Overview

Machine learning revolutionizes property valuation accuracy by automating data analysis and enhancing predictive insights. This transformation leads to more precise assessments and expedited decision-making for real estate professionals. The article highlights this shift through compelling case studies that illustrate significant advancements in valuation accuracy and efficiency. Organizations report notable productivity boosts and a reduction in forecasting errors, thanks to advanced machine learning applications.

Introduction

As the real estate industry evolves, the integration of machine learning is fundamentally reshaping property valuations, providing unparalleled accuracy and efficiency. This article explores ten innovative methods through which machine learning enhances property valuation accuracy, highlighting the transformative potential of data-driven insights for real estate professionals. However, with the rapid pace of technological advancement, stakeholders must consider how to effectively leverage these tools to navigate the complexities of the market.

Parse AI: Streamlining Title Research with Machine Learning

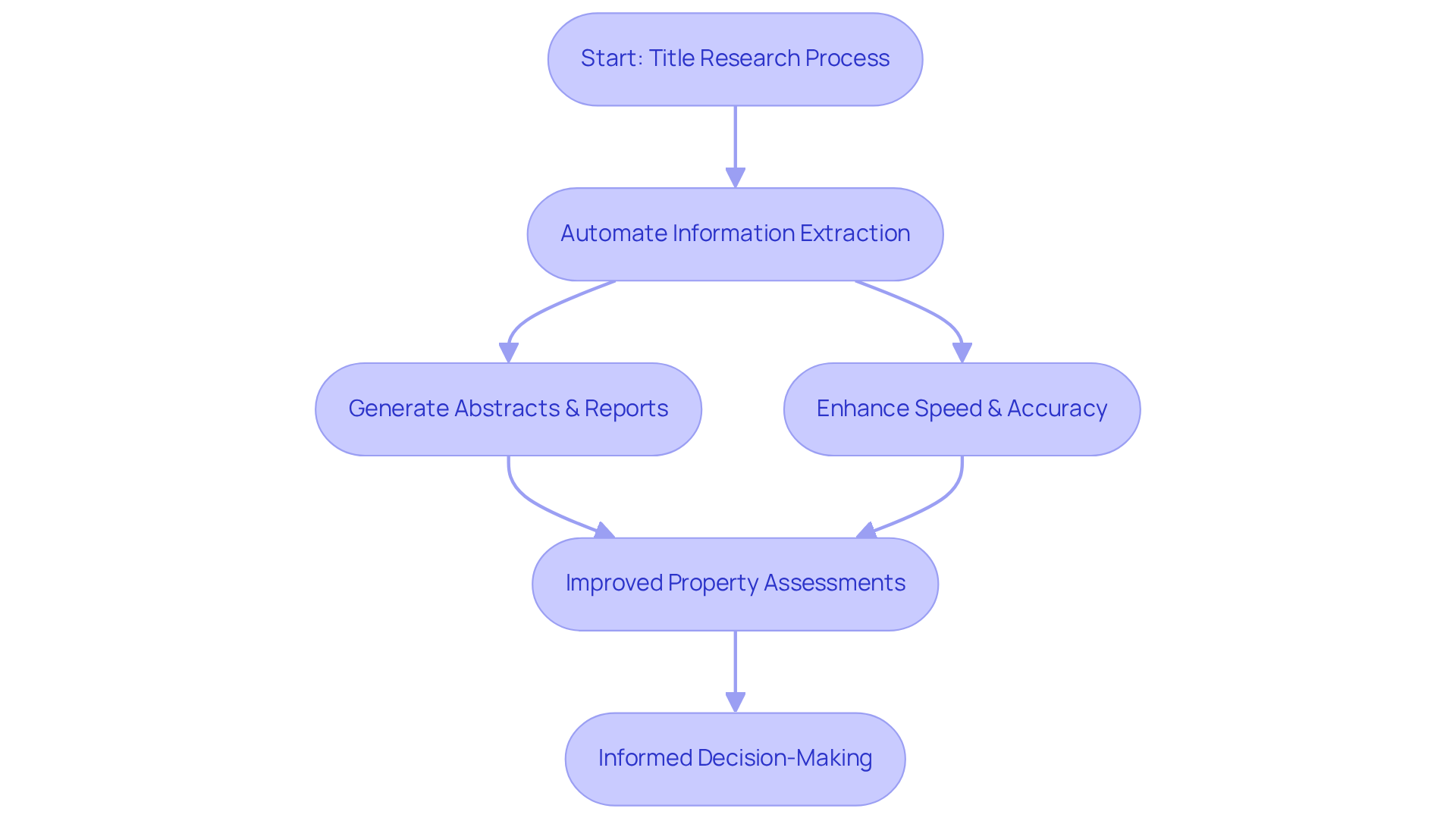

Parse AI harnesses advanced machine learning algorithms to streamline the analysis of extensive title document collections, drastically reducing the time and effort traditionally required for title research. By automating the extraction of critical information, Parse AI empowers title researchers to generate abstracts and reports with enhanced speed and accuracy. This automation not only accelerates the research process but also significantly improves the accuracy of property assessments, which is essential for property professionals who rely on machine learning in property valuation to make timely and informed decisions.

Furthermore, case studies illustrate that organizations employing machine learning in property valuation have reported productivity boosts of up to 50%, underscoring the technology's capacity to revolutionize workflows in the estate sector. As one industry expert noted, 'The integration of machine learning in property valuation has revolutionized our approach, allowing us to focus on strategic decision-making rather than manual data entry.'

Consequently, this transition towards automation not only enhances efficiency but also enables property professionals to respond more effectively to industry demands.

