Overview

This article presents five title verification solutions designed for banks to improve accuracy in property ownership assessments. It underscores the critical need for thorough document checks, the integration of advanced technologies such as machine learning and OCR, and adherence to best practices. These strategies significantly mitigate legal risks and financial losses stemming from property disputes, thereby protecting both the institution's investments and the trust of borrowers.

Introduction

In the intricate realm of real estate finance, the importance of precise title verification is paramount. As banks navigate an increasingly complex landscape rife with potential legal pitfalls and financial repercussions, it is essential to ensure that property titles are clear and free from encumbrances.

This article explores the critical role of accurate title verification, addressing common challenges, advanced technological solutions, and best practices that empower financial institutions to safeguard their investments and foster trust among borrowers.

By tackling these complexities and leveraging innovative tools, banks can enhance operational efficiency while simultaneously mitigating risks associated with ownership disputes and compliance failures.

Understand the Importance of Accurate Title Verification

Precise assessment of ownership is crucial for financial institutions, serving as a safeguard against potential legal conflicts and monetary losses. A transparent designation verifies that the property being financed is free from liens, encumbrances, or claims from third parties. This validation procedure not only protects the institution's investment but also fosters borrower trust, assuring them that their property rights are secure. For instance, financial institutions that neglect comprehensive ownership checks may face lawsuits related to property disputes, resulting in significant financial repercussions.

In 2025, the importance of precise ownership assessment is underscored by the increasing complexity of real estate transactions and the heightened risk of legal conflicts. Regulatory compliance further necessitates thorough document verification, as adherence to laws governing property transactions aids financial institutions in avoiding penalties and preserving their market reputation. A failure in this area can lead to substantial financial losses, as evidenced by numerous case studies showcasing financial institutions embroiled in due to oversight errors. The Supreme Court has emphasized the necessity for civil lawsuits to address such matters promptly, highlighting the legal consequences of inadequate property checks.

To illustrate the financial impact, statistics indicate that financial institutions experiencing property check failures may incur losses amounting to millions in legal expenses and settlements. Therefore, emphasizing thorough document assessment is not merely a recommended approach; it is an essential component of a financial institution's lending strategy, which can be greatly enhanced by title verification solutions for banks.

