Overview

This article presents a systematic approach for homeowners to accurately and efficiently verify their home title through five essential steps. Understanding the basics of home title is crucial, as it lays the foundation for safeguarding ownership rights.

- Gather the necessary documentation. This step is vital for ensuring that you have all relevant information at your fingertips.

- Conduct a comprehensive title search. This process allows you to uncover any potential issues that could complicate your ownership.

- Interpret title information effectively. It’s important to understand what the data means and how it impacts your ownership.

- Troubleshoot common title issues. By addressing these challenges proactively, you can avoid complications in real estate transactions.

By following these steps, homeowners can protect their ownership rights and navigate the complexities of real estate with confidence.

Introduction

Navigating the complexities of home ownership often begins with a crucial yet frequently overlooked step: verifying the home title. This legal document not only confirms ownership but also reveals any claims or liens that could jeopardize a homeowner's investment. Many homeowners remain unaware of the potential pitfalls tied to unclear title information. Therefore, understanding how to accurately check a home title becomes essential.

What steps can homeowners take to ensure their title is clear? Furthermore, how can they effectively troubleshoot common issues that may arise in the process? By addressing these questions, we can empower homeowners to protect their investments and navigate the intricacies of property ownership with confidence.

Understand Home Title Basics

A home deed is a vital legal document that establishes ownership of real estate. It outlines the owner's name, the legal description of the property, and any claims or liens that may exist. It's essential to distinguish between a designation and a deed: the deed facilitates the transfer of possession, while the designation indicates the legal rights associated with the asset.

Key concepts to understand include:

- 'chain of ownership,' which traces the history of possession

- 'encumbrances,' which are claims against the property that can impact ownership rights

Grasping these fundamentals is crucial for homeowners. Studies indicate that a significant number of homeowners lack clarity on the differences between ownership documents and deeds, which can lead to costly misconceptions.

Real estate experts emphasize the importance to check your home title to safeguard your investment and avoid complications in future transactions. For instance, one client faced challenges refinancing her property because her ex-husband's name remained on the deed, despite her having a valid document. This underscores the necessity of understanding ownership issues.

Furthermore, obtaining owner's insurance for the property is essential. It protects homeowners against unexpected claims and provides peace of mind regarding their investment.

