Overview

The article outlines a six-step process for implementing compliance tracking systems tailored specifically for title firms, underscoring the critical importance of regulatory adherence within the real estate industry.

Furthermore, it details essential components such as compliance design, operations, and measurement.

In addition, it highlights the financial advantages of effective compliance strategies, including substantial cost savings derived from minimized regulatory violations.

Introduction

In the intricate realm of real estate, compliance tracking systems have emerged as indispensable tools for title firms aiming to adeptly navigate regulatory requirements and mitigate associated risks. By implementing these systems, organizations not only bolster their operational efficiency but also unlock substantial financial savings—averaging millions in reduced compliance costs.

Nevertheless, the challenge resides in the effective integration of these systems into existing workflows.

How can title firms ensure that their compliance tracking initiatives yield enduring success and accountability in an ever-evolving regulatory landscape?

Understand Compliance Tracking Systems

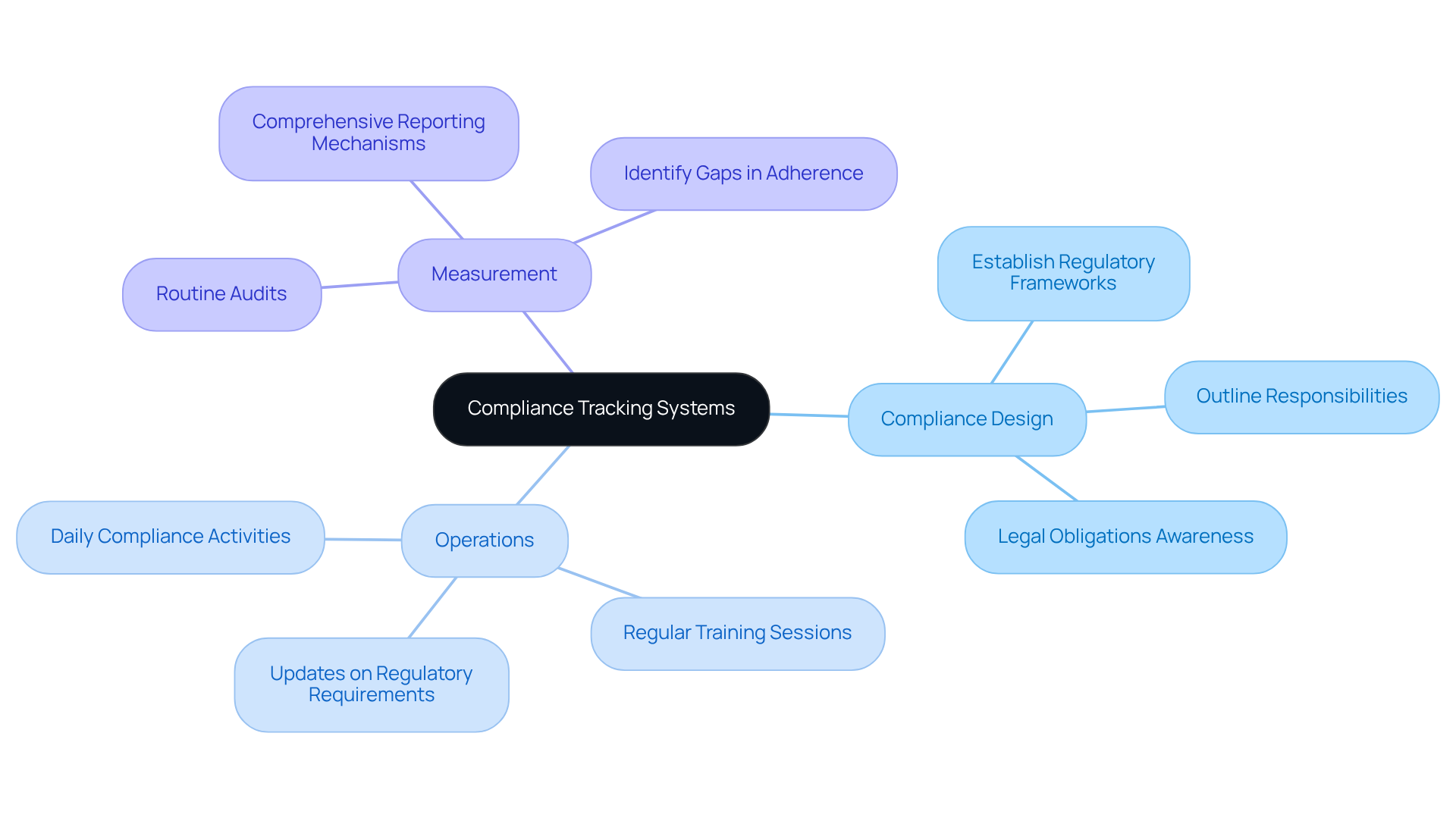

Compliance tracking systems for title firms are vital instruments that are meticulously designed to monitor adherence to regulatory requirements and internal policies. These systems encompass three critical components: regulatory design, operations, and measurement. Understanding these components is imperative for effectively managing regulatory risks and enhancing operational efficiency.

-

Compliance Design: This entails establishing frameworks that distinctly outline the necessary regulations and standards pertinent to the real estate industry. A well-structured regulatory framework guarantees that all stakeholders comprehend their responsibilities and the legal obligations they must meet.