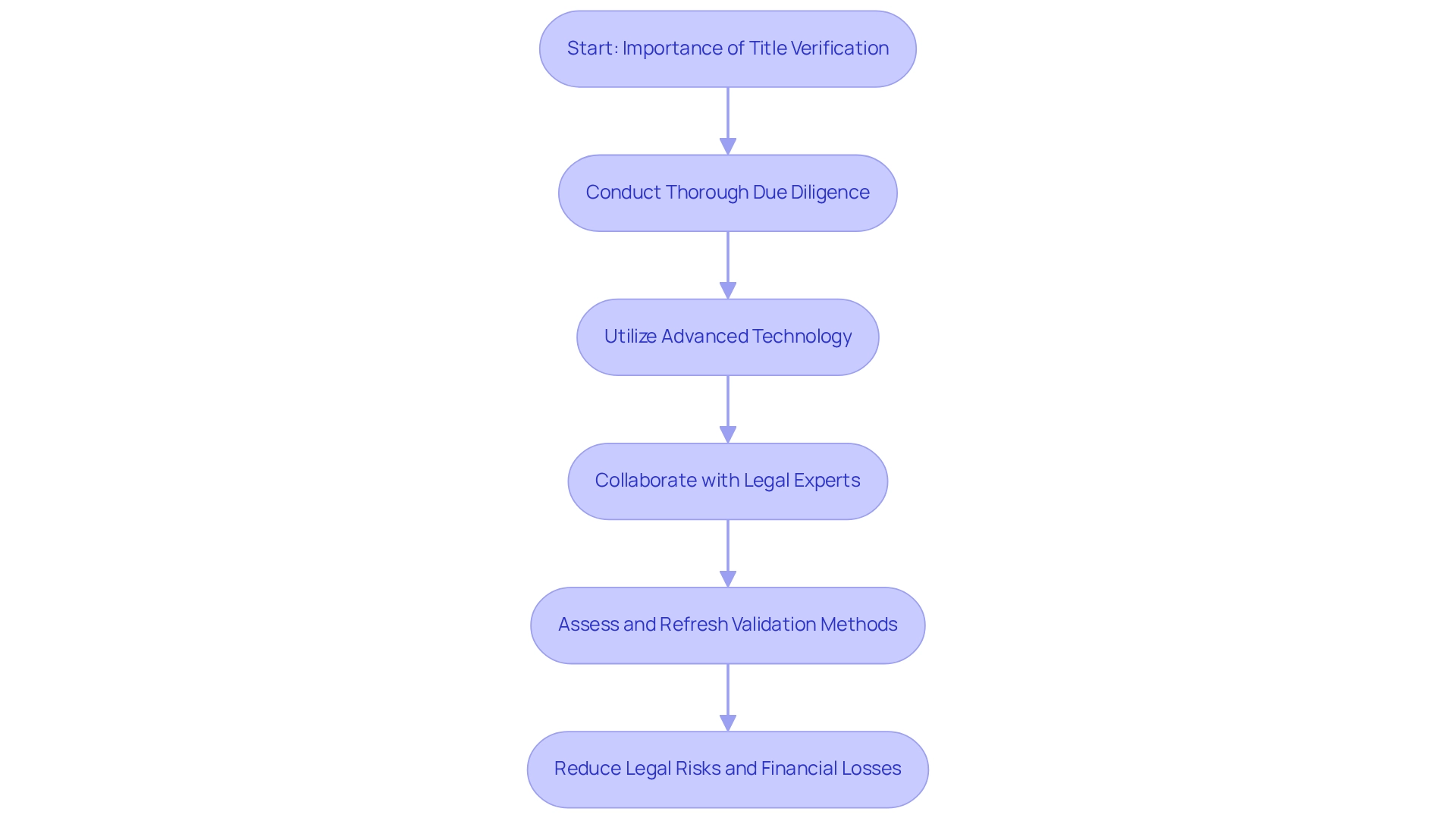

- Conduct thorough due diligence on all property documents.

- Utilize advanced technology, such as Parse AI's example manager and research automation tools, to enhance precision in document processing and research automation.

- Collaborate with legal experts to ensure compliance with all regulations.

- Consistently assess and refresh validation methods, including title verification solutions for banks, to adapt to evolving regulations and market conditions.

By addressing these common challenges and establishing systematic validation processes, banks can significantly reduce the likelihood of legal conflicts and financial setbacks, reinforcing the vital role of precise document authentication in their operations.