Altus Group: Enhancing Investment Analysis through Machine Learning

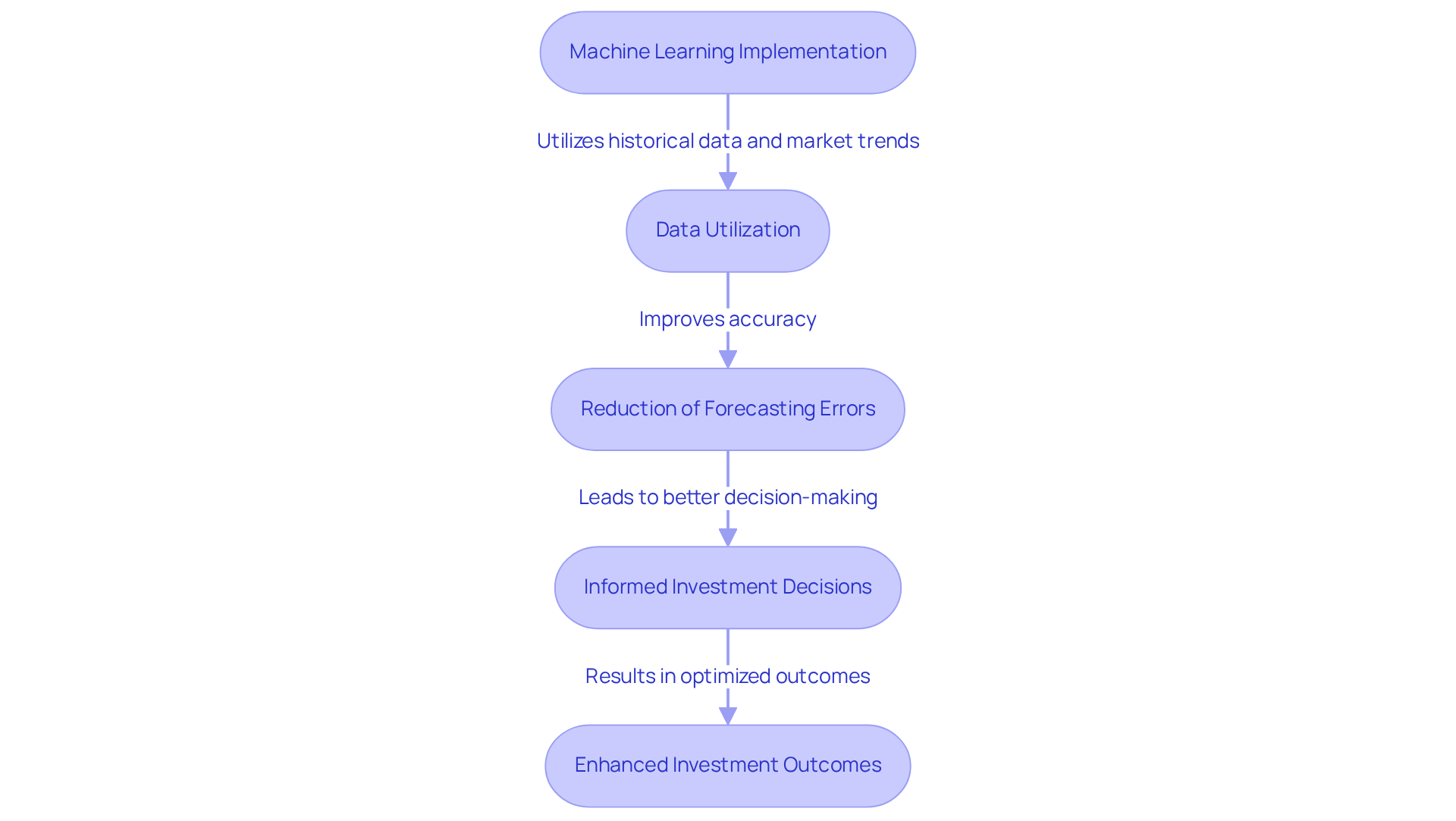

Parse AI harnesses the power of machine learning to enhance property ownership verification, enabling estate professionals to assess property values with remarkable accuracy. By leveraging extensive historical data and current market trends, Parse AI's advanced tools provide predictive insights that empower investors to make informed, data-driven decisions. This innovative approach not only improves assessment precision but also streamlines investment strategies, allowing clients to navigate the complexities of the property market with skill.

With machine learning significantly reducing forecasting errors—by as much as 68% compared to traditional methods—Parse AI positions itself at the forefront of asset assessment advancements, ensuring clients benefit from enhanced precision and optimized investment outcomes.

As Anh Tran, a Ph.D. real estate researcher, states, 'The combination of machine learning and big data can help improve our understanding of the predictability of commercial real estate excess returns.