-

Operations: Daily activities are paramount for maintaining regulatory compliance. This includes executing processes that promote adherence to established policies and regulations. For instance, regular training sessions and updates on regulatory requirements can substantially enhance operational effectiveness.

-

Measurement: Evaluating the effectiveness of adherence efforts is crucial. This can be accomplished through routine audits and comprehensive reporting mechanisms. Organizations that implement robust measurement strategies often find they can identify gaps in adherence and address them proactively.

The importance of adherence tracking systems in real estate cannot be overstated. Companies conducting regular adherence audits have reported average savings of $2.86 million, underscoring the financial benefits of maintaining stringent regulatory standards. Furthermore, organizations that adopted regulatory technology saved, on average, $1.45 million in regulatory expenses. Industry leaders emphasize that a strong adherence culture not only mitigates risks but also enhances overall operational efficiency. Tim Galer, IT Coordinator at LifeArc, stated, "It is essential that LifeArc’s workforce have easy and effortless access to the latest up-to-date policies and procedures, which is the structure Xoralia gave us."

Integrating compliance tracking systems for title firms allows these companies to refine their procedures, reduce the likelihood of costly fines, and foster a culture of accountability. As the regulatory landscape evolves, the ability to adapt and implement effective adherence strategies will be crucial for long-term success in the title research sector.