Identify Common Challenges in Title Verification Processes

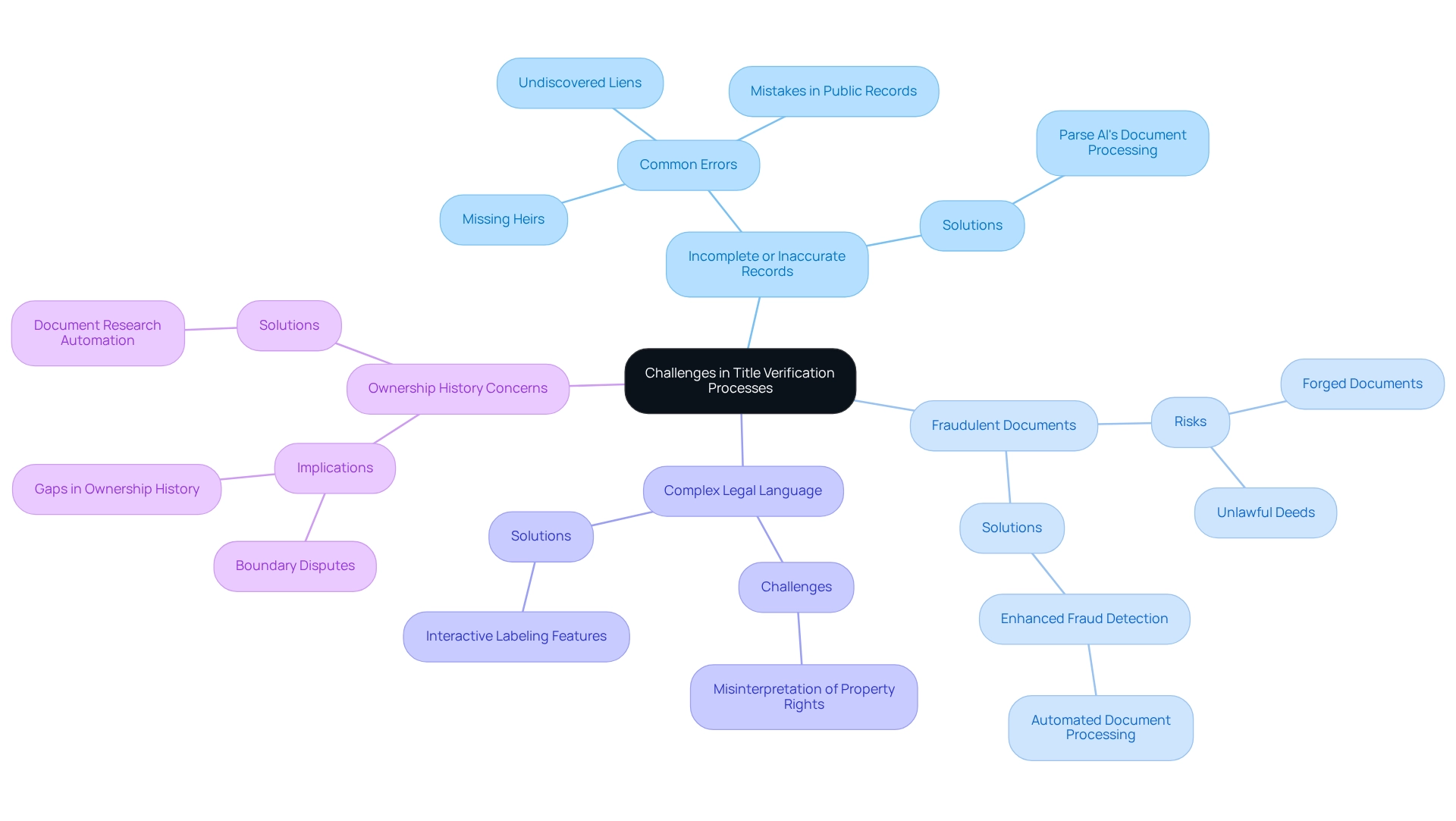

The challenges presented by title verification solutions for banks can significantly undermine accuracy. Key issues include:

- Incomplete or Inaccurate Records: Title searches often depend on public records, which may be outdated or incomplete. Frequent search errors involve undiscovered liens and mistakes in public records, resulting in expensive mistakes. Parse AI's advanced machine learning tools, including its example manager, expedite document processing, helping to identify and rectify these inaccuracies more efficiently.

- Fraudulent Documents: The rising occurrence of ownership fraud necessitates increased vigilance. Banks must remain alert to the risks posed by forged documents that can distort ownership representations. With Parse AI's automated document processing capabilities, institutions can enhance their fraud detection measures, ensuring that only legitimate documents are processed.

- Complex Legal Language: Titles frequently contain intricate legal terminology that can be misinterpreted, resulting in misunderstandings regarding property rights and obligations. Parse AI's interactive labeling features allow for clearer annotation and understanding of , reducing the risk of misinterpretation.

- Ownership History Concerns: Gaps in the ownership history can cause considerable uncertainty regarding possession, complicating the confirmation method and possibly resulting in conflicts. By utilizing Parse AI's robust document research automation, financial institutions can extract essential information from document records, enhancing the validation procedure with title verification solutions for banks and reducing the risk of conflicts.

These challenges not only affect the precision of document validation but also have wider implications for real estate deals. For instance, boundary disputes can complicate the chain of ownership, necessitating legal resolutions such as surveys, court hearings, or negotiations to clarify possession. By identifying these frequent traps and employing Parse AI's cutting-edge solutions, financial institutions can execute focused strategies to improve their documentation assessment methods, ultimately guaranteeing increased precision and dependability in their operations.