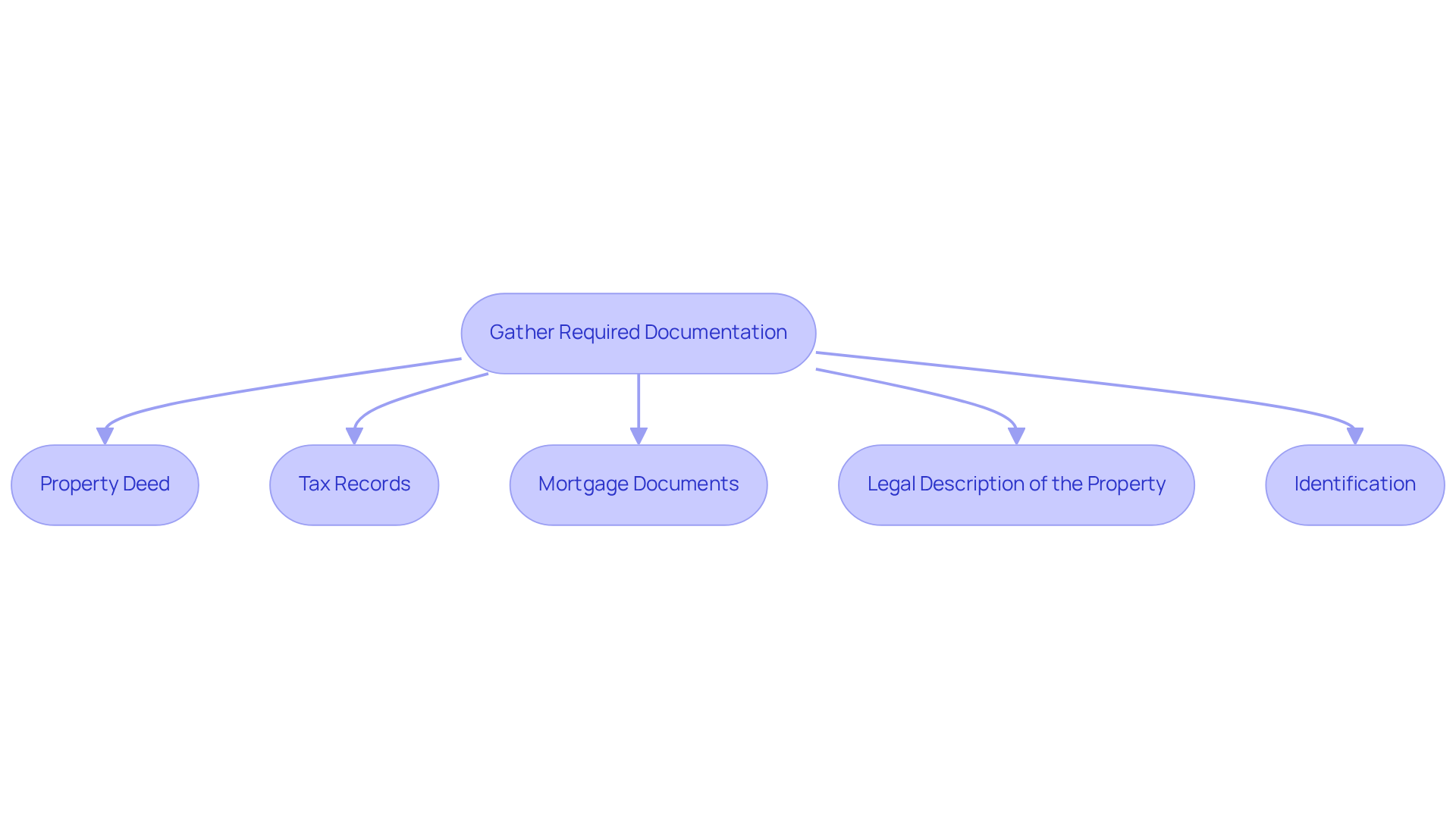

Gather Required Documentation

Before starting your search for ownership, it is essential to check your home title and gather all relevant documentation to ensure a smooth process. Key documents include:

- Property Deed: This document confirms current ownership and outlines any previous transfers, serving as the foundation for your title research.

- Tax Records: These records disclose any outstanding real estate taxes and potential liens, which are crucial for understanding the financial responsibilities linked to the asset.

- Mortgage Documents: If applicable, these documents outline any loans secured against the asset, providing insight into existing financial claims.

- Legal Description of the Property: Typically found in the deed, this description is vital for accurately identifying the property in public records.

- Identification: A government-issued ID may be necessary when accessing certain records, ensuring that you can confirm your identity during the inquiry.

Having these documents ready can significantly simplify your retrieval process, reducing the likelihood of delays. Notably, around 25% of document inquiries face absent paperwork, which can extend the procedure and complicate ownership confirmation. Outstanding liens or claims on a property can further complicate the ownership search, making it imperative to address these issues upfront. By being proactive and organized, you can mitigate these risks and enhance the efficiency of your title research.

Incorporating advanced tools like those offered by Parse AI can further optimize this process. Their machine learning capabilities, including the example manager, facilitate automated document handling and research automation, allowing researchers to extract essential information swiftly and precisely. This technology improves courthouse document processing with features like full-text retrieval and machine learning extraction, simplifying runsheet creation and increasing overall efficiency. Furthermore, choosing a reliable firm is essential, as their effectiveness can significantly influence the overall duration of the process, which typically spans from 10 to 14 days. As Bill Gassett, owner and founder of Maximum Real Estate Exposure, states, "The agent’s main job is to thoroughly examine all the available public records to determine the exact situation of the property owner." This underscores the significance of comprehensive documentation in guaranteeing a successful inquiry.