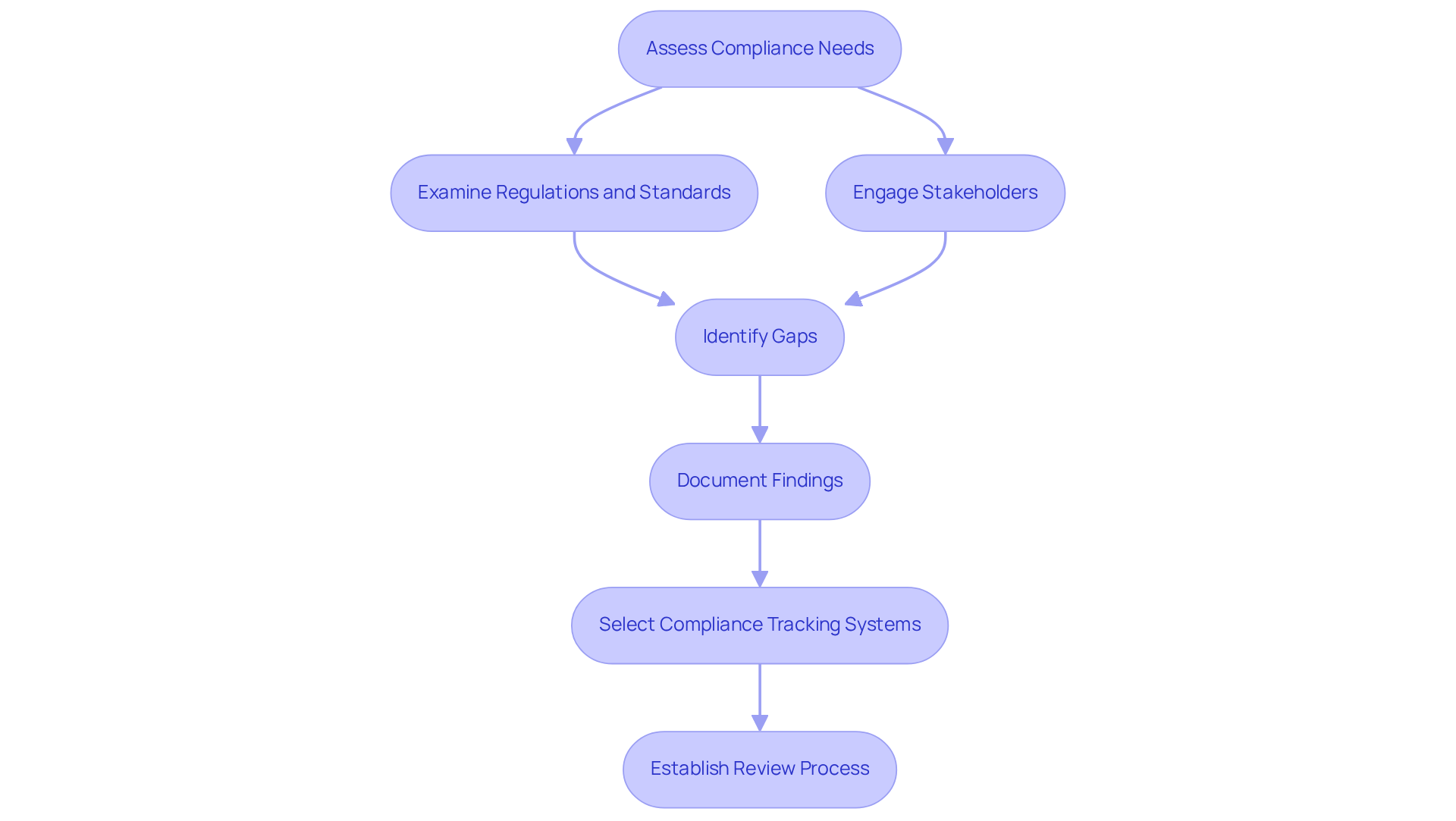

Assess Your Compliance Needs

To evaluate your adherence requirements, begin with a thorough examination of relevant regulations and industry standards. Engage with stakeholders across your organization to gather insights on current regulatory practices and identify existing gaps. Consider factors such as your firm's size, the types of transactions handled, and any specific state or federal regulations that apply. Document your findings to create a clear overview of your regulatory environment, which will help in selecting compliance tracking systems for title firms.

As regulatory experts emphasize, pinpointing weaknesses in your adherence program is crucial for mitigating risks and ensuring compliance with evolving regulations. Regular evaluations can lead to significant cost savings; entities utilizing regulatory technology report an average savings of $1.45 million. Furthermore, routine adherence audits have yielded average savings of $2.86 million for companies, underscoring the importance of continuous assessments.

It is essential to recognize the challenges organizations face in aligning policies with changing regulations, which can impede adherence efforts. Establishing a structured regulatory review process not only enhances your firm's operational efficiency but also strengthens your overall risk management strategy.