Innovify: Boosting Property Valuation Accuracy with AI

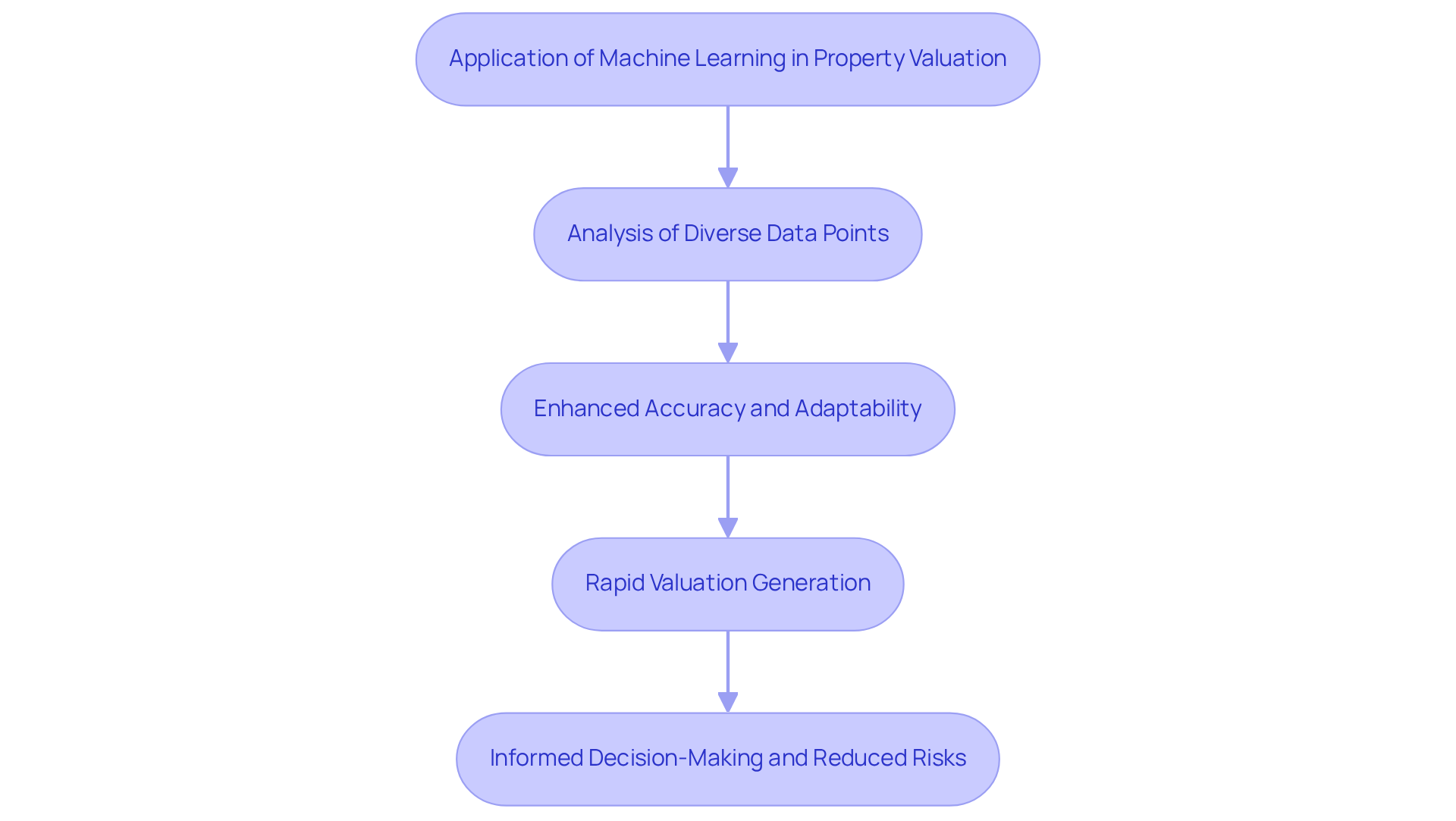

Innovify leverages machine learning in property valuation to significantly enhance the accuracy of property assessments by analyzing a diverse array of data points, including industry trends, property characteristics, and historical sales data. Their AI-driven models utilize machine learning in property valuation to rapidly adapt to fluctuating economic conditions, ensuring that valuations are both relevant and precise. This adaptability is crucial for real estate professionals who depend on reliable data to inform their investment decisions and pricing strategies.

With AI's ability to predict real estate price trends with up to 95% accuracy, Innovify utilizes machine learning in property valuation to empower clients to make informed choices in an ever-evolving market, ultimately aiding in the reduction of investment risks. Furthermore, the use of machine learning in property valuation facilitates the generation of real estate valuations in mere seconds or minutes, in stark contrast to traditional methods that may take days or weeks, thereby streamlining the process and enhancing operational efficiency.

As Matthew Bozorgi notes, 'These tools can analyze vast standardized datasets, providing precise and impartial value assessments,' emphasizing the transformative influence of machine learning in property valuation within the real estate sector.

FCIQ: Revolutionizing Insurance Assessments with AI

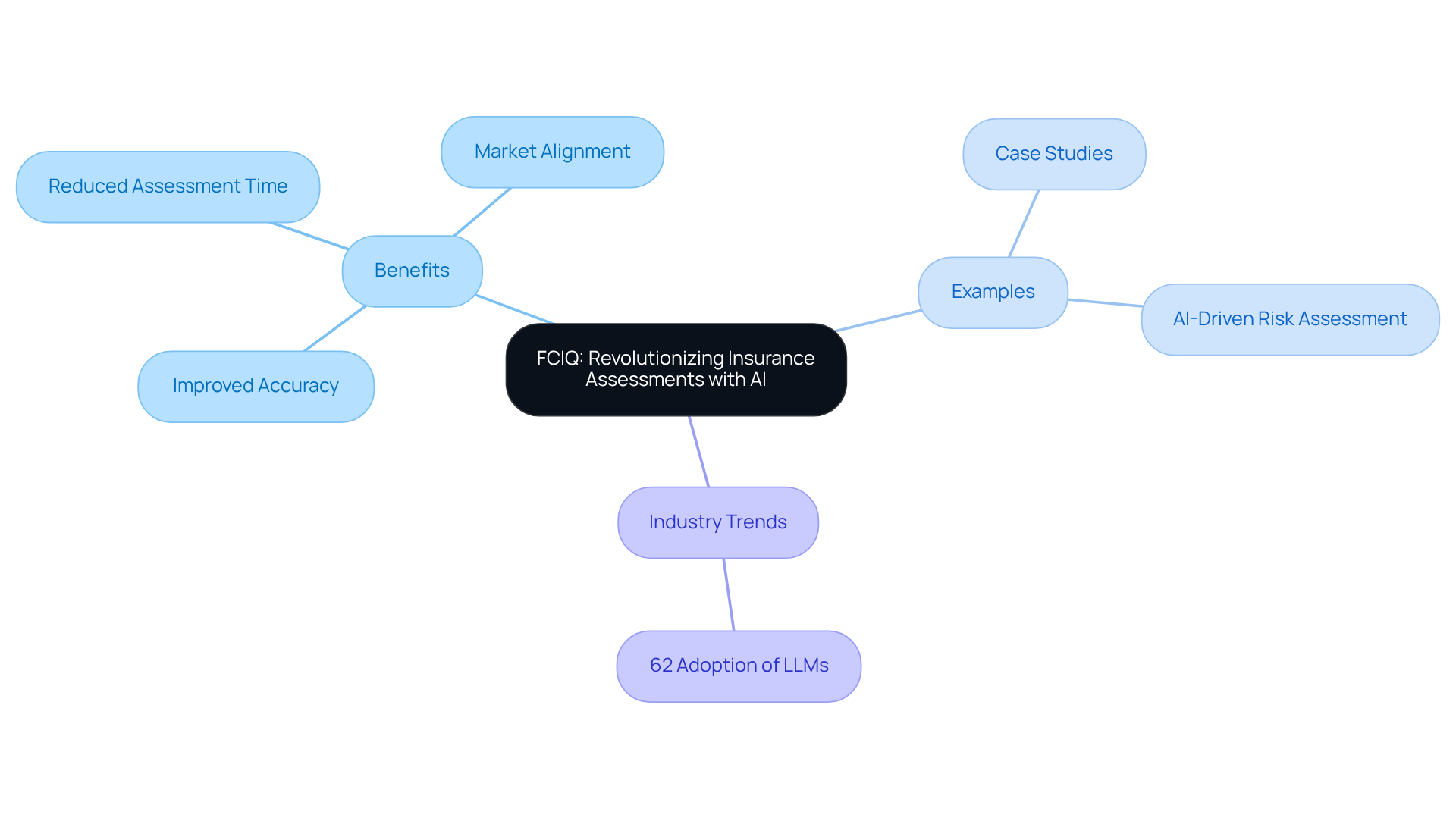

FCIQ stands at the forefront of integrating AI into insurance evaluations, fundamentally transforming the assessment of asset risks and values. By leveraging machine learning in property valuation, FCIQ analyzes extensive datasets to pinpoint potential risks and deliver precise evaluations of real estate. This innovation not only streamlines the insurance evaluation process—reducing asset assessment time from days to mere minutes—but also aligns asset pricing with current market dynamics, offering significant advantages for both insurers and asset owners.