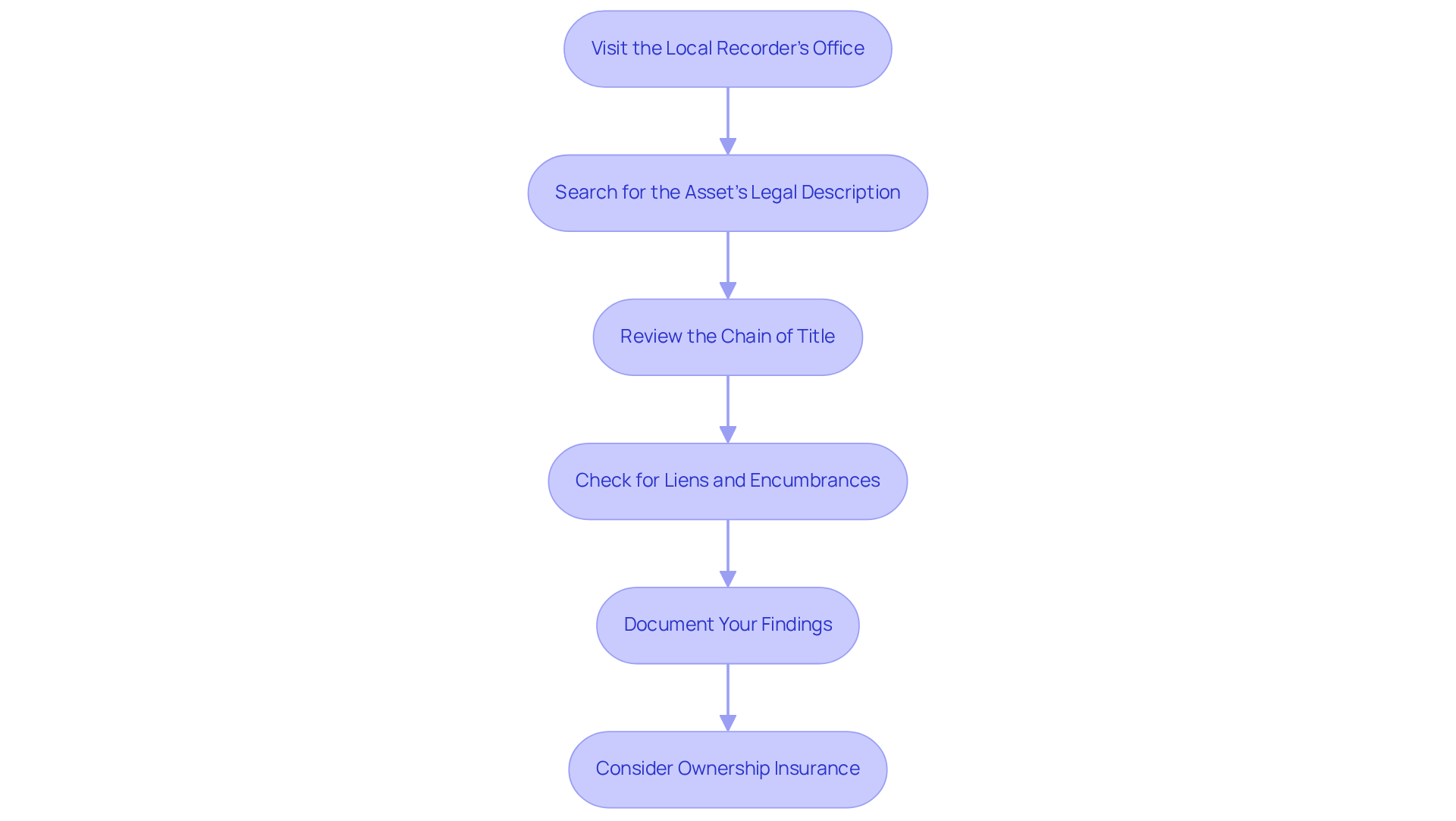

Conduct a Comprehensive Title Search

To conduct a comprehensive title search, follow these steps:

-

Visit the Local Recorder's Office: Start by visiting your local recorder's office or accessing their online portal. This office maintains public records related to real estate ownership, making it a vital resource for your search. Many records are now available online, which can expedite your research process.

-

Search for the Asset's Legal Description: Utilize the legal description you gathered earlier to locate the asset in the records. This description is essential for confirming that you are examining the correct property.

-

Review the Chain of Title: Carefully examine the history of possession to verify that the current owner is legitimate. Look for any breaks in the chain, as these could indicate potential issues that may impact property rights. As Peter Zinkovetsky, Esq., states, "The main objective is to confirm the legal ownership of the asset and to reveal any current claims, encumbrances, or other concerns that could affect the buyer’s capacity to obtain complete ownership." It is crucial to check your home title to avoid complications during transactions.

-

Check for Liens and Encumbrances: Investigate any claims against the asset, such as mortgages, tax liens, or judgments. These encumbrances can significantly impact your ownership rights and should be addressed before finalizing any transactions. It is necessary to check your home title to ensure a clear ownership document is in place for a real estate transaction, particularly when funding is included.

-

Document Your Findings: Keep comprehensive notes of your discoveries, including any discrepancies or issues you uncover. This documentation will be invaluable for resolving potential problems and ensuring a smooth transaction process. Keep in mind, the typical period for examination varies from 10 to 14 days, based on the intricacy of the property, so plan accordingly.

