Overview

The article highlights four essential tools that significantly enhance the efficiency of title insurance verification for real estate professionals. It underscores the critical role of technologies such as:

- Optical Character Recognition (OCR)

- Blockchain

- AI-powered validation tools

- Collaboration platforms

These resources not only improve the accuracy and speed of document examinations but also mitigate risks associated with title defects. Consequently, they ensure compliance in property transactions, ultimately fostering trust and reliability in the industry.

Introduction

In the intricate world of real estate, title insurance serves a pivotal function in safeguarding property owners and lenders from the potential financial pitfalls associated with title defects. As the market for title insurance expands—particularly in regions like Nigeria—grasping its fundamentals becomes essential for real estate professionals. This article explores the core components of title insurance, the significance of effective verification tools, and best practices for optimizing research processes.

Furthermore, by harnessing innovative technologies and fostering collaboration, professionals can navigate the complexities of title insurance, mitigate risks, and enhance their service delivery in an ever-evolving landscape.

Understand Title Insurance Fundamentals

Title insurance serves as a vital form of indemnity coverage, safeguarding property owners and lenders against financial losses stemming from defects in property ownership documents. It tackles potential challenges such as liens, encumbrances, and ownership disputes that may arise post-purchase. For real estate professionals, grasping the fundamentals of ownership insurance is crucial, as it underscores the necessity of using tools for verifying title insurance and the risks associated with insufficient verification. Key components include:

- Types of Title Insurance: The two primary categories are owner's title insurance, which protects the buyer, and lender's title insurance, which secures the lender's interests. Understanding this distinction is essential for recognizing the coverage each party receives.

- Common Title Concerns: can be jeopardized by various ownership issues, including undisclosed heirs, fraudulent claims, and inaccuracies in public records. Awareness of these challenges is critical for effective risk management.

- Legal Framework: A robust understanding of the legal landscape surrounding ownership insurance is necessary for compliance and to mitigate potential liabilities. This knowledge equips professionals to navigate the complexities of property law.

As the insurance market for property is projected to expand significantly, with Nigeria's market size anticipated to reach USD 120.08 million in 2024, reflecting a compound annual growth rate (CAGR) of 10.8%, the importance of property insurance in contemporary real estate practices cannot be overstated. This growth is propelled by increasing property transactions and an evolving regulatory environment, emphasizing the necessity for real estate professionals to remain informed about these trends. As Swasti Dharmadhikari, an associate at Cognitive Market Research, observes, "The primary factors behind the growth of the Title Insurance market are rising property transactions and a changing regulatory environment." This highlights the importance of staying abreast of these developments.

Furthermore, the property insurance market exhibits varied adoption rates across regions, with the MEA region experiencing a slight decline. This scenario presents both challenges and opportunities as the market evolves globally, underscoring the need for professionals to adapt their strategies accordingly.

In this context, Parse AI is committed to enhancing real estate solutions through innovative technologies and collaboration with industry professionals. By leveraging Parse AI's advanced resources, such as automated name searches and detailed data analysis, real estate professionals can deepen their understanding of insurance fundamentals, improve their inquiry efficiency, and utilize tools for verifying title insurance to effectively protect their clients. Common pitfalls in insurance practices, such as overlooking potential claims or failing to conduct thorough searches, can lead to significant complications. Mastering these fundamentals not only mitigates risks but also positions professionals to capitalize on the advantages of a growing market. For those seeking to refine their examination techniques, utilizing Parse AI's resources can provide a substantial edge in navigating the complexities of title insurance.

Select Effective Verification Tools

Choosing suitable assessment instruments is crucial for researchers aiming to enhance their productivity. The following tools are highly recommended:

- Optical Character Recognition (OCR) Software: Solutions like Parse AI utilize OCR technology to swiftly extract critical data from title documents, significantly accelerating the research process. Studies indicate that OCR can capture highly accurate data at the outset of business operations, with accuracy rates often exceeding 90%, thereby enhancing overall productivity.

- Blockchain Technology: The utilization of blockchain platforms ensures secure and immutable records of property ownership, effectively mitigating the risk of fraud. This technology is increasingly acknowledged for its potential to transform property authentication processes.

- AI-Powered Validation Tools for Verifying Title Insurance: Advanced solutions such as Flueid and Westcor's validation tool employ to identify discrepancies and confirm ownership histories, streamlining the validation process.

- Collaboration Platforms: Tools that enhance communication among team members play a crucial role in the verification process, ensuring that all stakeholders remain informed and aligned. This cooperative method is essential for upholding precision and effectiveness in document examination.

The incorporation of these resources not only enhances the pace and precision of document examinations but also aligns with current trends in digital transformation and automation, which are expected to expand significantly in the upcoming years. For instance, the Asia Pacific market is projected to grow at a CAGR of about 17.66% from 2024-2032, fueled by rapid digital transformation and increasing investments in automation technologies. As Brian Moore, VP, remarked, "The caliber of investigation they have conducted for us has been excellent." This underscores the significance of embracing these assessment resources in the evolving landscape of property examination.

