Overview

Machine learning models that significantly contribute to success in real estate finance include:

- Linear regression

- Decision trees

- Ensemble methods such as random forests

Each of these models offers unique strengths in property valuation. Furthermore, these models enhance predictive accuracy and operational efficiency by leveraging data-driven insights. Studies indicate that ensemble methods outperform traditional approaches in capturing the complexities of housing prices, thereby reinforcing their value in the industry.

Introduction

The integration of machine learning in real estate finance is reshaping how professionals approach property valuation and investment strategies. By harnessing the power of advanced algorithms, stakeholders can unlock insights that were previously obscured by traditional methods, leading to more informed decisions and improved financial outcomes.

However, the journey towards effective implementation is fraught with challenges, from ensuring data quality to selecting the right models.

Furthermore, real estate professionals must navigate this complex landscape to leverage machine learning for maximum success. Addressing these challenges is not merely an option; it is essential for staying competitive in an evolving market.

By understanding the intricacies of machine learning applications, stakeholders can enhance their strategies and drive significant financial benefits.

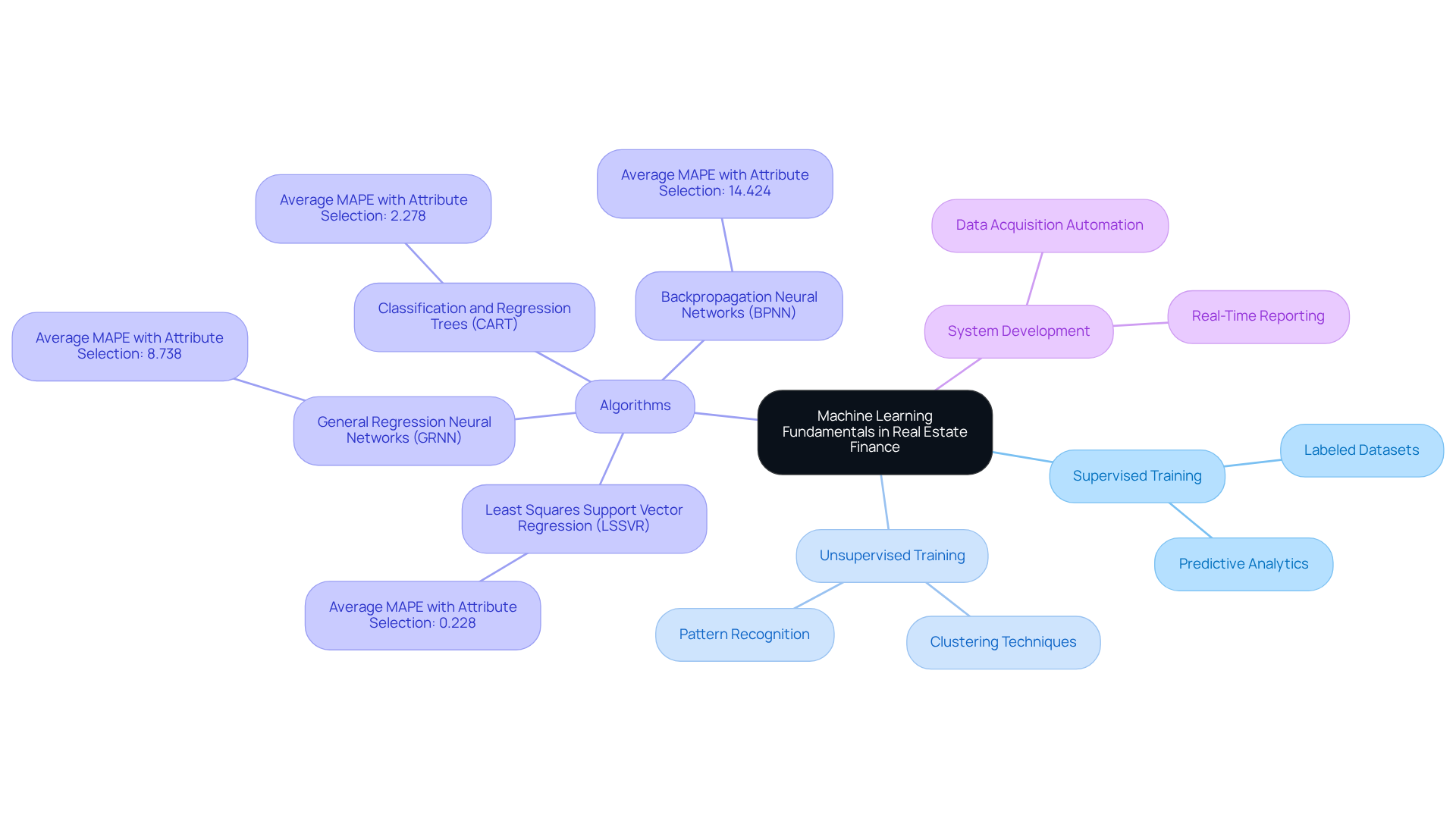

Understand Machine Learning Fundamentals in Real Estate Finance

Machine intelligence (ML), a critical component of artificial intelligence, empowers systems to learn from data, recognize patterns, and make informed decisions with minimal human oversight. In property finance, understanding the principles of machine learning models for real estate finance is essential, encompassing key concepts such as:

- Supervised training

- Unsupervised training

- Algorithms

- System development

For example, supervised learning employs labeled datasets to train models, facilitating accurate predictions of outcomes like property values based on historical data. This foundational understanding equips property professionals to implement ML solutions effectively, enhancing decision-making and operational efficiency.

Practical applications of machine learning models for real estate finance encompass predictive analytics for property valuation, where algorithms analyze market trends and historical sales data to project future prices. Research indicates that the least squares support vector regression (LSSVR) technique consistently achieved the lowest average absolute percentage error (MAPE), underscoring its effectiveness in forecasting accuracy. By comprehending these core principles, professionals can appreciate the transformative potential of ML in optimizing workflows and improving financial outcomes. As P.-F. Pai noted, "With attribute selection, LSSVR, GRNN, and CART achieved highly accurate predictions, while BPNN provided good predictions," highlighting the significance of selecting the appropriate attributes for model performance.

Nevertheless, it is crucial to recognize the complexities involved in property price forecasting, influenced by various quantitative and qualitative factors. The integration of artificial intelligence not only streamlines processes but also significantly enhances the precision of property decision-making, ultimately leading to more informed and strategic investments. A comparative analysis of different machine intelligence systems for predicting real estate prices revealed that machine learning models for real estate finance outperform traditional linear regression methods, providing a more robust framework for understanding market dynamics.