For instance, FCIQ's application of machine learning in property valuation has led to a notable enhancement in accuracy, enabling more informed decision-making and increasing customer satisfaction. Case studies illustrate that assets evaluated using FCIQ's AI-driven methodologies, such as those highlighted in the 'AI-Driven Risk Assessment in Real Estate' case study, have experienced a reduction in appraisal errors and expedited turnaround times. This underscores the practical benefits of adopting such groundbreaking technologies within the insurance sector.

Furthermore, with 62% of industry respondents piloting large language models (LLMs) in risk control and pricing, FCIQ is at the helm of a significant movement towards AI adoption in the insurance landscape.

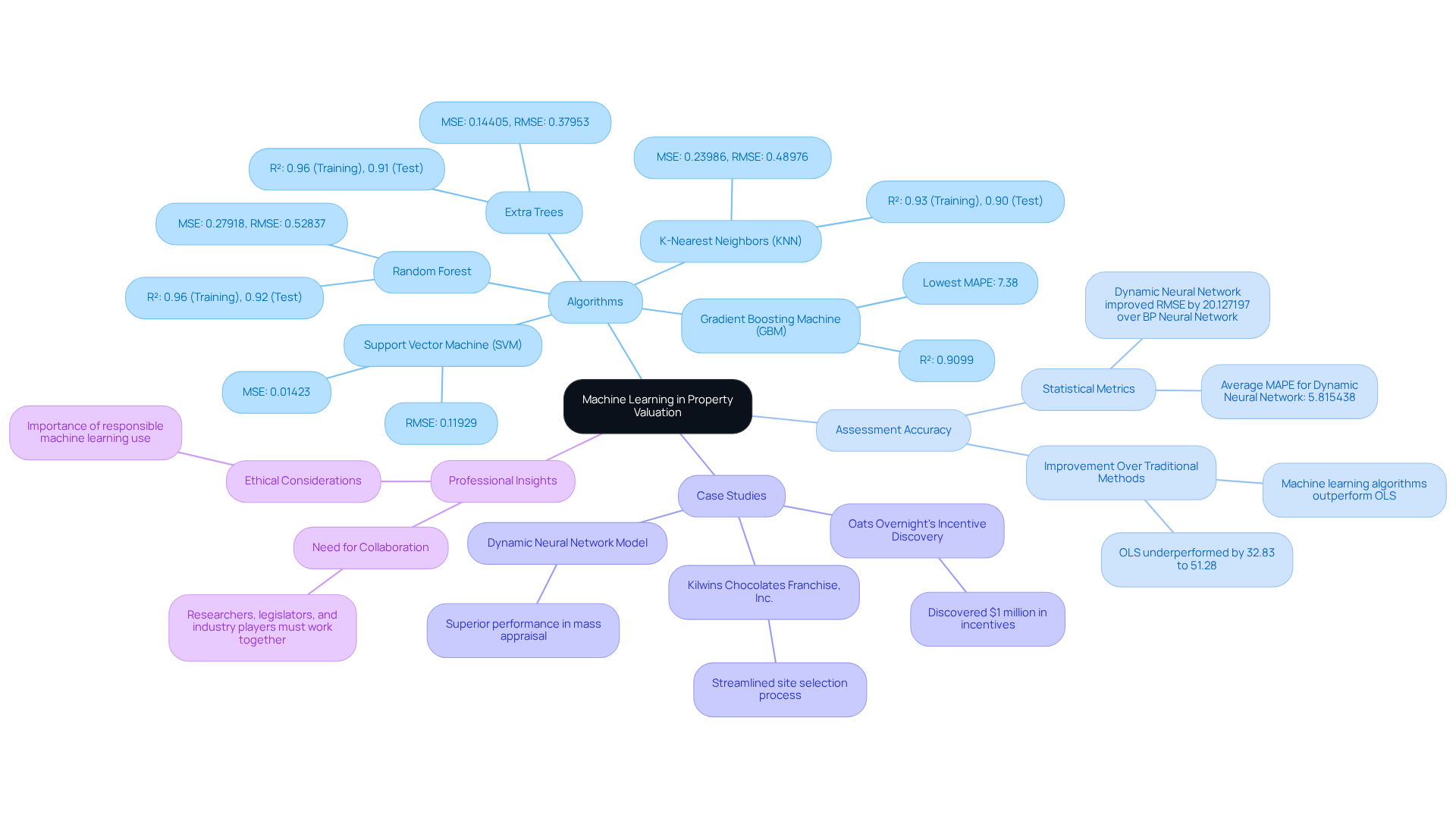

ResearchGate: Empirical Studies on Machine Learning in Property Valuation

ResearchGate showcases a multitude of empirical studies that examine the effectiveness of machine learning in property valuation. These studies illustrate how various algorithms can significantly enhance assessment accuracy by analyzing complex datasets and identifying patterns that traditional methods may overlook. Furthermore, by presenting successful case studies and research results, these studies provide invaluable insights for property professionals eager to integrate machine learning in property valuation into their assessment processes.

