Overview

The article emphasizes four essential AI platforms for real estate analytics that professionals must consider, detailing their capabilities and advantages. Notably, platforms such as HouseCanary and Parse AI significantly enhance property valuation and streamline workflows. This advancement empowers real estate professionals to make informed decisions and boosts operational efficiency in a rapidly evolving market.

Introduction

AI is revolutionizing the real estate sector, empowering professionals to leverage extensive data with unmatched speed and precision. As the integration of AI technologies accelerates, it becomes increasingly vital for industry players to discern which platforms can optimize property analytics. Furthermore, what challenges and opportunities will emerge as firms confront the intricacies of incorporating these sophisticated tools into their operations?

Understanding AI in Real Estate Analytics

AI platforms for real estate analytics are fundamentally transforming the property sector by automating processes, enhancing data analysis, and improving decision-making. Currently, 14% of firms are actively utilizing AI, with 58% in early adoption stages. The integration of technologies such as machine learning and optical character recognition empowers real estate professionals to leverage AI platforms for real estate analytics, allowing them to analyze vast datasets with remarkable speed and accuracy.

Furthermore, these advanced tools can:

- Forecast trends in commerce with up to 95% accuracy

- Evaluate property values with error margins as low as 2-3%

- Streamline workflows, significantly reducing the time required for tasks such as lease management and contract evaluation

AI platforms for real estate analytics can analyze thousands of data points in seconds, allowing companies to adapt to a rapidly evolving market landscape. Consequently, AI not only facilitates more informed investment decisions but also enhances operational efficiency.

Industry leaders emphasize the importance of leveraging AI while maintaining the human touch in client interactions, ensuring that ethical standards and client trust remain paramount in this technological shift. As Dennis Riccio stated, "AI doesn’t change our fundamental legal and ethical duties." However, it is essential to remain vigilant regarding the potential dangers associated with AI, including its misuse for fraud, which presents considerable challenges in the property sector.