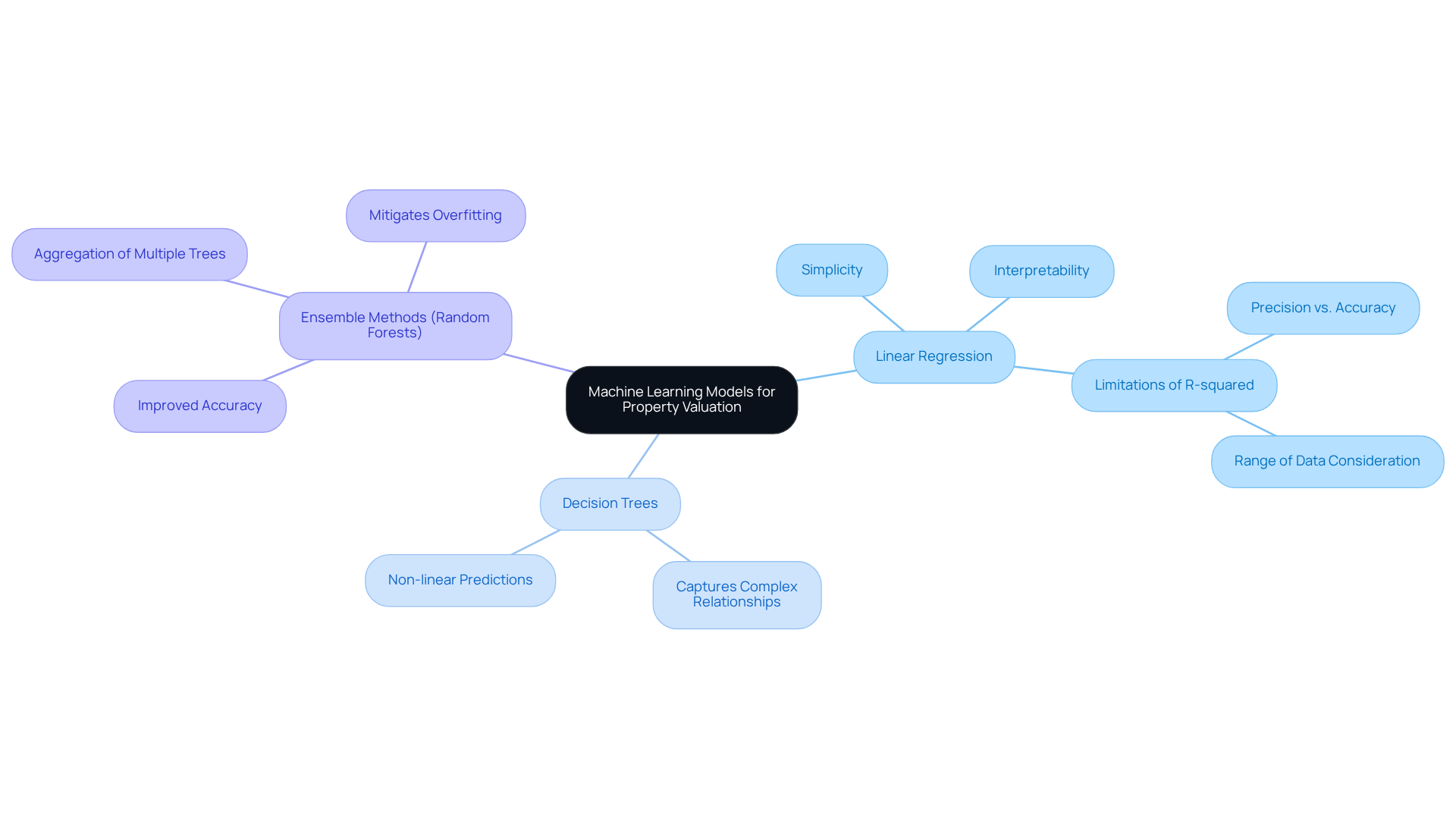

Identify Effective Machine Learning Models for Property Valuation

Machine learning models for real estate finance have emerged as powerful tools for property valuation, with linear regression, decision trees, and ensemble methods like random forests leading the way. Linear regression is favored for its simplicity and interpretability, making it ideal for straightforward valuation tasks. As Jim Frost observes, "R-squared is a goodness-of-fit metric concerning precision but not accuracy," emphasizing the significance of grasping the constraints of linear approaches.

In contrast, decision trees excel at capturing complex relationships within data, enabling more nuanced predictions. Atrayee Dasgupta highlights that "a very good comprehensive guide covering all relevant necessities used for linear regression" is essential for practitioners to understand the complexities of these approaches.

Furthermore, machine learning models for real estate finance, particularly ensemble methods such as random forests, enhance predictive accuracy by aggregating the outputs of multiple decision trees, thereby mitigating overfitting. Recent studies suggest that machine learning models for real estate finance, particularly random forests, substantially exceed conventional approaches in property price predictions, as they consider a wider range of factors, including location, property size, and current market trends. For instance, a study analyzing over 10,000 regional house sales found that random forests provided superior insights compared to linear regression, capturing the complex dynamics of housing prices.

By utilizing the unique strengths of these systems, real estate experts can make better-informed investment choices customized to their specific valuation requirements through machine learning models for real estate finance. However, it is crucial to be aware of common pitfalls, such as overfitting and the need for proper feature selection, to ensure the models are applied effectively.