-

Consider Ownership Insurance: After finishing your ownership search, it is wise to acquire ownership insurance to safeguard against any unexpected ownership issues that may develop after the purchase. This insurance can protect your investment and provide peace of mind.

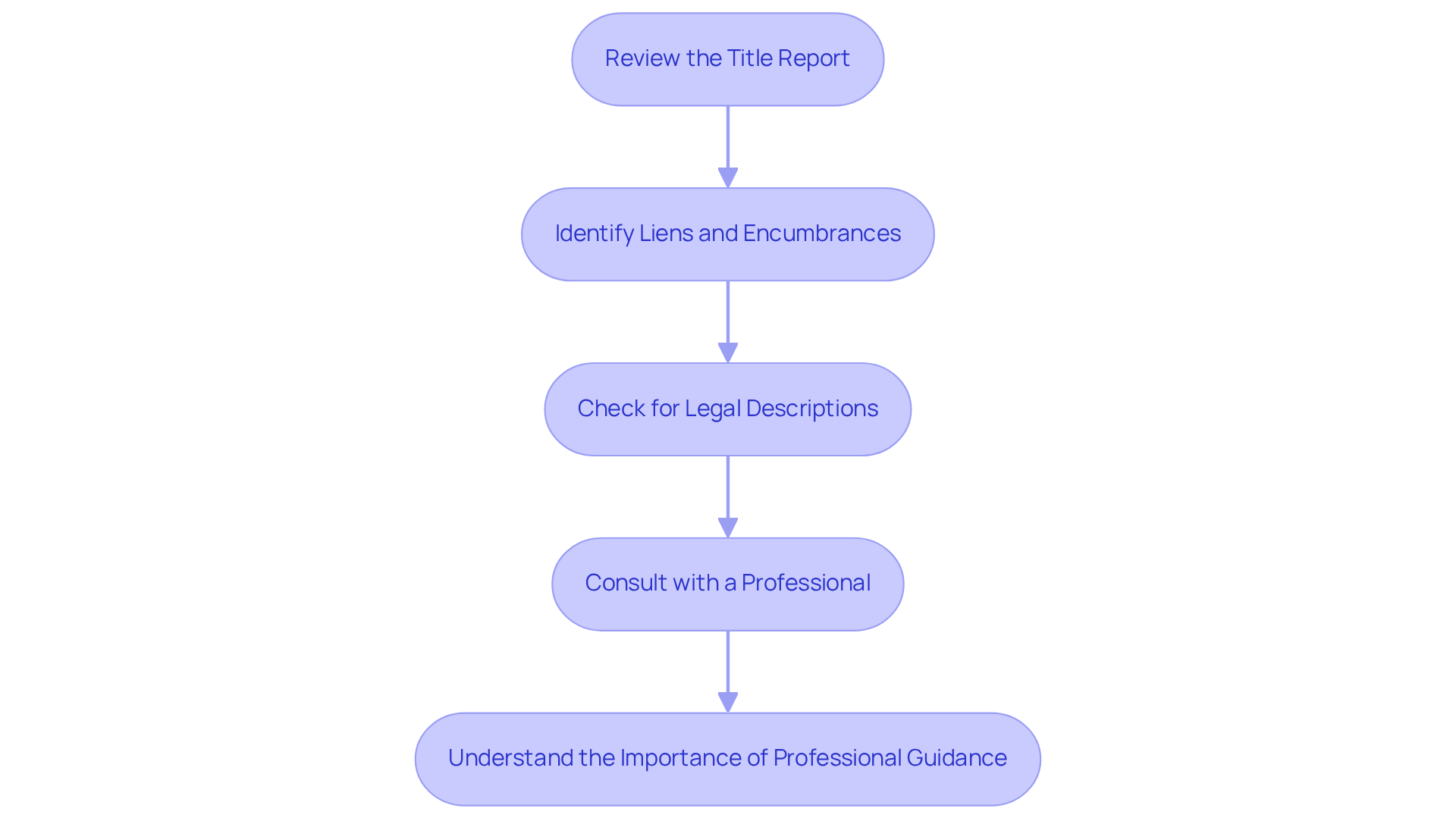

Interpret Title Information Effectively

To effectively interpret your title information, follow these steps:

-

Review the Title Report: This essential document details the ownership history, including any liens and encumbrances. Scrutinize it for discrepancies or unusual entries that could signal potential issues.