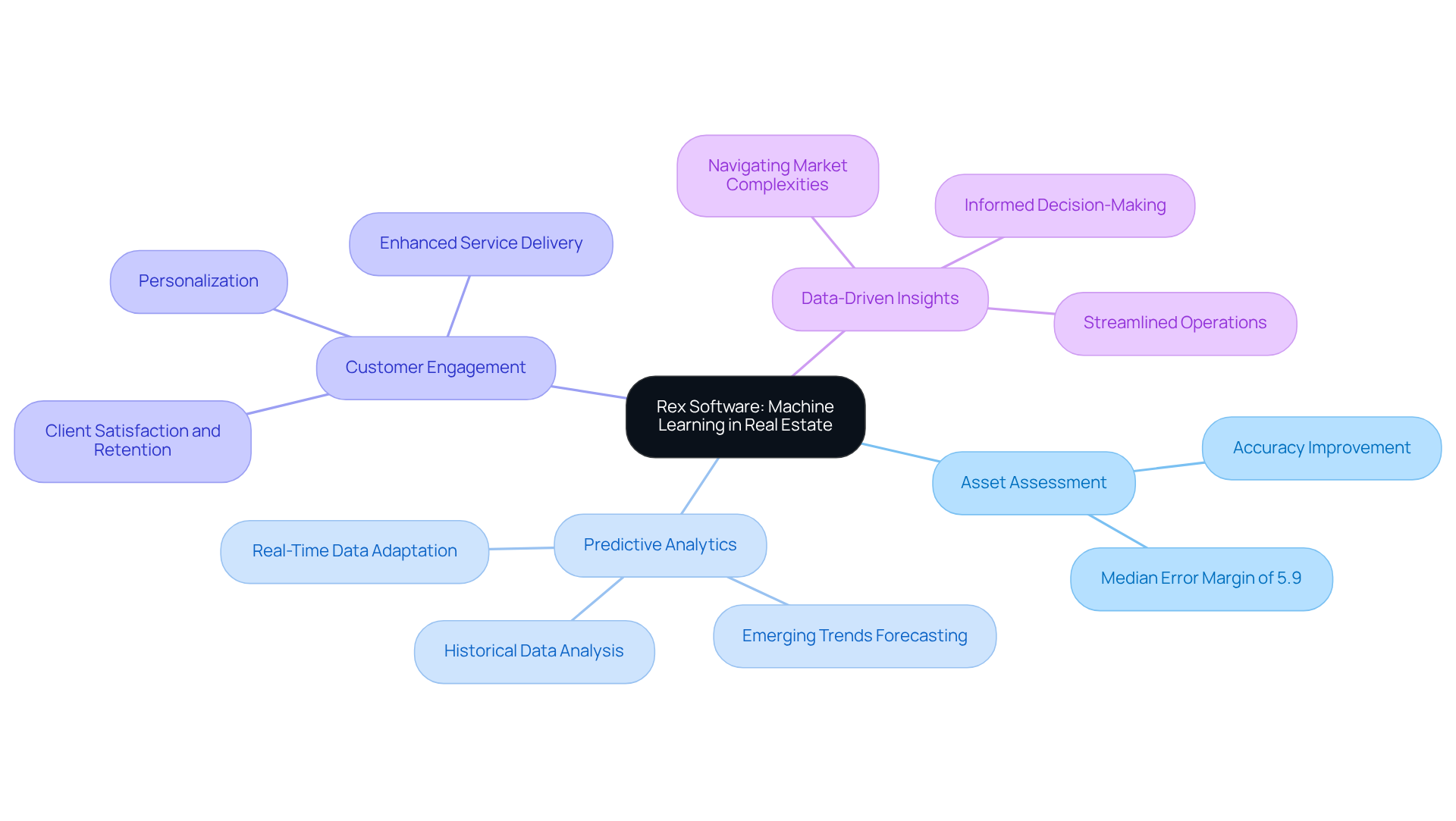

Rex Software: Diverse Applications of Machine Learning in Real Estate

Rex Software harnesses the power of machine learning across various facets of the estate industry, significantly enhancing asset assessment accuracy and industry analysis. By utilizing advanced algorithms, the platform equips real estate professionals with actionable insights that drive informed decision-making.

For instance, predictive analytics models scrutinize historical sales data and emerging trends, yielding property valuations with a median error margin of just 5.9%. This degree of precision streamlines operations and empowers agents to swiftly adapt to environmental shifts, refining their strategies based on real-time data.

Furthermore, machine learning elevates customer engagement by personalizing interactions and enhancing service delivery, ultimately fostering greater client satisfaction and retention rates. As the industry increasingly depends on data-driven insights, Rex Software's innovative approach positions real estate professionals to confidently navigate the market's complexities.