Comparison Criteria for AI Platforms

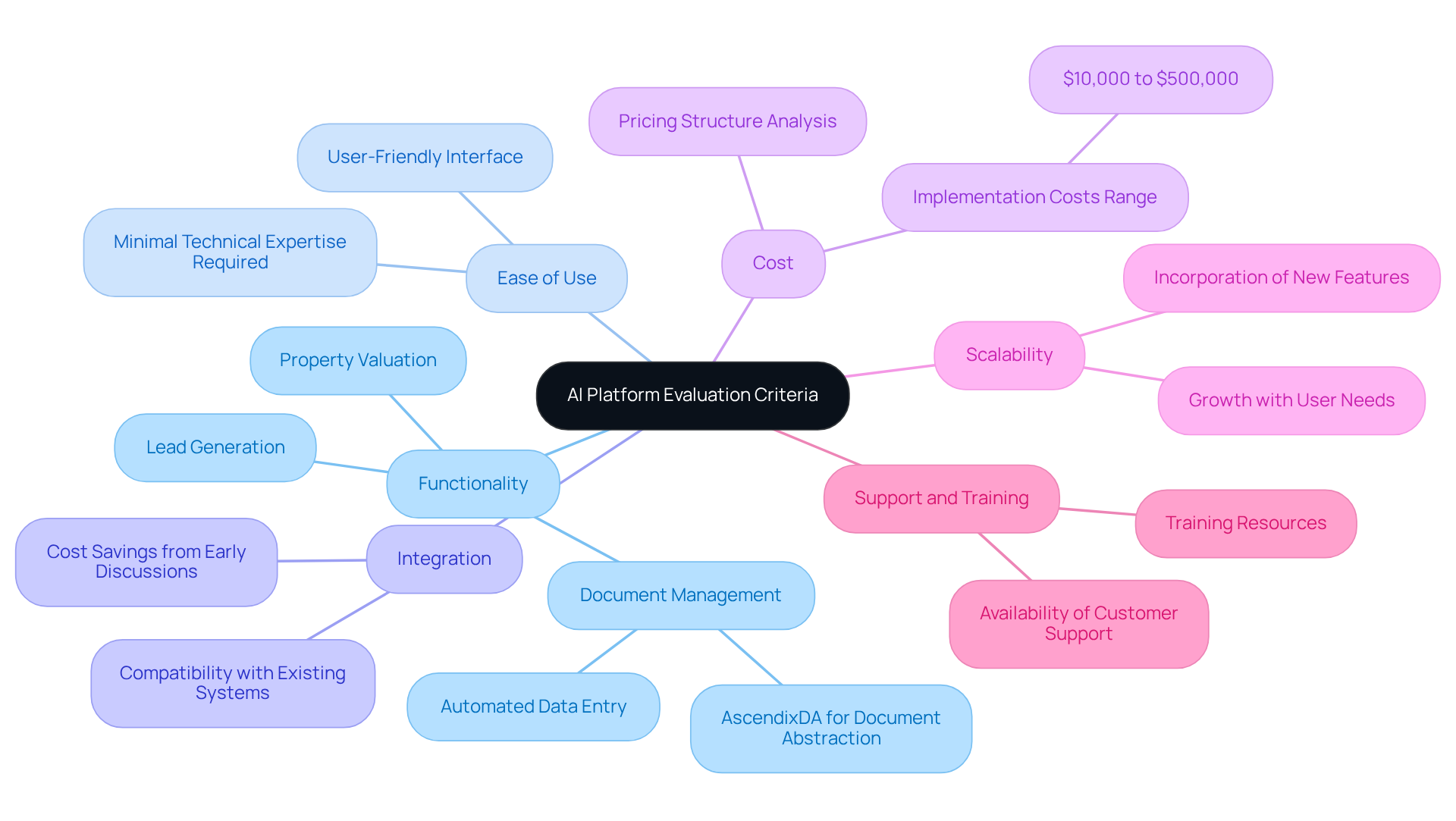

When evaluating AI platforms for real estate analytics, several key criteria should be prioritized:

-

Functionality: Evaluate the specific tasks that the system can automate or improve, such as property valuation, lead generation, or document management. Systems like AscendixDA excel in document abstraction, significantly reducing manual entry time, with AI tools reported to halve listing durations through automated data entry.

-

Ease of Use: Assess whether the system is user-friendly or requires technical expertise. High ease of use ratings are essential for ensuring that all team members can effectively utilize the tool without extensive training.

-

Integration: Examine how effectively the system connects with existing frameworks and data sources. Successful integration minimizes disruption and enhances workflow efficiency, as demonstrated in case studies where early discussions with AI partners about integration strategies led to substantial cost savings and smoother transitions.

-

Cost: Analyze the pricing structure to ensure it aligns with the value provided by the features. Understanding that AI implementation costs can range from $10,000 to over $500,000 is crucial for budgeting and ensuring that the total cost of ownership, including licensing and maintenance, is manageable.

-

Scalability: Consider whether the platform can grow with the user's needs. A scalable solution allows for the incorporation of features and capabilities as business needs evolve, which is increasingly important as AI in the property market is anticipated to expand significantly.

-

Support and Training: Investigate the availability of customer support and training resources. Comprehensive support can greatly enhance user experience and adoption rates, as noted by feedback from property experts who value continuous assistance, emphasizing that effective training can lead to a smoother integration process.

By concentrating on these criteria, users can make informed choices when selecting AI platforms for real estate analytics that are tailored to their specific property requirements, ensuring they leverage technology effectively to enhance their operations.

In-Depth Analysis of Leading AI Platforms

-

Parse AI: This platform excels in enhancing title research efficiency by employing machine learning and optical character recognition to swiftly extract critical information from title documents. By significantly reducing the time and costs associated with traditional title research methods, Parse AI platforms for real estate analytics streamline workflows for real estate professionals, ultimately enhancing productivity and accuracy.

-

HouseCanary: Renowned for its accuracy in property valuation and analysis, HouseCanary utilizes AI platforms for real estate analytics to provide real-time data and predictive analytics that empower investors to make informed choices. Its automated valuation models (AVMs) are continuously refined using real-time data, ensuring precision that reflects current economic conditions. Notably, HouseCanary’s proprietary home price forecasts explain over 95% of historical variability in price changes (R2>0.95%), establishing it as a reliable tool for investment strategies. Case studies further validate its effectiveness; for instance, a liquidation team expressed the necessity to analyze a larger dataset historically rather than relying solely on current values, stating, "We wanted to get a larger dataset, and we wanted to see how it worked historically instead of just going from this month on." This approach led to improved pricing strategies and enhanced transparency through the use of AI platforms for real estate analytics, including HouseCanary's retroactive AVMs.