Leverage Technology for Efficient Title Verification

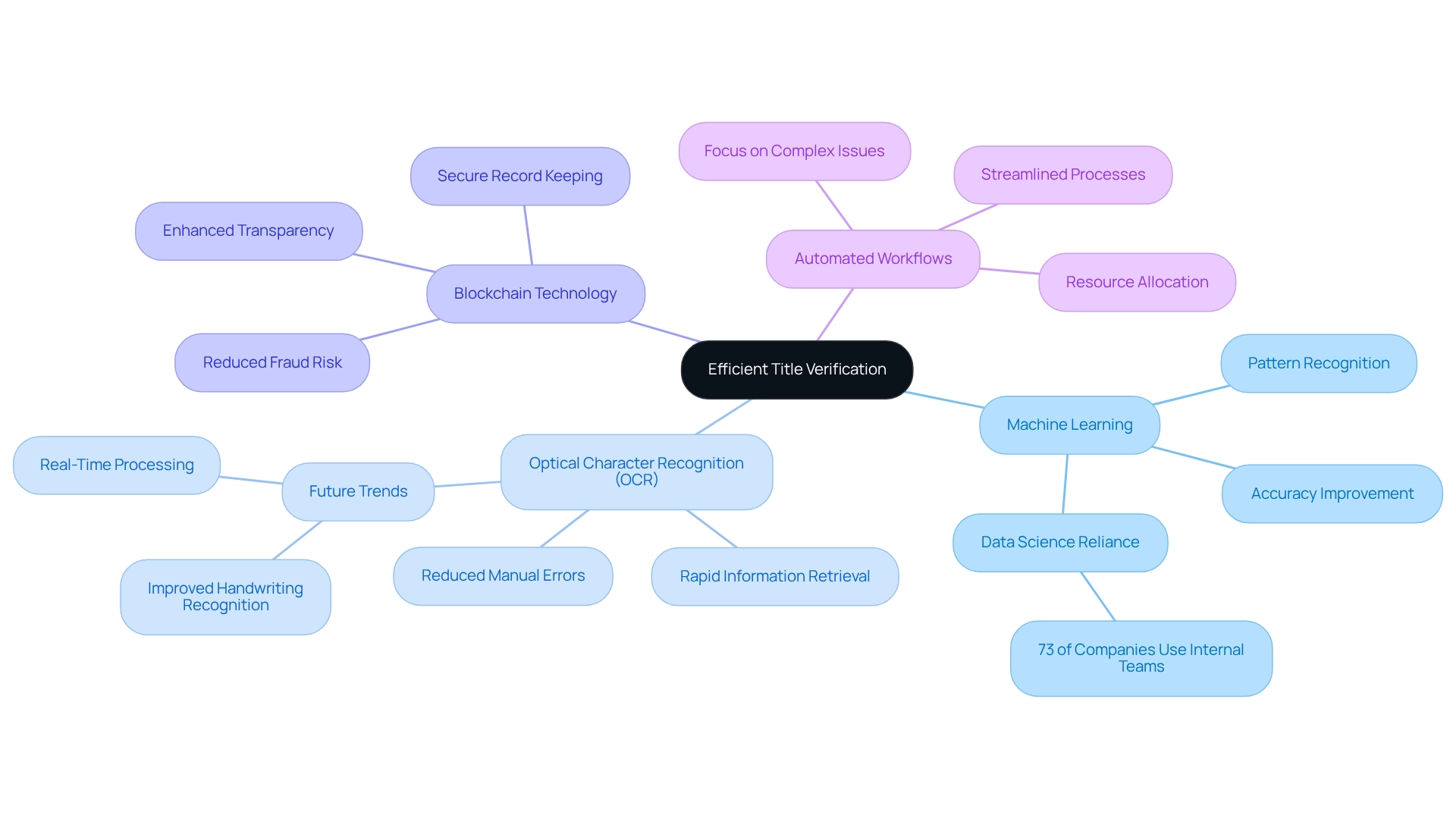

Incorporating advanced technology into document confirmation methods significantly enhances both efficiency and precision. The key technologies driving this transformation include:

- Machine Learning: By employing sophisticated algorithms, banks can swiftly analyze extensive documentation data, uncovering patterns and discrepancies that human reviewers might overlook. This capability not only accelerates the verification process but also increases accuracy, as machine learning systems continuously improve through exposure to new data. In fact, 73% of the most sophisticated companies rely on their internal data science teams, underscoring the importance of machine learning in modern business practices.

- Optical Character Recognition (OCR): OCR technology facilitates the rapid retrieval of information from scanned documents, expediting search processes and reducing manual data entry errors. Recent advancements in OCR, such as enhanced handwriting recognition and real-time processing, are poised to further elevate processing efficiency, making it an essential tool for document researchers. Future trends indicate a shift towards more sophisticated OCR systems capable of handling a wider variety of document types, thereby improving overall processing efficiency.

- Blockchain Technology: By providing a secure and immutable record of property transactions, blockchain enhances transparency and trust in title assessment. This technology ensures that all parties involved have access to the same verified information, thereby reducing the risk of disputes and fraud.

- Automated Workflows: The introduction of automated systems streamlines the confirmation method, ensuring that all essential checks are conducted effectively. By automating routine tasks, financial institutions can allocate resources more efficiently, enabling staff to focus on more complex issues that require human judgment.

However, it is crucial to recognize common pitfalls in implementing these technologies. For example, without proper leadership and adaptation across various business aspects, as noted by Erik Brynjolfsson, Director of the MIT Initiative on the Digital Economy, the integration of machine learning can lead to misalignment in operations. This indicates that when machine learning alters one aspect of the business — such as product assortment — other sections must also adapt, including marketing and production. By utilizing title verification solutions for banks, financial institutions can significantly enhance the precision of their assessments while simultaneously reducing the time and resources required for the task. As the industry evolves, the combination of machine learning and OCR will be vital in shaping the future of document authentication, enabling financial institutions to meet the increasing demands for efficiency and reliability in .