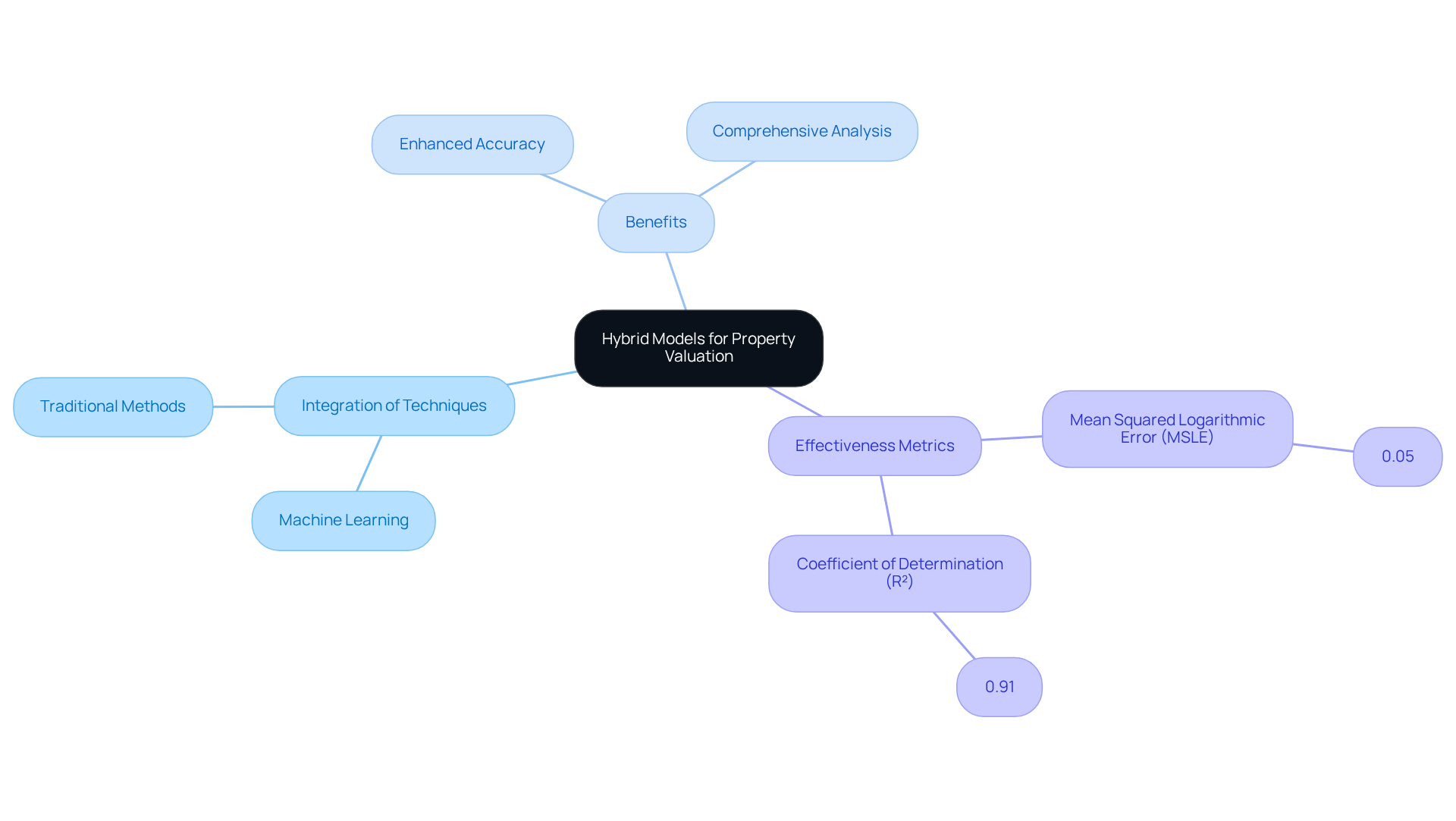

ScienceDirect: Hybrid Models for Enhanced Property Valuation

Research highlighted on ScienceDirect underscores the effectiveness of hybrid models that integrate machine learning with traditional asset assessment techniques, significantly enhancing accuracy. These innovative models leverage the strengths of both quantitative and qualitative methods, facilitating a more comprehensive analysis of asset values. By merging numerical information with contextual insights, hybrid models offer a nuanced perspective on market dynamics, leading to more precise assessments of real estate. This approach not only amplifies predictive power but also addresses the limitations of conventional methods, notably the 'black box problem' associated with machine learning models.

Furthermore, the results hold practical implications for property investors, city planners, and decision-makers, establishing hybrid models as essential tools for refining assessment processes. Notably, a proposed hybrid model achieved a Mean Squared Logarithmic Error (MSLE) of 0.05 and a coefficient of determination (R²) of 0.91, illustrating its effectiveness. Additionally, the research developed specific arrangements of the RVAM, which further enhance the understanding of hybrid models in asset assessment.

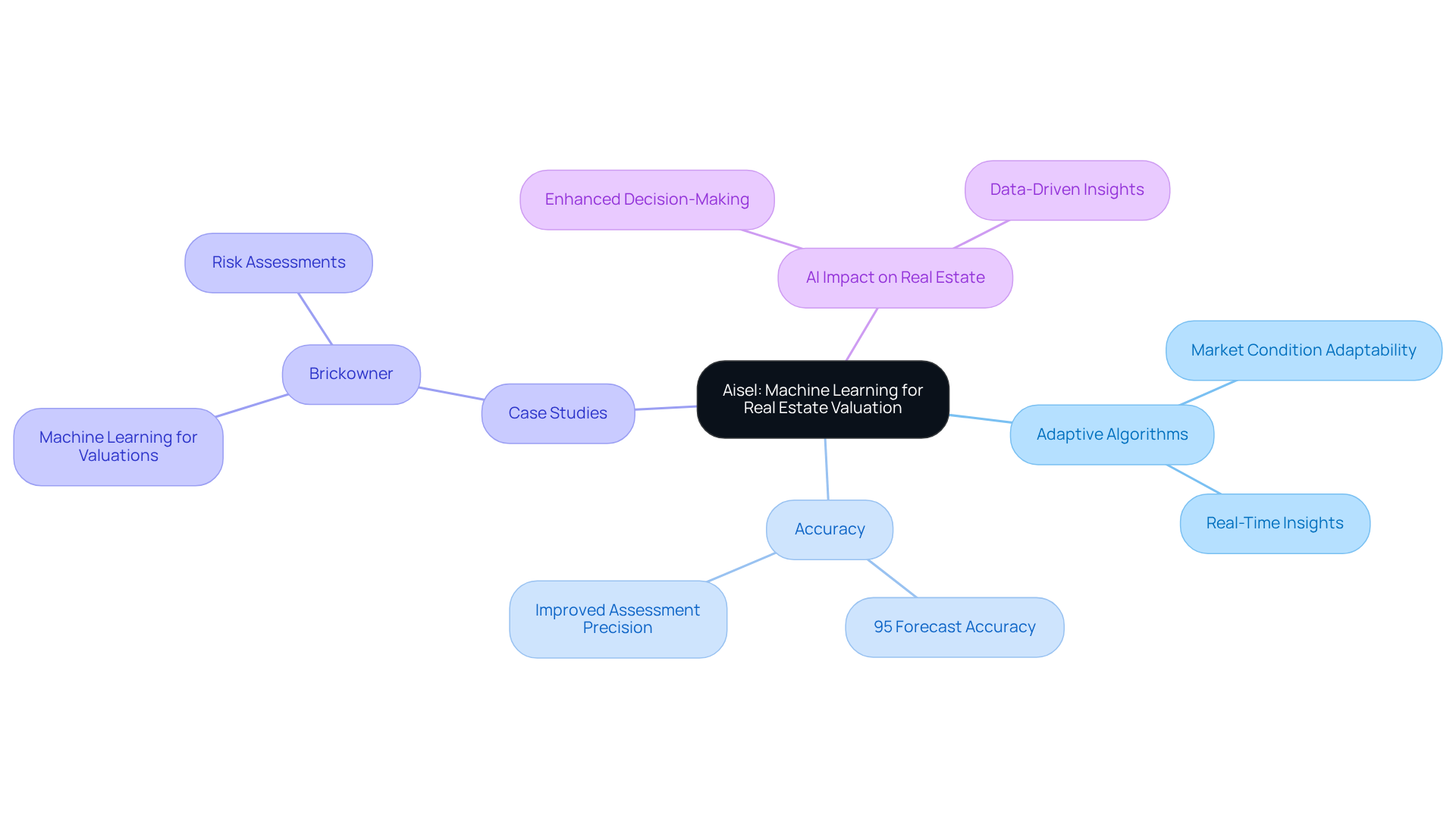

Aisel: Machine Learning Approaches for Real Estate Valuation

Aisel specializes in developing machine learning methods tailored for asset assessment, utilizing algorithms that scrutinize characteristics, industry trends, and historical data. These models are designed to adapt to shifting market conditions, ensuring that evaluations remain accurate and relevant. By focusing on the unique attributes of real estate, Aisel's methodologies enhance the precision of asset assessments, providing real estate professionals with reliable insights to inform their decisions.