Implement Best Practices for Tool Utilization

To enhance the efficiency of validation resources in document examination, it is imperative to apply the following best practices:

- Training and Onboarding: Comprehensive training is essential for all team members to proficiently utilize validation resources, including like those provided by Parse AI. Regular training sessions not only sharpen existing skills but also familiarize staff with new features, such as interactive labeling and OCR technology, ultimately enhancing productivity. Research indicates that organizations investing in employee training experience a 17% increase in productivity, underscoring the importance of continuous development in this field. Moreover, investing in employee development produces substantial benefits, such as fewer safety incidents and higher retention rates, further emphasizing the importance of comprehensive training, especially when it involves the use of tools for verifying title insurance to ensure consistency and precision throughout the title examination process. These procedures help standardize practices, ensuring that all team members adhere to the same guidelines, which is vital for compliance and quality assurance. Significantly, 34% of employees glance over compliance details, highlighting the necessity for comprehensive training to guarantee that compliance is grasped and observed.

- Regular Audits: Carrying out routine assessments of the validation process enables organizations to identify areas requiring enhancement and ensures conformity to industry standards. This proactive method not only improves the quality of studies but also reduces risks linked to non-compliance. Utilizing Parse AI's automated document processing capabilities can streamline this audit process, making it more efficient with the help of tools for verifying title insurance. This input is invaluable for ongoing enhancement, allowing teams to adjust and improve their processes based on real-world experiences and challenges encountered during project exploration. The 2024 NAR Member Profile found that 94% of REALTORS® prefer to communicate with clients via text messaging, illustrating the importance of adapting to digital communication methods in training and feedback mechanisms to enhance engagement and effectiveness.

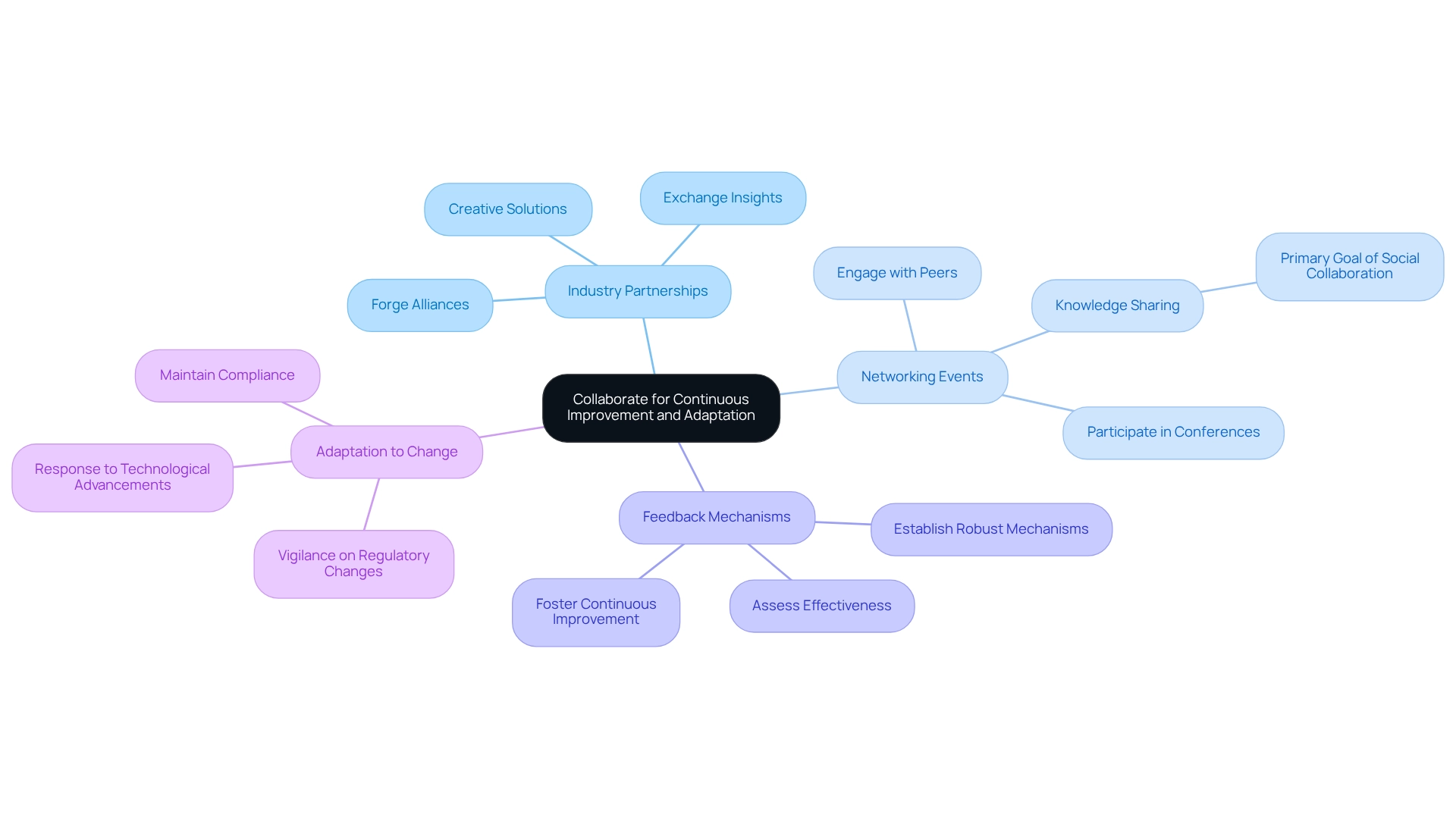

Collaborate for Continuous Improvement and Adaptation

Collaboration is essential for driving continuous improvement in research related to titles. Effective strategies to enhance collaborative efforts include:

- Industry Partnerships: Forge alliances with technology providers and fellow title companies to exchange insights and best practices. Such collaborations can result in creative solutions that simplify procedures and enhance precision in the tools for verifying title insurance.

- Networking Events: Actively participate in industry conferences and workshops to engage with peers, share experiences, and stay updated on emerging trends and technologies. Attendance at these events has been shown to significantly boost knowledge sharing, with almost half of organizations viewing knowledge sharing as the primary goal of social collaboration.

- Feedback Mechanisms: Establish robust feedback mechanisms with clients and stakeholders to assess the effectiveness of the tools for verifying title insurance and verification processes. This iterative approach not only enhances service delivery but also fosters a culture of continuous improvement. As highlighted in the case study titled "Knowledge Sharing as a Purpose of Collaboration," effective knowledge sharing through collaboration can lead to significant improvements in organizational efficiency.

- Adaptation to Change: Remain vigilant about regulatory changes and technological advancements. Adapting practices in response to these shifts is crucial for maintaining compliance and operational efficiency, ensuring that title research remains relevant and effective in .

Conclusion

The intricate landscape of title insurance is undeniably vital for safeguarding the interests of property owners and lenders alike. Understanding the fundamentals—ranging from the types of coverage available to the common title issues that can arise—enables real estate professionals to effectively mitigate risks and enhance their service offerings. As the title insurance market continues to expand, particularly in regions like Nigeria, the need for thorough knowledge and adeptness in navigating these complexities becomes increasingly apparent.

Utilizing effective verification tools is essential for optimizing title research processes. The integration of technologies such as Optical Character Recognition, blockchain, and AI-powered solutions not only accelerates research but also ensures accuracy and security. By adopting best practices, including comprehensive training and the establishment of standard operating procedures, professionals can maximize the potential of these tools, fostering a culture of continuous improvement.

Collaboration stands as the cornerstone of success in the title insurance domain. By forging partnerships, participating in industry events, and maintaining open feedback channels, professionals can stay ahead of emerging trends and enhance their operational efficiency. As the industry evolves, the ability to adapt to regulatory changes and technological advancements will be crucial for maintaining relevance and effectiveness.

In conclusion, a proactive approach to title insurance—rooted in a deep understanding of its fundamentals, the strategic use of verification tools, and a commitment to collaboration—empowers real estate professionals to thrive. By embracing these principles, they can safeguard their clients' interests and capitalize on the opportunities presented by a growing market.

Frequently Asked Questions

What is the purpose of title insurance?

Title insurance serves as a form of indemnity coverage that protects property owners and lenders from financial losses due to defects in property ownership documents, addressing issues such as liens, encumbrances, and ownership disputes that may arise after the purchase.

What are the main types of title insurance?

The two primary types of title insurance are owner's title insurance, which protects the buyer, and lender's title insurance, which secures the interests of the lender. Understanding the distinction between these two is essential for recognizing the coverage each party receives.

What common concerns are associated with title insurance?

Common concerns include undisclosed heirs, fraudulent claims, and inaccuracies in public records, all of which can jeopardize real estate transactions. Being aware of these issues is critical for effective risk management.

Why is understanding the legal framework of title insurance important?

A robust understanding of the legal landscape surrounding ownership insurance is necessary for compliance and to mitigate potential liabilities, enabling professionals to navigate the complexities of property law effectively.

What is the projected growth of the property insurance market in Nigeria?

The property insurance market in Nigeria is projected to reach USD 120.08 million in 2024, reflecting a compound annual growth rate (CAGR) of 10.8%, driven by increasing property transactions and an evolving regulatory environment.

How does the adoption rate of property insurance vary by region?

The adoption rates of property insurance vary across regions, with the MEA region experiencing a slight decline. This presents both challenges and opportunities as the market evolves globally.

How can Parse AI assist real estate professionals with title insurance?

Parse AI enhances real estate solutions through innovative technologies, providing resources like automated name searches and detailed data analysis. These tools help professionals deepen their understanding of insurance fundamentals and improve their inquiry efficiency for verifying title insurance.

What are some common pitfalls in title insurance practices?

Common pitfalls include overlooking potential claims and failing to conduct thorough searches, which can lead to significant complications. Mastering insurance fundamentals can mitigate these risks and help professionals capitalize on the advantages of a growing market.