Select Appropriate Compliance Tracking Software

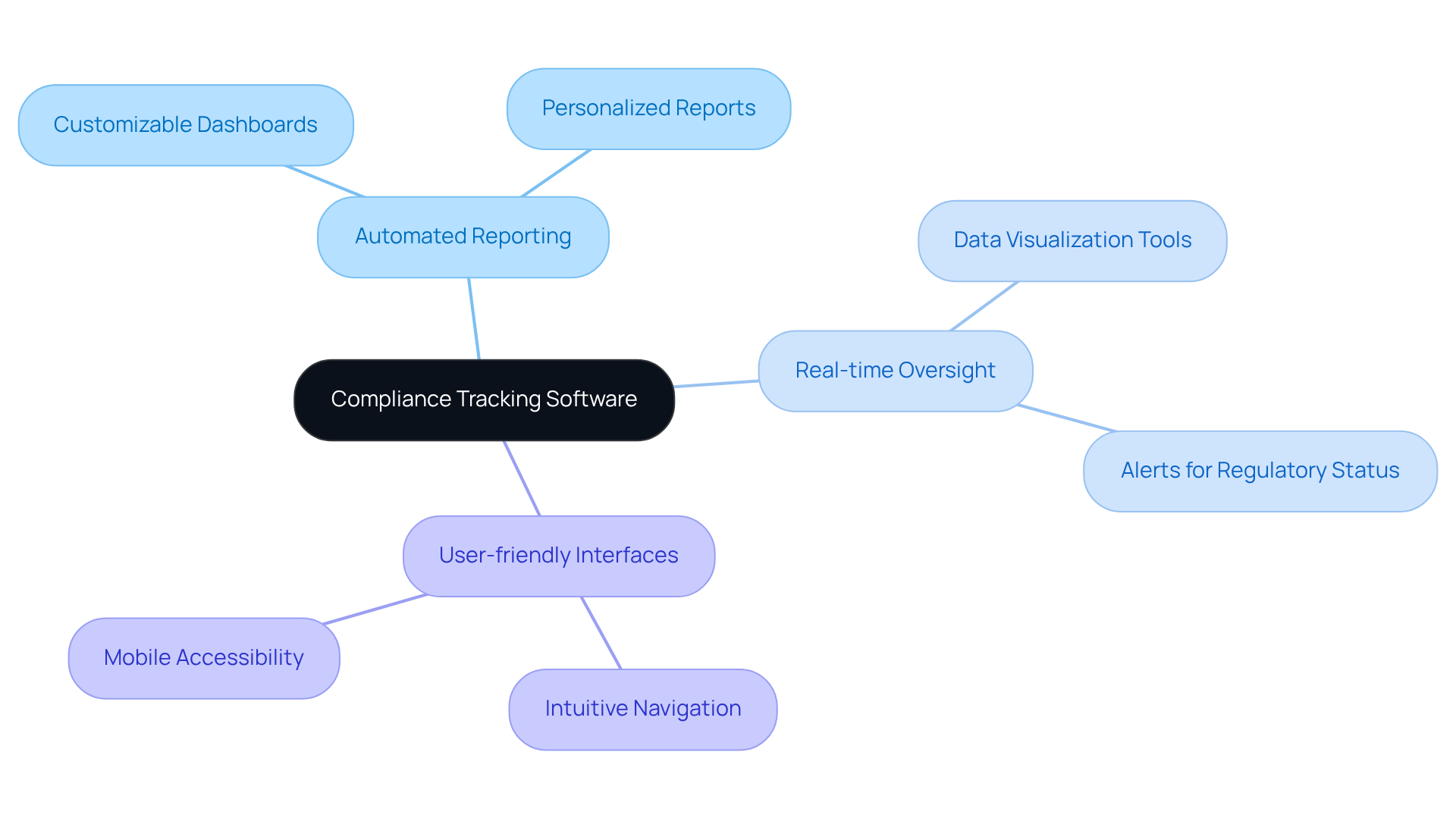

When selecting compliance tracking systems for title firms, it is crucial to prioritize critical aspects such as:

- Automated reporting

- Real-time oversight

- User-friendly interfaces

Companies that have implemented governance, risk, and regulatory technologies have saved an average of $1.43 million, underscoring the financial benefits of efficient regulatory tracking. Evaluate various vendors based on their ability to integrate seamlessly with existing systems and provide ongoing support. Look for software that offers customizable dashboards and alerts to keep your team informed about regulatory status; effective monitoring software includes:

- Dashboards

- Personalized reports

- Data visualization tools for displaying compliance metrics and key performance indicators (KPIs)

Furthermore, consider the scalability of the software to accommodate future growth and evolving regulatory requirements, especially as the Compliance Management Software Market is projected to grow at a CAGR of 10.9% from 2024 to 2031. Conduct product demonstrations and solicit feedback from your team to ensure that the selected solution aligns with their needs. The overall cost of non-compliance is projected to exceed $14 million, highlighting the critical importance of efficient oversight. By focusing on these key elements, title firms can make informed decisions that enhance regulatory management and mitigate risks associated with regulatory violations.