-

Identify Liens and Encumbrances: Familiarize yourself with the implications of each lien. For example, a mortgage lien indicates that the asset is financed, while a tax lien refers to unpaid real estate taxes. Understanding these can significantly impact your ability to check your home title and ownership rights.

-

Check for Legal Descriptions: Verify that the legal description aligns with the property in question. Any inconsistencies may suggest underlying problems that need addressing, particularly in relation to the details outlined in the Purchase and Sale Agreement.

-

Consult with a Professional: If you encounter intricate legal terms or ambiguous entries, seek assistance from a real estate firm or an attorney. Their expertise is invaluable in navigating potential issues and ensuring clarity in your report.

-

Understand the Importance of Professional Guidance: Statistics indicate that in 2005, ownership issues were identified in 36% of residential real estate transactions, emphasizing the complexity of these documents. Engaging with experts can prevent misunderstandings and protect your investment. As noted by industry professionals, "Understanding terminology such as 'vesting,' 'encumbrance,' and 'legal description' is crucial for accurate interpretation of the report.

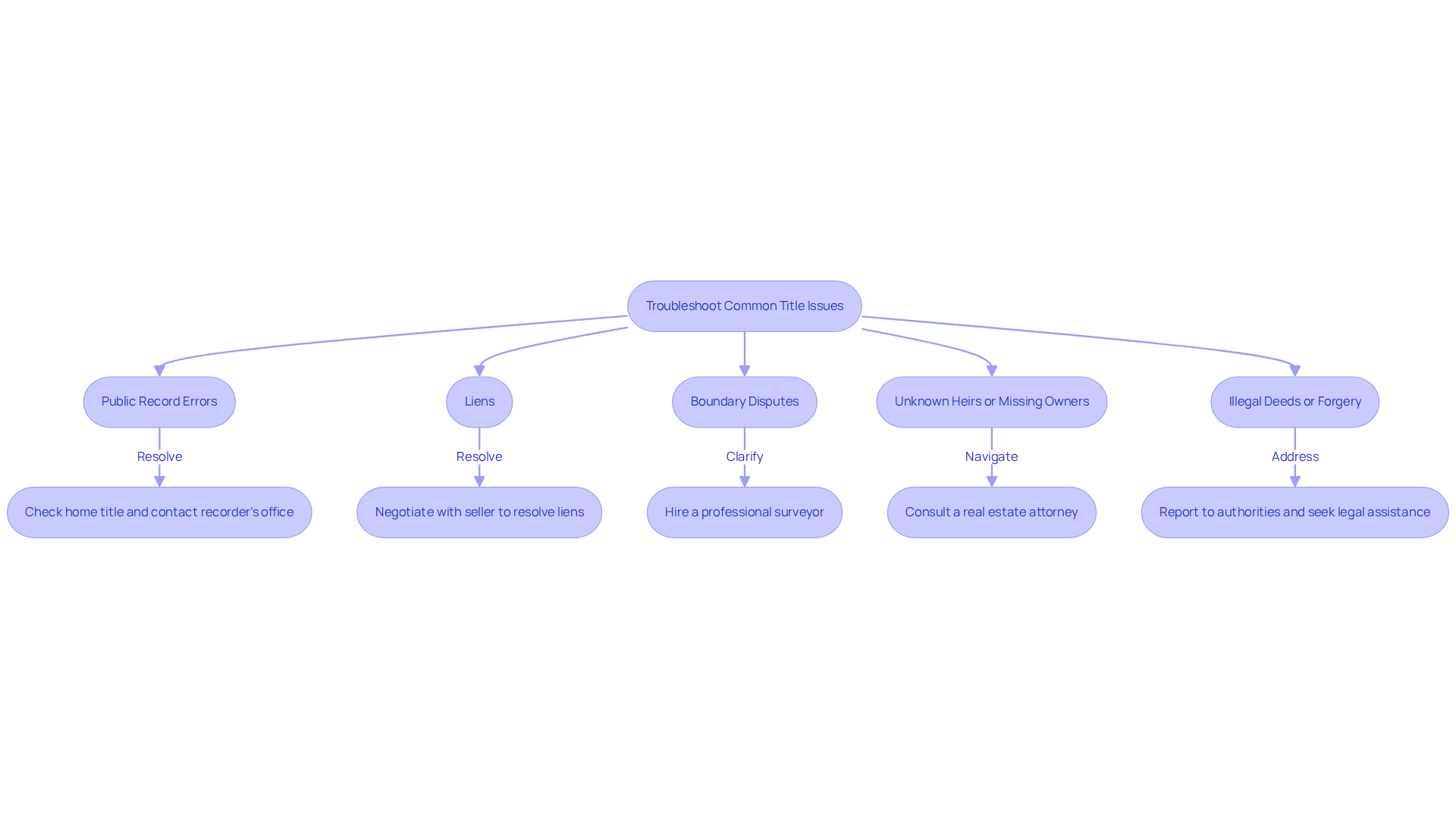

Troubleshoot Common Title Issues

Common title issues can arise when you check your home title during your search. Here’s how to troubleshoot them:

-

Public Record Errors: Discrepancies in public records can create significant hurdles. If you encounter such issues, you should check your home title and promptly contact the recorder's office to request corrections. Be sure to provide any supporting documentation to facilitate the process. According to industry experts, you can rectify most recording errors by first checking your home title and then filing a corrective deed or other legal documents with the county recorder’s office.

-

Liens: Outstanding liens can complicate the closing process. It’s advisable to negotiate with the seller to resolve these issues before finalizing the transaction. To safeguard against future claims and cover legal costs incurred in defending property rights, it is essential to check your home title.

-

Boundary Disputes: Unclear property lines can lead to disputes with neighbors. Hiring a professional surveyor can clarify boundaries and prevent future conflicts. Furthermore, to ensure homeowners maintain complete control of their land, it is important to check your home title as title insurance offers protection for legal costs associated with boundary disputes.

-

Unknown Heirs or Missing Owners: Discovering unknown heirs can complicate ownership claims. In such cases, legal action may be necessary to resolve these issues. Consulting with a real estate attorney is crucial for navigating these complexities and helping you check your home title to ensure your rights are protected.

-

Illegal Deeds or Forgery: If fraud is suspected, it’s essential to report it to the authorities immediately. Legal assistance is vital in these situations to address potential claims against the property title and to mitigate financial losses. Title insurance can also cover legal costs associated with fraudulent documentation, providing peace of mind for homeowners.