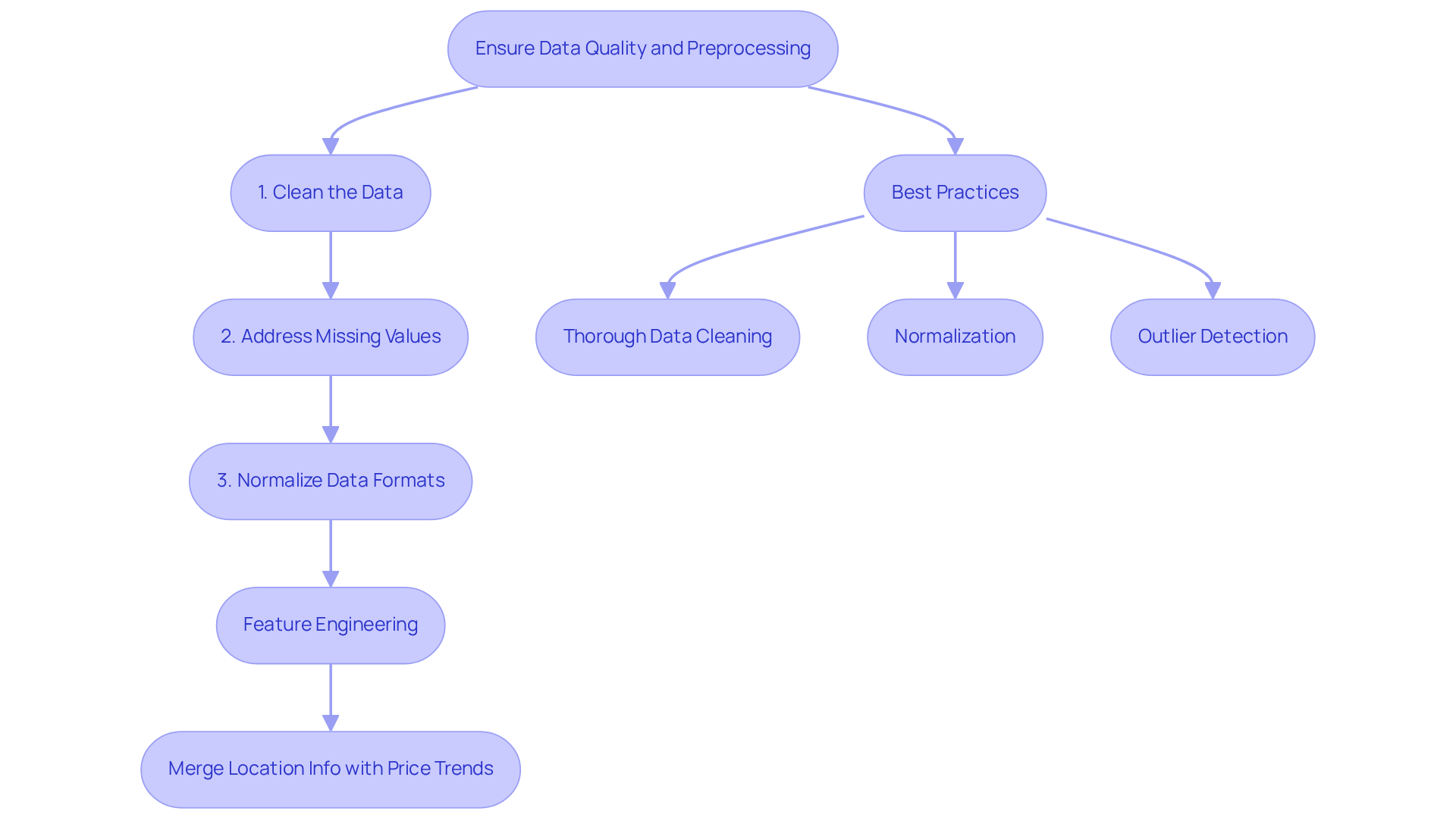

Ensure Data Quality and Preprocessing for Accurate Predictions

To achieve precise predictions in property valuation, ensuring high-quality information and effective preprocessing is essential. This process involves:

- Cleaning the data to eliminate inaccuracies

- Addressing missing values

- Normalizing data formats

For instance, standardizing property size measurements—whether in square feet or square meters—is crucial for maintaining consistency in analysis.