Implement the Compliance Tracking System

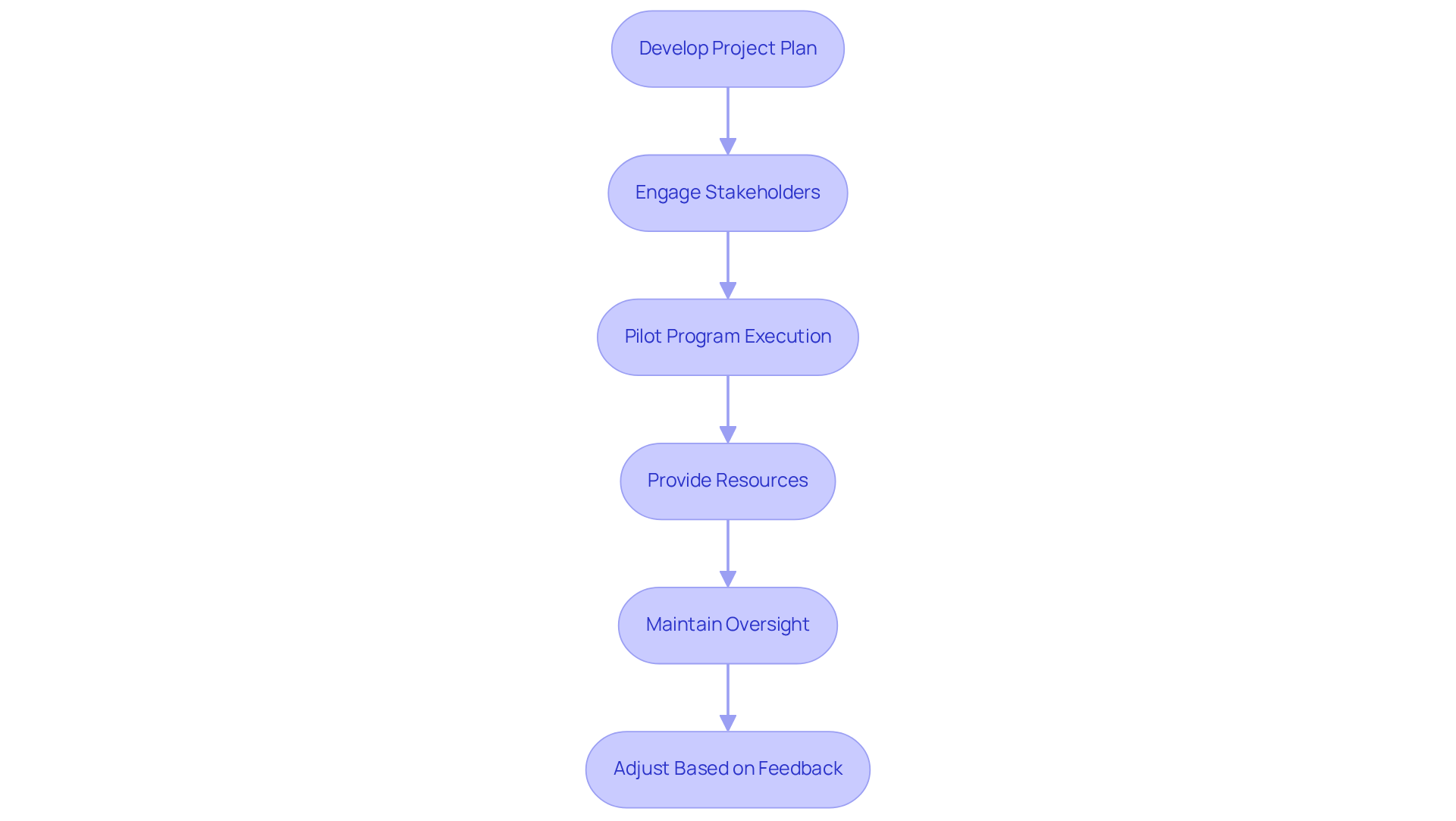

To effectively execute your regulatory monitoring framework, begin by developing a comprehensive project plan that clearly outlines timelines, responsibilities, and key milestones. Engaging key stakeholders throughout this process is essential for securing their buy-in and support. Commence execution with a pilot program, which allows for evaluation in a controlled environment and identification of potential issues prior to full-scale deployment. Ensure your team has access to necessary resources, including training materials and user guides, to facilitate a seamless transition.

Throughout the implementation, maintain diligent oversight and be prepared to make adjustments based on feedback and performance metrics. For instance, entities such as LifeArc have successfully employed regulatory monitoring tools to enhance their operational efficiency, achieving a remarkable attestation rate of 87.5% rapidly with Xoralia. However, common challenges, including resistance to change and insufficient training, can emerge; thus, addressing these proactively is vital for success.

Furthermore, it is crucial to recognize that the average adherence expense for entities globally is projected at $5.47 million, underscoring the significant stakes involved in executing these frameworks.