Conclusion

Checking your home title is a critical process for any homeowner, ensuring clarity and security in property ownership. Understanding the fundamentals of home titles, gathering essential documentation, and conducting a thorough title search are vital steps that protect investments and help avoid potential complications in real estate transactions.

Key steps outlined in this article emphasize the importance of:

- Recognizing encumbrances

- Gathering necessary documents like property deeds and tax records

- Accurately interpreting title information

Furthermore, troubleshooting common title issues—such as public record errors or boundary disputes—is essential for maintaining a clear title. Engaging with professionals when needed can significantly enhance the effectiveness of this process.

In conclusion, the significance of verifying home titles cannot be overstated. Homeowners must take proactive measures in checking their titles to safeguard against unforeseen claims and ensure a smooth transaction process. By following the outlined steps and utilizing available resources, individuals can confidently navigate the complexities of home ownership and secure their investment for the future.

Frequently Asked Questions

What is a home deed, and why is it important?

A home deed is a vital legal document that establishes ownership of real estate, outlining the owner's name, the legal description of the property, and any claims or liens that may exist. It is essential for transferring possession and indicates the legal rights associated with the asset.

What are key concepts related to home titles that homeowners should understand?

Key concepts include 'chain of ownership,' which traces the history of possession, and 'encumbrances,' which are claims against the property that can impact ownership rights.

Why is it important to check your home title?

Checking your home title is crucial to safeguard your investment and avoid complications in future transactions, such as refinancing issues that can arise if names on the deed are not updated.

What documentation is required for checking home ownership?

Required documentation includes the Property Deed, Tax Records, Mortgage Documents, Legal Description of the Property, and Identification (a government-issued ID may be necessary).

How can missing documentation affect the ownership confirmation process?

Around 25% of document inquiries face absent paperwork, which can extend the procedure and complicate ownership confirmation, making it imperative to gather all necessary documents beforehand.

What role does owner's insurance play for homeowners?

Owner's insurance protects homeowners against unexpected claims and provides peace of mind regarding their investment.

How can technology assist in the title research process?

Advanced tools like those offered by Parse AI can optimize the process through automated document handling and research automation, improving efficiency in retrieving essential information.

What is the typical duration for the home title research process?

The home title research process typically spans from 10 to 14 days, depending on the reliability of the firm conducting the research.