-

Zillow: Recognized for its intuitive interface and comprehensive property listings, Zillow leverages AI to enhance property search features and deliver precise industry insights. Its integration with various property services makes it a favored option among agents and buyers alike. However, it primarily caters to casual users rather than professionals who require detailed analytics.

-

Reonomy: This service specializes in commercial property analytics by utilizing AI platforms for real estate analytics to provide insights into ownership, transaction history, and market trends. Its extensive database is invaluable for investors seeking to identify opportunities in the commercial sector, offering a depth of information that supports strategic decision-making.

-

Propelio: Aimed at property investors, Propelio leverages AI platforms for real estate analytics to streamline lead generation and property assessment, thereby facilitating the discovery and analysis of potential investments. Its emphasis on user experience and seamless integration with other tools enhances its appeal, making it a practical choice for those aiming to optimize their investment workflows.

![]()

Choosing the Right AI Platform for Your Needs

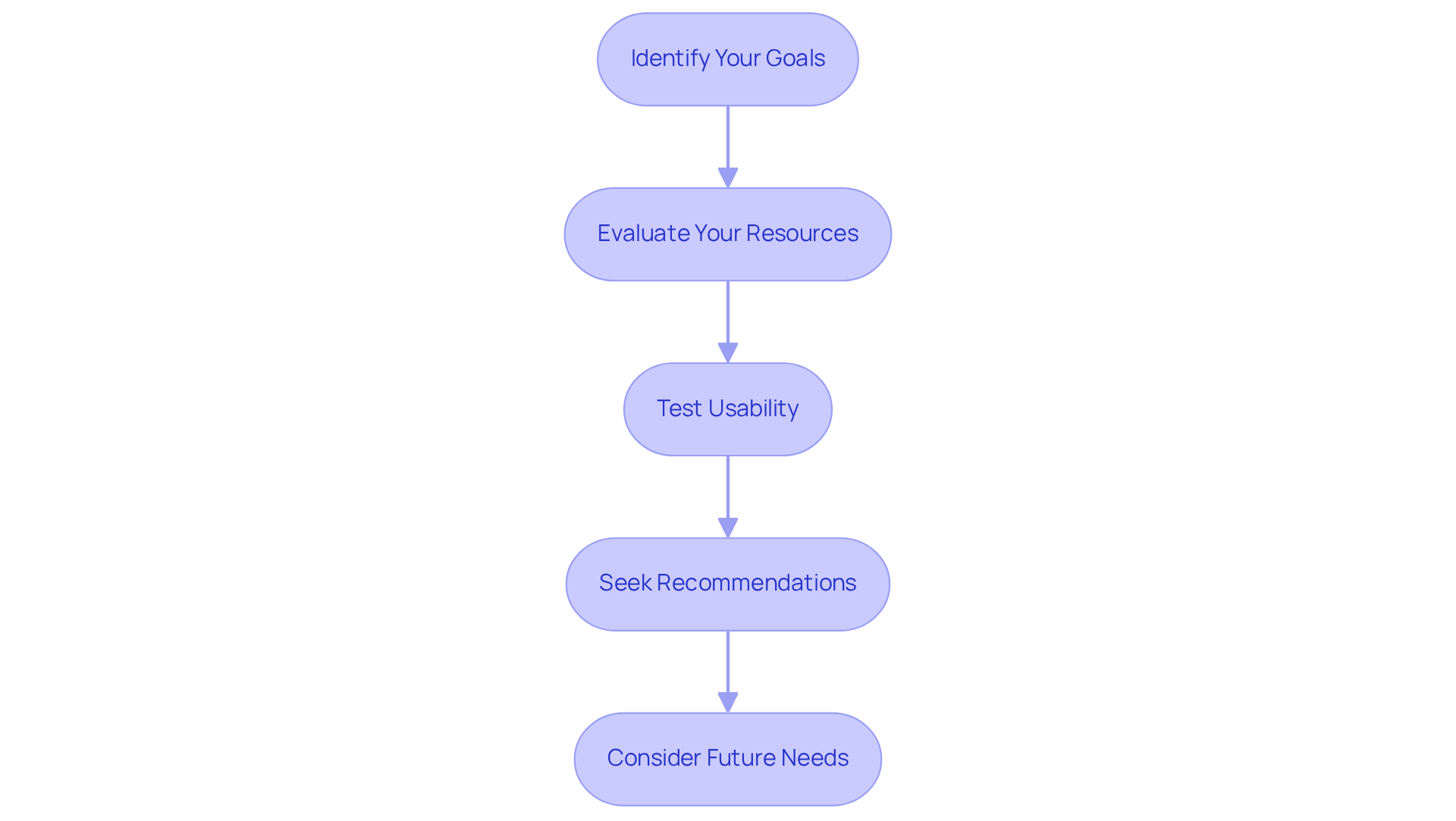

Choosing the appropriate AI platforms for real estate analytics necessitates a strategic method customized to your particular requirements and operational context. To guide your decision-making, consider the following essential steps:

- Identify Your Goals: Clearly define what you aim to achieve with AI, such as improving operational efficiency, enhancing data analysis, or automating routine tasks.

- Evaluate Your Resources: Assess your budget, technical capabilities, and existing systems to ensure compatibility with the selected system. This evaluation is crucial, as 70% of property management companies currently leverage AI for predictive maintenance and risk assessment, highlighting the importance of resource alignment.

- Test Usability: Utilize free trials or demos to assess the user-friendliness of the system and its integration within your workflow. This hands-on experience can reveal how well the tool meets your operational needs.

- Seek Recommendations: Engage with industry peers or experts to gather insights based on their experiences with different systems. This peer feedback can provide valuable context and help you avoid common pitfalls.

- Consider Future Needs: Choose a platform that not only meets your present requirements but is also flexible to future changes in your business or the industry landscape. As the AI property market is expected to reach USD 41.5 billion by 2033, it is essential to select scalable AI platforms for real estate analytics to ensure sustained success.

By following these steps, real estate professionals can make informed decisions that enhance operational efficiency and maintain a competitive edge in a rapidly evolving industry.

Conclusion