Implement Best Practices for Title Verification Solutions

To enhance ownership confirmation procedures, banks must adopt the following best practices:

- Conduct Comprehensive Training: It is essential that personnel engaged in document examination receive thorough training to identify potential issues and understand legal terminology. Regular feedback from employees can refine these training programs, as 73% of organizations that collect feedback report improved training outcomes. Furthermore, the absence of optimism about career development opportunities for upskilling or training, as expressed by 29% of workers, underscores the critical need for more focused and accessible learning paths.

- Utilize a Multi-Layered Validation Approach: Implementing multiple validation methods, such as cross-referencing public records and leveraging advanced technology, is crucial for confirming ownership. This approach not only enhances accuracy but also aligns with the growing trend of technology firms representing 30% of the global Learning Management System (LMS) market.

- Consistently Refresh Technology: Keeping up with technological progress is essential for enhancing document validation procedures. Employing advanced tools guarantees that validation methods remain effective and efficient. This is especially crucial as improved validation methods can result in heightened workplace productivity by an average of 21%, directly benefiting document authentication processes.

- Encourage Collaboration with Experts: Working with knowledgeable professionals enables financial institutions to obtain valuable insights and exchange best practices, which can significantly improve overall precision in verification.

- Implement Quality Control Measures: Creating a system for routine assessments of document confirmation methods aids in recognizing and correcting persistent problems. This proactive approach is essential for maintaining high standards and ensuring compliance, especially as 34% of employees admit to skimming through compliance information. This highlights the need for clear and engaging content delivery in compliance training for title verification staff, which is crucial for effective title verification solutions for banks.

By implementing these best practices, banks can significantly improve the reliability and efficiency of their title verification processes, leading to better risk management and .

Conclusion

Accurate title verification stands as a cornerstone of effective real estate finance, safeguarding banks against legal disputes and financial losses. The complexity of property transactions and the necessity for regulatory compliance underscore the need for meticulous title checks. By identifying common pitfalls—such as incomplete records, fraudulent documents, and chain of title issues—financial institutions can take proactive steps to mitigate risks.

Furthermore, leveraging advanced technologies like machine learning, optical character recognition, and blockchain can significantly enhance the efficiency and accuracy of title verification processes. These innovations not only streamline operations but also foster greater transparency and trust among stakeholders. In addition, implementing best practices, such as comprehensive training and multi-layered verification approaches, ensures that banks are well-equipped to navigate the intricate landscape of real estate finance.

Ultimately, the commitment to thorough title verification transcends mere procedural necessity; it is essential for protecting investments and maintaining the trust of borrowers. By prioritizing accuracy and embracing technological advancements, banks can enhance operational efficiency and reduce the risk of costly disputes, thereby reinforcing their position in the competitive real estate market. The future of title verification lies in continuously adapting to evolving challenges and integrating innovative solutions that drive reliability and confidence in property transactions.

Frequently Asked Questions

Why is precise assessment of ownership important for financial institutions?

Precise assessment of ownership is crucial for financial institutions as it serves as a safeguard against potential legal conflicts and monetary losses. It ensures that the property being financed is free from liens, encumbrances, or claims from third parties, protecting the institution's investment and fostering borrower trust.

What are the consequences of neglecting ownership checks?

Neglecting comprehensive ownership checks can lead to lawsuits related to property disputes, resulting in significant financial repercussions for financial institutions, including costly legal expenses and settlements.

How has the complexity of real estate transactions affected the need for ownership assessment?

In 2025, the increasing complexity of real estate transactions and heightened risk of legal conflicts underscore the importance of precise ownership assessment, making thorough document verification essential for regulatory compliance and avoiding penalties.

What role do regulatory compliance and document verification play for financial institutions?

Regulatory compliance necessitates thorough document verification, as adherence to laws governing property transactions helps financial institutions avoid penalties and preserve their market reputation. Failure to comply can lead to substantial financial losses.

What statistics highlight the financial impact of property check failures?

Statistics indicate that financial institutions experiencing property check failures may incur losses amounting to millions in legal expenses and settlements, emphasizing the need for thorough document assessment.

What are some recommended practices for ensuring accurate ownership assessments?

Recommended practices include conducting thorough due diligence on all property documents, utilizing advanced technology for document processing, collaborating with legal experts for compliance, and consistently assessing and refreshing validation methods.

How can banks reduce the likelihood of legal conflicts and financial setbacks?

By addressing common challenges and establishing systematic validation processes, banks can significantly reduce the likelihood of legal conflicts and financial setbacks, reinforcing the importance of precise document authentication in their operations.