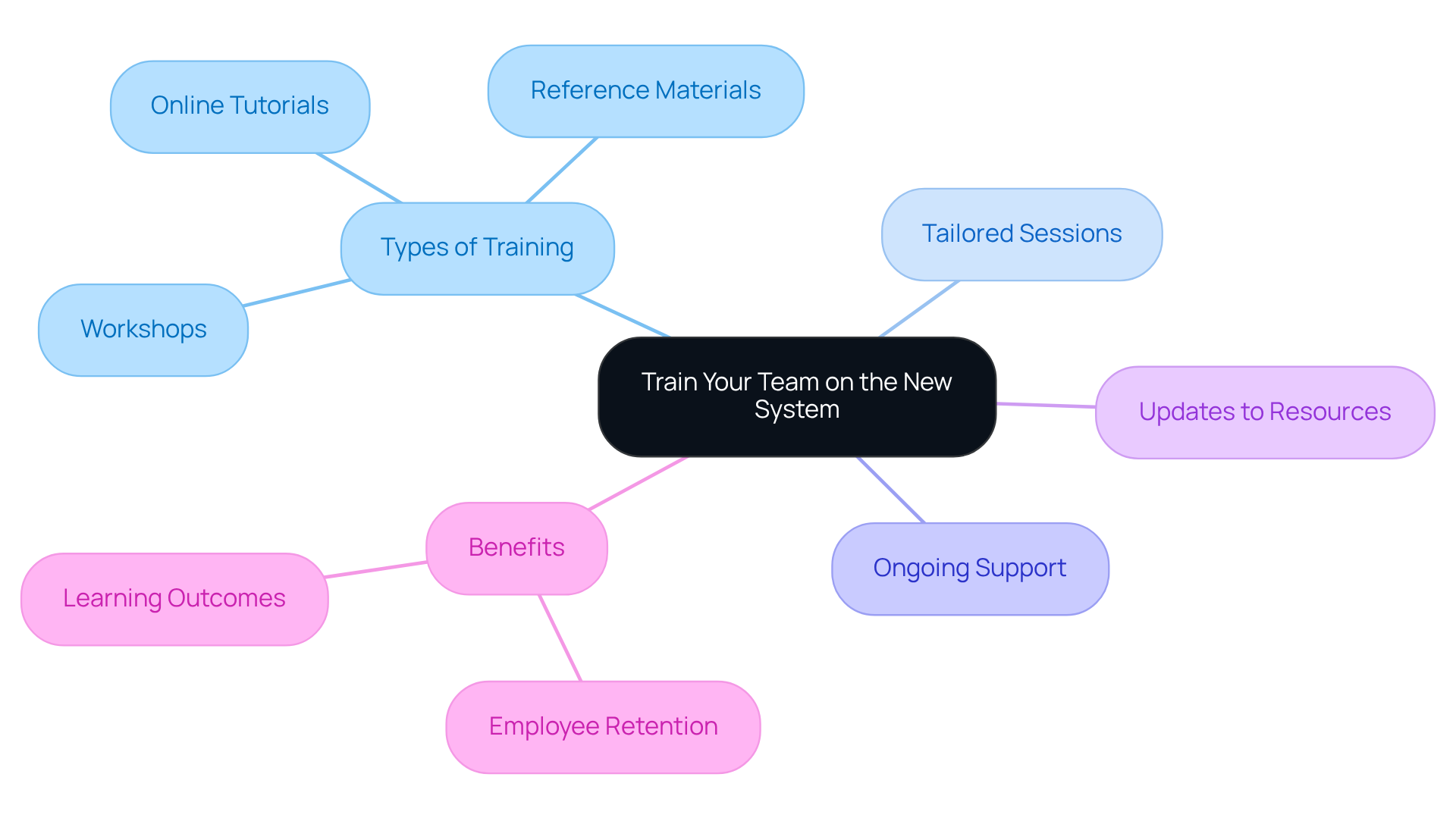

Train Your Team on the New System

Efficient instruction for the new regulatory tracking framework is paramount. It should encompass a blend of practical workshops, online tutorials, and comprehensive reference materials. Tailoring training sessions for different user roles within the company is essential, ensuring that each team member comprehends how the platform aligns with their specific responsibilities.

Furthermore, encouraging questions and providing ongoing support will effectively address any challenges that may arise post-training. Regular updates to training resources are crucial to reflect changes in the framework or regulatory requirements, thereby fostering a culture of continuous learning. This approach not only enhances user engagement but also significantly boosts the adoption rate of regulatory software.

Organizations that invest in customized training witness a notable increase in employee retention and satisfaction. According to LinkedIn Learning, 94% of employees believe they would remain with a firm longer if they were involved in their learning and development. In addition, effective training programs, particularly those that incorporate blended learning techniques, have demonstrated substantial improvements in learning outcomes.