For example, AI can forecast property price trends with a remarkable 95% accuracy, underscoring the effectiveness of Aisel's adaptive algorithms. Furthermore, case studies, such as those involving Brickowner, illustrate how Aisel's approaches have significantly improved assessment accuracy by incorporating real-time industry insights, ultimately leading to more strategic investment decisions.

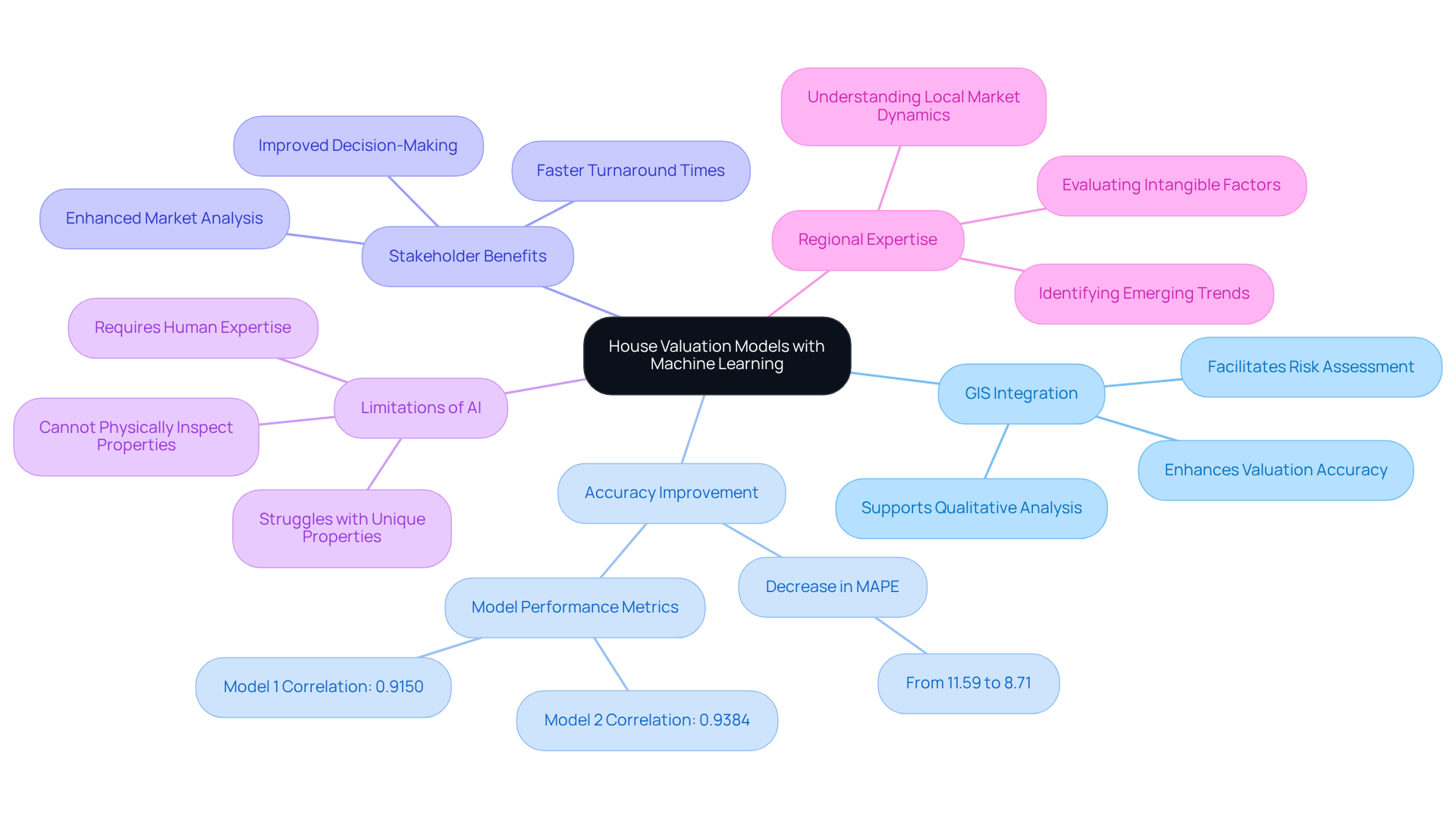

Learn ArcGIS: Building House Valuation Models with Machine Learning

Learn ArcGIS offers invaluable resources for developing house assessment models that leverage machine learning techniques. By integrating geographic information systems (GIS) with machine learning, users can create data-driven models that accurately assess property values based on location, features, and current market trends. This innovative approach markedly enhances estimation accuracy, as demonstrated by a decrease in Mean Absolute Percentage Error (MAPE) from 11.59% to 8.71% when advanced models are employed.

Furthermore, Gabriela Droj notes that "by incorporating GIS into real estate assessment methodologies, stakeholders can navigate the complexities of urban environments with improved accuracy and promote equitable assessment practices that foster sustainable urban development."

However, it is essential to recognize the limitations of AI in real estate assessment, as these systems are unable to physically inspect buildings or evaluate unique characteristics that may influence value.

Case studies reveal that the integration of GIS with machine learning in property valuation not only boosts accuracy but also facilitates informed decision-making by revealing the intricate relationships between asset features and their locations, while regional expertise remains a crucial factor in understanding these dynamics.