Furthermore, feature engineering, which entails generating new variables from existing data, can significantly enhance performance. Merging location information with historical price trends, for example, can provide deeper insights into market dynamics. By prioritizing information quality and preprocessing, property experts can greatly bolster the reliability of their machine learning systems, ultimately leading to improved financial outcomes.

Best practices for data preprocessing encompass:

- Thorough data cleaning

- Normalization

- Implementation of techniques such as outlier detection and feature scaling

These steps are vital for enhancing accuracy and ensuring that predictive analytics effectively inform decision-making within the real estate sector.

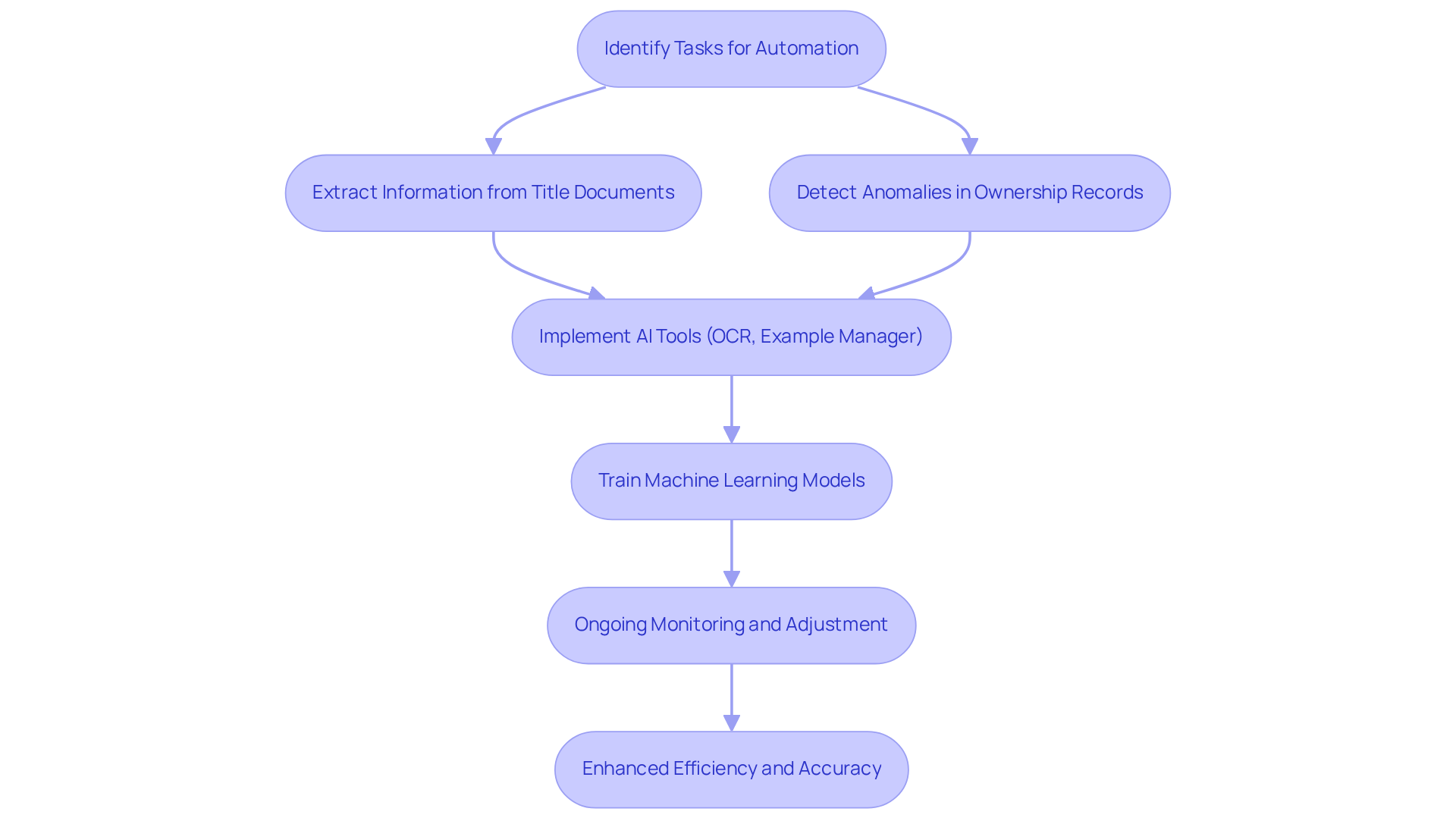

Implement Machine Learning Models in Title Research Workflows

Incorporating machine intelligence models into title research workflows necessitates a strategic approach. Experts should first identify particular tasks suitable for automation, such as:

- Extracting information from title documents

- Detecting anomalies in ownership records

Parse AI's advanced machine intelligence tools, including optical character recognition (OCR) and the example manager for annotating documents, simplify the extraction of relevant information from scanned documents. This drastically reduces manual effort and improves precision.

Training the chosen machine intelligence systems on past information is essential to guarantee they can accurately forecast results based on fresh inputs. Furthermore, ongoing observation and adjustment of these models are crucial to staying responsive to changing market conditions and trends. By embedding these advanced technologies into their workflows, title researchers can significantly boost efficiency, minimize errors, and deliver more dependable services to their clients.

Statistics indicate that automation in title research workflows can lead to a reduction in processing time by up to 50%, allowing professionals to focus on higher-value tasks. Embracing automation not only enhances productivity but also fosters a more agile response to client needs. Case studies illustrate the transformative effect of Parse AI's OCR and artificial intelligence capabilities in accelerating systematic reviews and enhancing data accuracy. As the landscape of title research continues to evolve, leveraging machine learning and automation will be crucial for maintaining a competitive edge.

Conclusion

The integration of machine learning models into real estate finance is not merely a trend; it signifies a fundamental shift in how property valuation and decision-making processes are approached. By leveraging advanced algorithms and data-driven insights, real estate professionals can enhance their predictive capabilities, streamline workflows, and ultimately make more informed investment choices.

Key points highlighted throughout the article include:

- The importance of understanding machine learning fundamentals

- Identifying effective models such as linear regression and random forests

- Ensuring data quality through rigorous preprocessing techniques

Furthermore, the discussion emphasizes the transformative potential of machine learning in title research workflows, showcasing how automation can significantly reduce processing times while enhancing accuracy.

As the real estate landscape continues to evolve, embracing machine learning becomes essential for maintaining a competitive edge. By prioritizing data quality, selecting appropriate models, and integrating advanced technologies into everyday operations, professionals can unlock unprecedented opportunities for success. The future of real estate finance is undoubtedly intertwined with machine learning, making it imperative for industry stakeholders to adapt and innovate in order to thrive.

Frequently Asked Questions

What is machine learning (ML) in the context of real estate finance?

Machine learning is a component of artificial intelligence that enables systems to learn from data, recognize patterns, and make informed decisions with minimal human oversight. In real estate finance, it helps professionals analyze data and improve decision-making.

What are the key concepts of machine learning relevant to real estate finance?

The key concepts include supervised training, unsupervised training, algorithms, and system development.

How does supervised learning work in real estate finance?

Supervised learning uses labeled datasets to train models, allowing for accurate predictions of outcomes such as property values based on historical data.

What are some practical applications of machine learning in real estate finance?

Practical applications include predictive analytics for property valuation, where algorithms analyze market trends and historical sales data to forecast future prices.

Which machine learning technique has shown the best forecasting accuracy in real estate finance?

The least squares support vector regression (LSSVR) technique has consistently achieved the lowest average absolute percentage error (MAPE), demonstrating its effectiveness in forecasting accuracy.

What is the importance of attribute selection in machine learning models?

Attribute selection is crucial as it can significantly impact model performance. Techniques like LSSVR, GRNN, and CART have shown high accuracy in predictions when the right attributes are selected.

What are the challenges in property price forecasting using machine learning?

Property price forecasting is complex due to the influence of various quantitative and qualitative factors, making it essential to consider multiple variables in the analysis.

How do machine learning models compare to traditional linear regression methods in real estate finance?

Machine learning models generally outperform traditional linear regression methods, providing a more robust framework for understanding market dynamics and enhancing prediction accuracy.