Monitor and Evaluate Compliance Tracking Effectiveness

To effectively monitor and assess your tracking system, establishing key performance indicators (KPIs) that align with your regulatory objectives is paramount. These KPIs should encompass metrics such as the percentage of escalated regulatory issues, calculated by dividing the number of escalated issues by the total regulatory issues filed. Consistently examining regulatory reports and audit findings will assist in recognizing trends and areas for enhancement, enabling proactive modifications.

Furthermore, soliciting input from team members regarding the usability of the platform and any challenges they encounter is essential. This feedback can inform data-driven decisions about necessary enhancements. For instance, entities that adopt automated regulatory systems frequently report a notable decrease in regulatory violations, with data indicating that companies utilizing such technologies incur reduced expenses related to data breaches. In fact, organizations lose an average of $4 million in revenue in a single non-adherence event, underscoring the financial implications of ineffective regulation monitoring.

Conducting periodic reviews of your adherence processes ensures they remain aligned with evolving regulations and industry best practices. Compliance professionals emphasize the importance of adapting to changes in the regulatory landscape, as 53% of businesses consider managing data privacy essential for their operations. Moreover, the typical success rate for adherence onboarding is 80%, underscoring the efficiency of strong regulatory frameworks. By consistently improving your regulatory monitoring system, you can enhance its efficiency and foster a robust adherence culture within your organization. As Ayush Saxena notes, the growing importance of compliance is a foundational element of successful business operations.

![]()

Conclusion

Implementing compliance tracking systems for title firms transcends mere regulatory obligation; it represents a strategic initiative poised to significantly enhance operational efficiency and risk management. By grasping the critical components of compliance tracking—design, operations, and measurement—firms can forge a robust framework that guarantees adherence to regulations while cultivating a culture of accountability.

This article delineates a comprehensive approach to establishing these systems, emphasizing essential steps such as:

- Assessing compliance needs

- Selecting suitable software

- Implementing the system

- Training the team

- Monitoring its effectiveness

Each phase is paramount, from evaluating regulatory requirements to ensuring that employees are adept at utilizing the new tools effectively. The financial advantages of rigorous compliance tracking, including substantial savings and diminished risk of penalties, further underscore the significance of this initiative.

In conclusion, the successful implementation of compliance tracking systems is critical for title firms striving to navigate the intricate regulatory landscape. By investing in the appropriate technologies and training, firms can not only mitigate risks but also position themselves for enduring success. Embracing these systems is not solely about compliance; it is about fostering a resilient organization that adapts to change and flourishes in a competitive environment. Taking decisive action today will pave the way for a more secure and efficient future in the title industry.

Frequently Asked Questions

What are compliance tracking systems for title firms?

Compliance tracking systems are tools designed to monitor adherence to regulatory requirements and internal policies within title firms. They consist of three components: regulatory design, operations, and measurement.

What is involved in compliance design?

Compliance design involves establishing frameworks that outline the necessary regulations and standards relevant to the real estate industry, ensuring that all stakeholders understand their responsibilities and legal obligations.

How do operations contribute to compliance tracking?

Operations involve daily activities that promote adherence to established policies and regulations, such as regular training sessions and updates on regulatory requirements, which enhance operational effectiveness.

Why is measurement important in compliance tracking systems?

Measurement is crucial for evaluating the effectiveness of adherence efforts through routine audits and comprehensive reporting mechanisms, allowing organizations to identify and address gaps in compliance proactively.

What financial benefits can adherence tracking systems provide?

Companies conducting regular adherence audits have reported average savings of $2.86 million, while organizations that adopted regulatory technology saved, on average, $1.45 million in regulatory expenses.

How can compliance tracking systems enhance operational efficiency?

A strong adherence culture mitigates risks and enhances overall operational efficiency by ensuring that organizations can adapt to evolving regulations and implement effective adherence strategies.

What steps should be taken to assess compliance needs?

To assess compliance needs, examine relevant regulations and industry standards, engage with stakeholders for insights on current practices, and document findings to create an overview of the regulatory environment.

What challenges do organizations face in compliance?

Organizations may struggle to align policies with changing regulations, which can impede adherence efforts. Establishing a structured regulatory review process can enhance operational efficiency and strengthen risk management strategies.