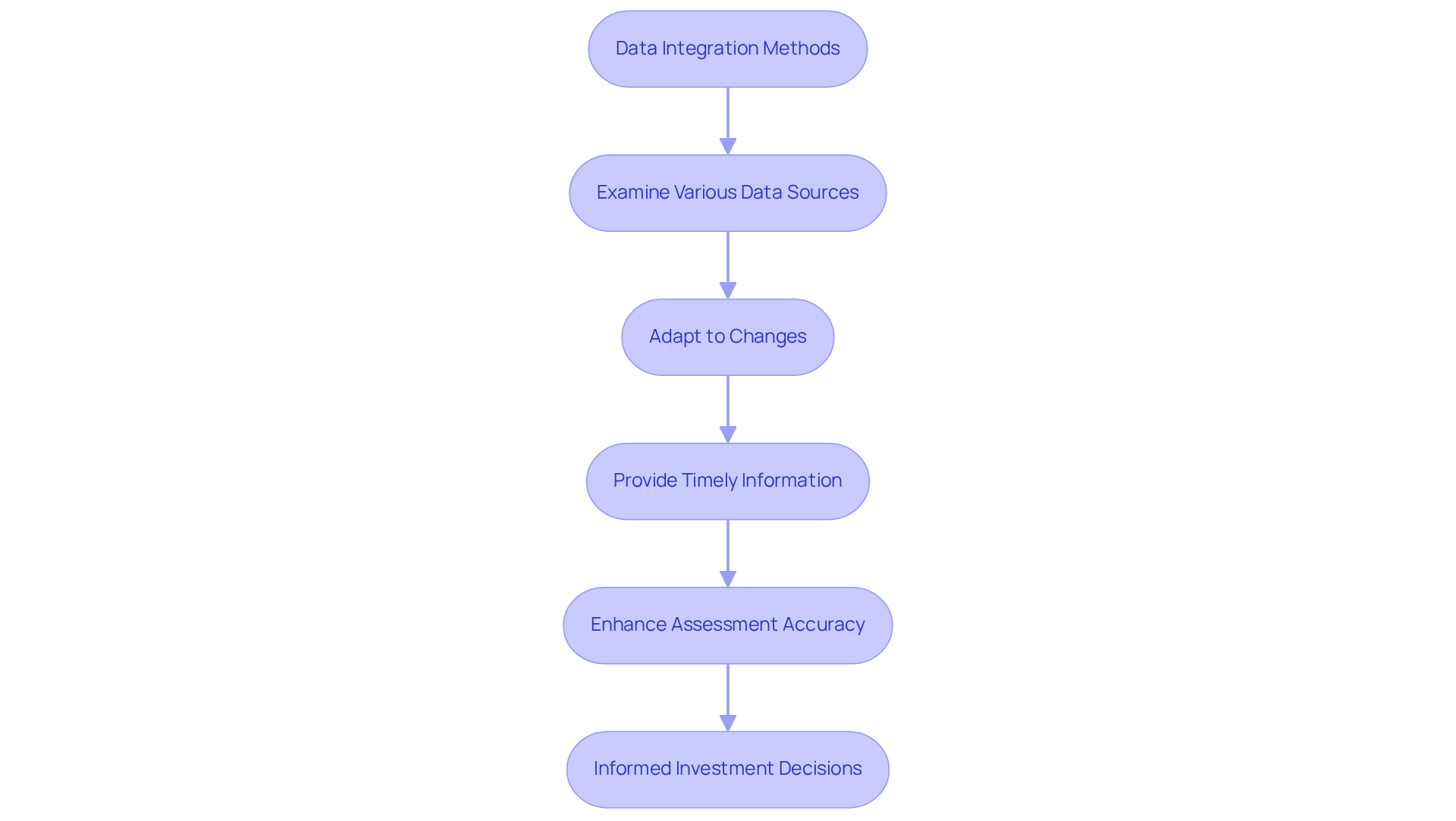

FCIQ: Real-Time Market Adjustments through Data Integration

FCIQ employs advanced data integration methods to facilitate real-time adjustments, ensuring that property assessments accurately reflect the most recent conditions. By consistently examining various data sources, FCIQ swiftly adapts to changes, providing property professionals with timely information that is crucial for precise assessment processes. This capability is essential for maintaining assessment accuracy, particularly in a rapidly evolving real estate landscape.

For instance, a case study on 'Investment Analysis Software' demonstrated that the incorporation of demographic data and industry trends significantly enhanced assessment accuracy, enabling more informed investment decisions. As noted, "Data analytics transforms asset valuation by utilizing historical and current data, ensuring your evaluations are precise."

The importance of data integration cannot be overstated; it not only bolsters the reliability of property evaluations but also empowers professionals to navigate the complexities of the industry effectively. With the global real estate market projected to reach USD 4.26 trillion by 2025, the role of data integration becomes increasingly critical in supporting informed decision-making.

Conclusion

The integration of machine learning into property valuation signifies a transformative shift in how real estate professionals assess and analyze property values. By leveraging advanced algorithms and data analytics, stakeholders achieve unprecedented accuracy and efficiency in their valuations, ultimately leading to more informed decision-making and enhanced investment strategies.

Throughout this article, various applications of machine learning are explored, underscoring its role in:

- Streamlining title research

- Enhancing investment analysis

- Revolutionizing insurance assessments

Companies such as Parse AI, Innovify, and FCIQ exemplify how machine learning significantly reduces forecasting errors, accelerates research processes, and increases assessment precision. Empirical studies validate these advancements, showcasing the effectiveness of hybrid models that combine traditional techniques with modern algorithms for superior property valuation outcomes.

As the real estate industry evolves, embracing machine learning is not merely an option; it is a necessity for professionals aiming to remain competitive. The future of property valuation resides in the ability to harness data effectively, adapt to market changes, and make strategic decisions backed by robust insights. Engaging with these technologies will empower stakeholders to navigate the complexities of the market and unlock new opportunities for growth and success.

Frequently Asked Questions

What is Parse AI and how does it benefit title research?

Parse AI is a tool that uses advanced machine learning algorithms to streamline the analysis of extensive title document collections, significantly reducing the time and effort required for title research. It automates the extraction of critical information, enabling title researchers to generate abstracts and reports more quickly and accurately.

How does machine learning impact property assessments?

Machine learning enhances the accuracy of property assessments, which is crucial for property professionals in making timely and informed decisions. It allows for faster processing of data and reduces the potential for human error.

What productivity improvements have organizations reported by using machine learning in property valuation?

Organizations employing machine learning in property valuation have reported productivity boosts of up to 50%, indicating the technology's effectiveness in transforming workflows in the estate sector.

How does Parse AI enhance investment analysis?

Parse AI improves property ownership verification and assessment accuracy by leveraging extensive historical data and current market trends. This helps investors make informed, data-driven decisions and streamlines investment strategies.

What is the extent of error reduction in forecasting with machine learning?

Machine learning can reduce forecasting errors by as much as 68% compared to traditional methods, which enhances the precision of asset assessments.

How does Innovify utilize machine learning in property valuation?

Innovify uses machine learning to analyze a variety of data points, including industry trends and historical sales data, to enhance the accuracy of property assessments. Their AI-driven models adapt to changing economic conditions, ensuring relevant and precise valuations.

What accuracy can AI achieve in predicting real estate price trends?

AI can predict real estate price trends with up to 95% accuracy, which helps clients make informed decisions and reduces investment risks.

How does machine learning streamline the property valuation process?

Machine learning allows for the generation of real estate valuations in seconds or minutes, compared to traditional methods that may take days or weeks, thus enhancing operational efficiency.