights and automated cost strategies, Optimal Blue streamlines the decision-making process, enabling document analysts to access vital financial information quickly and facilitate efficient transactions.

Why is efficiency important in the real estate market?

In a fast-paced real estate market, timely decisions can significantly influence outcomes, making efficiency crucial for lenders and brokers to succeed in their transactions.