AI platforms for real estate analytics are revolutionizing the industry by enabling faster, more accurate decision-making and enhancing operational efficiency. As the adoption of these technologies increases, it becomes evident that leveraging AI is not merely a trend but a vital component for success in the property sector. The ability to analyze vast amounts of data swiftly and accurately empowers real estate professionals to navigate an ever-changing market landscape effectively.

The article highlights several key AI platforms, including:

- Parse AI

- HouseCanary

- Zillow

- Reonomy

- Propelio

Each offering unique functionalities that cater to different needs within the real estate analytics space. By focusing on criteria such as functionality, ease of use, integration, cost, scalability, and support, real estate professionals can make informed choices that align with their specific operational requirements. The insights provided illustrate the importance of selecting the right tools to enhance investment strategies and streamline workflows.

In a rapidly evolving industry, the significance of AI in real estate analytics cannot be overstated. As the market continues to grow, professionals must remain proactive in adopting these technologies to maintain a competitive edge. By understanding the capabilities of various AI platforms and following a strategic approach to selection, real estate stakeholders can harness the full potential of AI, ensuring informed decision-making and sustained success in an increasingly data-driven environment.

Frequently Asked Questions

How is AI transforming the real estate analytics sector?

AI is transforming real estate analytics by automating processes, enhancing data analysis, and improving decision-making, allowing professionals to analyze vast datasets quickly and accurately.

What percentage of firms are currently using AI in real estate?

Currently, 14% of firms are actively utilizing AI, while 58% are in the early adoption stages.

What technologies are integrated into AI platforms for real estate analytics?

Technologies such as machine learning and optical character recognition are integrated into AI platforms for real estate analytics.

What are some capabilities of AI platforms in real estate analytics?

AI platforms can forecast trends in commerce with up to 95% accuracy, evaluate property values with error margins as low as 2-3%, and streamline workflows, significantly reducing the time required for tasks like lease management and contract evaluation.

How quickly can AI platforms analyze data in real estate?

AI platforms can analyze thousands of data points in seconds, allowing companies to adapt to a rapidly evolving market landscape.

What benefits does AI provide to real estate investment decisions?

AI facilitates more informed investment decisions and enhances operational efficiency.

What do industry leaders emphasize regarding the use of AI in real estate?

Industry leaders emphasize the importance of leveraging AI while maintaining the human touch in client interactions, ensuring that ethical standards and client trust remain paramount.

What potential dangers are associated with the use of AI in real estate?

Potential dangers include the misuse of AI for fraud, which presents considerable challenges in the property sector.